Chainlink and SBI Digital Markets have formed a strategic alliance to power tokenized real-world assets through CCIP integration.

The launch of CRE and Confidential Compute marks a major milestone in Chainlink’s enterprise infrastructure.

LINK’s exchange supply is at a five-year low, suggesting long-term accumulation and investor optimism.

Institutional partnerships continue to position Chainlink as a critical bridge between traditional finance and blockchain technology.

According to the announcement, SBI Digital Markets (SBIDM) will integrate Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to enable compliant, secure movement of tokenized real-world assets (RWAs) across both public and private blockchains.

Source: X (@chainlink)

This integration is expected to simplify the issuance, settlement, and secondary trading of digital assets in a regulated environment.

By leveraging CCIP Private Transactions, SBIDM can safeguard sensitive information such as trade amounts and counterparty identities, ensuring privacy while maintaining transparency where required.

In addition, SBIDM is exploring Chainlink’s Automated Compliance Engine (ACE) to enforce jurisdictional policies across global financial markets.

This marks a significant move toward creating a comprehensive digital asset ecosystem capable of bridging traditional finance and blockchain infrastructure.

This collaboration also builds upon previous partnerships between SBI Group and Chainlink, including their joint participation in the Monetary Authority of Singapore’s Project Guardian with UBS Asset Management.

That initiative successfully demonstrated blockchain’s ability to automate fund management and streamline administrative processes.

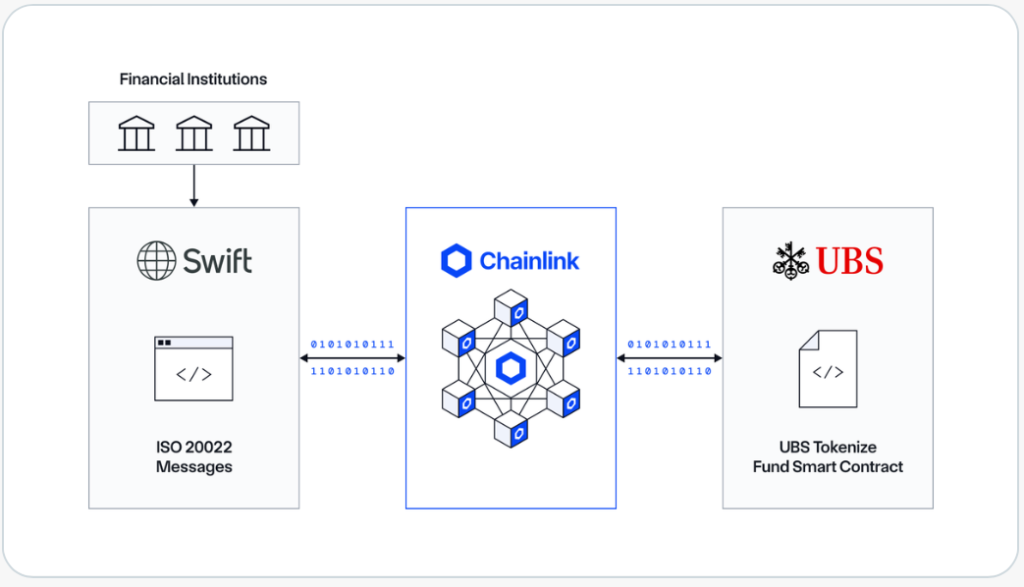

The Chainlink SBI Digital Markets partnership adds another prestigious name to Chainlink’s growing list of institutional collaborators, which already includes SWIFT, Mastercard, Euroclear, UBS, and ANZ.

The Swift–Chainlink–UBS Workflow Designed For Tokenized Fund Transactions

Source: Chainlink

These partnerships highlight Chainlink’s role as a unifying layer between traditional financial systems and decentralized blockchain networks.

Coinciding with the SBI Digital Markets announcement, Chainlink launched two major infrastructure upgrades in November 2025: the Chainlink Runtime Environment (CRE) and Chainlink Confidential Compute (CC).

The CRE serves as an orchestration layer connecting Chainlink’s suite of services, including Oracles, CCIP, Proof of Reserve, and ACE, into a cohesive and scalable network.

This structure aims to make Chainlink’s ecosystem more efficient and enterprise-ready.

Meanwhile, Chainlink Confidential Compute, expected to go live in 2026, introduces a secure computing environment that enables confidential smart contract execution.

This feature could be a game changer for financial institutions, allowing them to deploy private solutions for tokenized funds, private credit markets, and Delivery versus Payment (DvP) settlements.

Despite market volatility, on-chain data indicates rising confidence among Chainlink (LINK) investors. In fact, LINK’s exchange supply has dropped to 143.5 million tokens, the lowest level since October 2019.

Over 80 million LINK were withdrawn from exchanges in 2025 alone, about 11% of the circulating supply, suggesting strong long-term holding trends.

Whale accumulation has reached its highest point in years, typically a signal of reduced selling pressure and growing conviction among institutional and large-scale investors.

Although LINK has fallen 36.7% over the past month, it recently rebounded to $14.96, marking a slight recovery.

Analysts believe that the confluence of institutional partnerships, technological innovation, and supply scarcity could set the stage for a bullish trend reversal.

As one trader observed, “After years of downtrend, LINK’s chart is coiling like a spring, disbelief compressing into raw potential.”

This collaboration integrates Chainlink’s CCIP and compliance tools into SBI’s ecosystem, supporting the tokenization and cross-chain transfer of regulated financial assets.

Confidential Compute will allow enterprises to execute smart contracts privately, protecting sensitive financial data while maintaining blockchain security.

A reduction in exchange reserves typically signals investor confidence, as fewer tokens available for trading can reduce selling pressure and potentially support price appreciation.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.051.23%

Figure Heloc(FIGR_HELOC)$1.051.23% USDS(USDS)$1.00-0.02%

USDS(USDS)$1.00-0.02% Hyperliquid(HYPE)$30.737.98%

Hyperliquid(HYPE)$30.737.98% Canton(CC)$0.1690933.54%

Canton(CC)$0.1690933.54% Ethena USDe(USDE)$1.00-0.02%

Ethena USDe(USDE)$1.00-0.02% USD1(USD1)$1.000.02%

USD1(USD1)$1.000.02% Rain(RAIN)$0.0102871.14%

Rain(RAIN)$0.0102871.14% World Liberty Financial(WLFI)$0.1068866.40%

World Liberty Financial(WLFI)$0.1068866.40% MemeCore(M)$1.432.18%

MemeCore(M)$1.432.18% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Aster(ASTER)$0.7313.47%

Aster(ASTER)$0.7313.47% Falcon USD(USDF)$1.000.12%

Falcon USD(USDF)$1.000.12% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00% Global Dollar(USDG)$1.00-0.01%

Global Dollar(USDG)$1.00-0.01% HTX DAO(HTX)$0.0000021.97%

HTX DAO(HTX