The Chainlink and World Liberty Financial partnership enables WLFI to go cross-chain securely via Chainlink CCIP.

WLFI and USD1 holders can now bridge assets across Ethereum, Solana, and BNB Chain.

Institutional capital continues to flow into Chainlink (LINK), despite cooling retail interest.

LINK remains technically bullish, trading above major EMAs with a potential breakout on the horizon.

Macroeconomic indicators like a potential Fed rate cut could act as a catalyst for crypto growth.

World Liberty Financial has officially adopted Chainlink’s Cross-Chain Token (CCT) standard, allowing WLFI and USD1 token holders to seamlessly bridge assets across multiple chains.

Source: X (@chainlink)

This significantly enhances token utility, liquidity, and accessibility for users and developers alike.

Users can now bridge their WLFI and USD1 tokens using:

World Liberty Finance Bridge

Transporter.io

This move represents a step forward in DeFi by addressing the key challenge of secure interoperability between blockchains, a major friction point in multi-chain ecosystems.

Despite the market’s current cautious tone, Chainlink’s native token LINK continues to hold strong above the $23.00 support level.

At the time of writing, LINK is trading at $22.49, down 2.87% over the past 24 hours.

$3.6 million in capital inflows were recorded last week

Total assets under management (AUM) for LINK-based products now stand at $137 million

LINK remains above key 50-day, 100-day, and 200-day EMA levels

A buy signal from the SuperTrend indicator supports a bullish outlook

However, futures Open Interest (OI) has declined to $1.53 billion from a recent high of $1.91 billion, suggesting that retail momentum is cooling off.

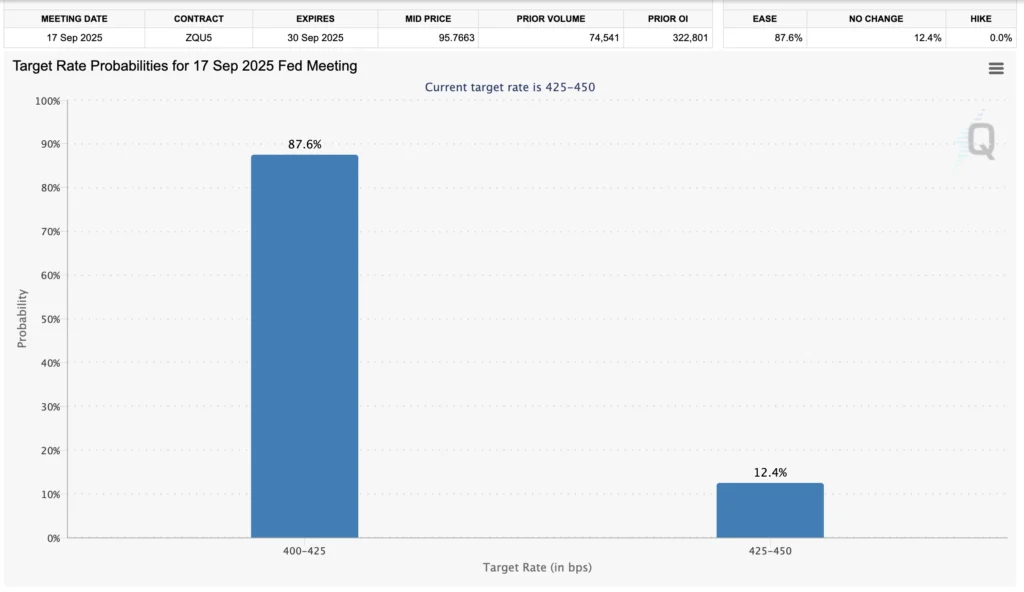

According to the CME FedWatch Tool, there’s an 87.6% probability that the Federal Reserve will cut interest rates by 25 basis points, possibly lowering the target range to 4%–4.25%.

This potential easing of monetary policy could act as a tailwind for crypto assets, including LINK and WLFI.

Source: cmegroup.com

LINK continues to consolidate above its short-term support of $23.00, with bulls defending this zone to prevent a drop to the psychological support level at $20.00.

Key resistance levels to watch:

$27.86 (tested on August 22nd)

$30.93 (tested in mid-December)

Technical indicators and other partnerships show a neutral-to-bullish sentiment, with the MACD indicating cautious optimism and the RSI holding steady above the midline.

Chainlink CCIP (Cross-Chain Interoperability Protocol) enables secure cross-chain communication, allowing tokens and data to move across blockchain networks with enterprise-grade security.

It brings robust cross-chain capabilities to WLFI and USD1 tokens, making them usable across Ethereum, Solana, and BNB Chain without sacrificing security or decentralization.

You can bridge WLFI using either the World Liberty Finance Bridge or Transporter.io, both of which are powered by Chainlink CCIP.

While LINK is showing technical strength, macroeconomic uncertainties and falling futures interest suggest a mixed outlook. Investors should weigh institutional demand and technical indicators before making decisions.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.051.23%

Figure Heloc(FIGR_HELOC)$1.051.23% USDS(USDS)$1.00-0.06%

USDS(USDS)$1.00-0.06% Hyperliquid(HYPE)$30.335.42%

Hyperliquid(HYPE)$30.335.42% Canton(CC)$0.1683463.15%

Canton(CC)$0.1683463.15% Ethena USDe(USDE)$1.00-0.01%

Ethena USDe(USDE)$1.00-0.01% USD1(USD1)$1.000.00%

USD1(USD1)$1.000.00% Rain(RAIN)$0.009776-4.89%

Rain(RAIN)$0.009776-4.89% World Liberty Financial(WLFI)$0.1056935.72%

World Liberty Financial(WLFI)$0.1056935.72% MemeCore(M)$1.430.72%

MemeCore(M)$1.430.72% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Falcon USD(USDF)$1.00-0.08%

Falcon USD(USDF)$1.00-0.08% Aster(ASTER)$0.709.70%

Aster(ASTER)$0.709.70% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00% Global Dollar(USDG)$1.00-0.01%

Global Dollar(USDG)$1.00-0.01% HTX DAO(HTX)$0.0000021.90%

HTX DAO(HTX)$0.0000021.90%