LINK surged 82.5% in Q3 2025, its best performance in over four years.

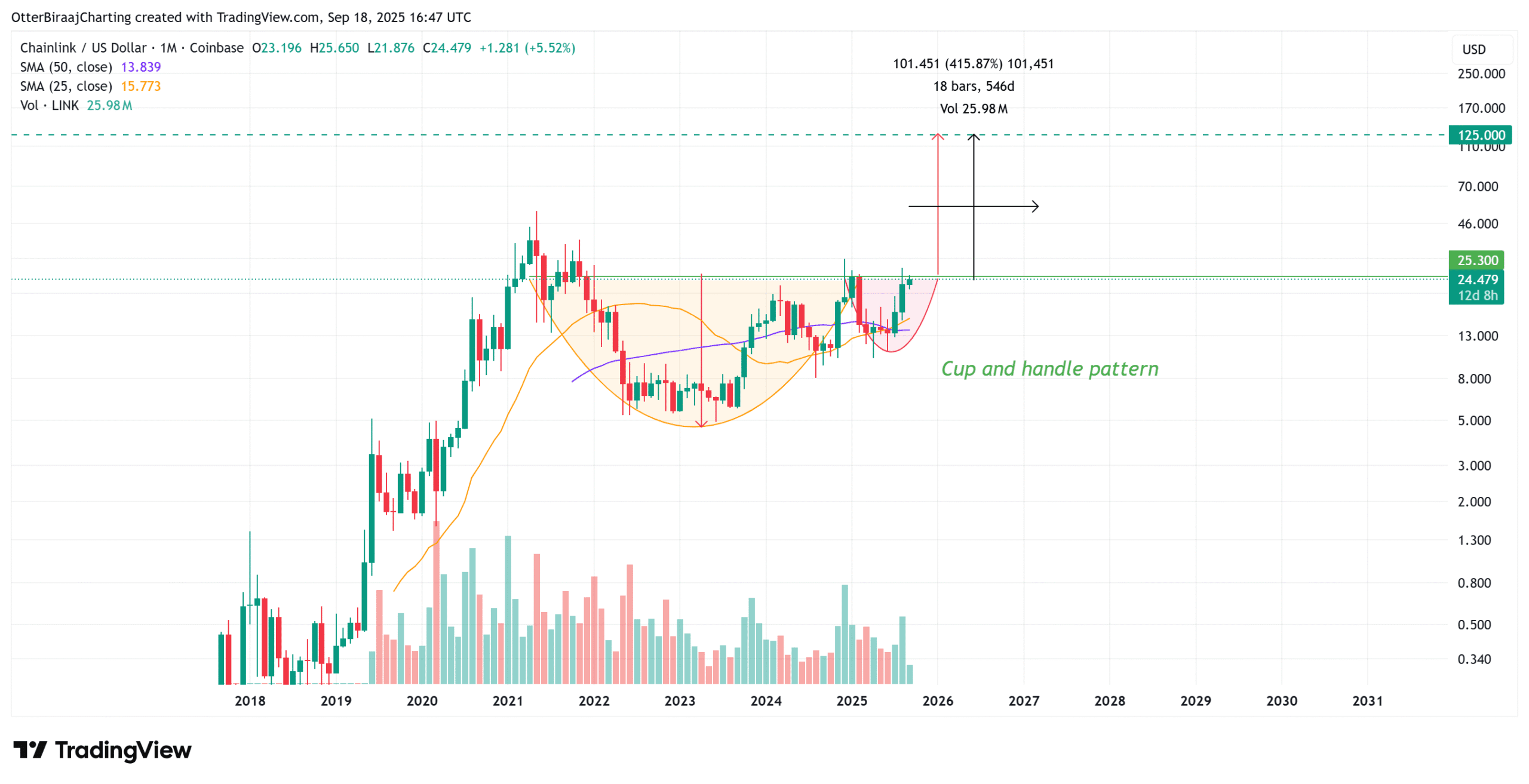

A confirmed cup-and-handle pattern projects a target of $100–$125.

On-chain data shows decreasing exchange supply, reducing sell pressure.

Institutional partnerships in RWA tokenization are fueling Chainlink’s utility.

Chainlink is currently trading around $24.56, up 82.5% this quarter, marking its best performance since early 2021. A key resistance level sits at $25.30.

A monthly close above this threshold would not only confirm the bullish breakout but also mark the highest monthly close since October 2021. This momentum is supported by a long-term technical setup that traders and analysts have been monitoring closely.

A cup-and-handle pattern is a classic bullish continuation setup often signaling the start of a major breakout.

On Chainlink’s monthly chart, this pattern has been forming for 45 months (approx. 1,370 days), one of the most extended formations seen in the altcoin market.

LINK Is Forming A Cup & Handle Pattern On Its Monthly Chart

Source: TradingView

The pattern’s neckline resistance lies at $25.30. A decisive monthly close above this level would validate the formation, triggering a potential long-term rally.

Chainlink is also trading above both the 25-month and 50-month moving averages, a signal of sustained bullish sentiment.

While $125 remains the long-term target, some analysts are highlighting intermediate levels worth watching.

$47.15 – A near-term target, representing a 90% upside

$88.26 – A mid-term target, signaling a 255% potential gain

These figures are based on technical momentum and increasing market confidence in Chainlink’s foundational role in Web3 infrastructure.

With:

Strong technical signals

Declining exchange reserves

Rapidly expanding institutional partnerships

Market leadership in oracle services

…the case for a $100 Chainlink price is not just hopeful speculation, it’s becoming a credible outcome in the medium to long term.

As of September 15, LINK’s exchange reserves have dropped to 158 million tokens, the lowest since June 2022, according to CryptoQuant.

This declining exchange supply indicates reduced selling pressure, often a precursor to strong upward price movements.

Chainlink is benefiting from its early involvement in real-world asset tokenization, a sector projected to reach $66 billion.

In a recent Hong Kong pilot, Chainlink collaborated with UBS and DigiFT to automate tokenized fund operations. Using Digital Transfer Agent contracts, Chainlink enables seamless subscription, redemption, and settlement processes, critical for traditional finance to embrace blockchain.

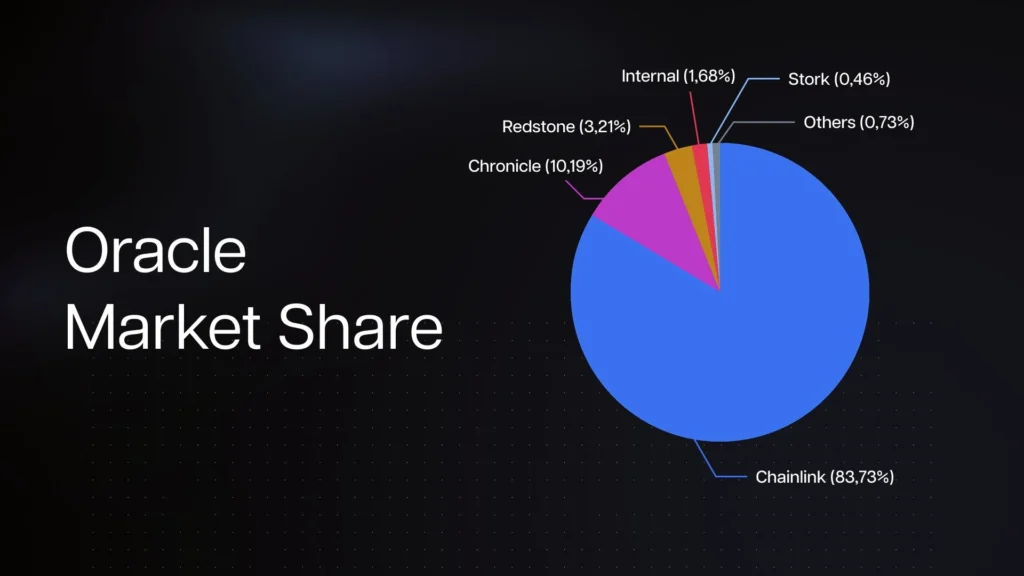

Chainlink continues to dominate the oracle space.

Chainlink’s Oracle Market Share Dominance

Source: Token Metrics

The platform managed to secure:

Over 83% of Ethereum’s Total Value Secured (TVS)

Roughly 67–68% of the global oracle market

More than $93 billion in on-chain value

Its Cross-Chain Interoperability Protocol (CCIP) is now active across 60+ blockchains, while Q1 2025 saw a 777% surge in data stream throughput, a sign of accelerating enterprise and DeFi adoption.

If the current cup-and-handle pattern confirms, LINK could reach $100 to $125 within the next 6–12 months.

Several factors: strong technical chart patterns, reduced token supply on exchanges, institutional adoption of its oracle services, and growing involvement in RWA tokenization.

The key resistance level is $25.30. A monthly close above it would confirm the cup-and-handle breakout.

Yes. Chainlink recently partnered with UBS and DigiFT in a Hong Kong pilot to automate tokenized asset management.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.031.19%

Figure Heloc(FIGR_HELOC)$1.031.19% Wrapped stETH(WSTETH)$3,484.511.44%

Wrapped stETH(WSTETH)$3,484.511.44% USDS(USDS)$1.000.01%

USDS(USDS)$1.000.01% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.01%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.01% Hyperliquid(HYPE)$32.128.68%

Hyperliquid(HYPE)$32.128.68% WETH(WETH)$2,855.241.41%

WETH(WETH)$2,855.241.41% Wrapped eETH(WEETH)$3,090.941.25%

Wrapped eETH(WEETH)$3,090.941.25% Ethena USDe(USDE)$1.000.06%

Ethena USDe(USDE)$1.000.06% Coinbase Wrapped BTC(CBBTC)$88,209.002.53%

Coinbase Wrapped BTC(CBBTC)$88,209.002.53% World Liberty Financial(WLFI)$0.1593749.42%

World Liberty Financial(WLFI)$0.1593749.42% sUSDS(SUSDS)$1.07-0.29%

sUSDS(SUSDS)$1.07-0.29% Ethena Staked USDe(SUSDE)$1.210.04%

Ethena Staked USDe(SUSDE)$1.210.04% USDT0(USDT0)$1.00-0.02%

USDT0(USDT0)$1.00-0.02% USD1(USD1)$1.000.01%

USD1(USD1)$1.000.01% Canton(CC)$0.074158-8.89%

Canton(CC)$0.074158-8.89% Bittensor(TAO)$268.001.90%

Bittensor(TAO)$268.001.90%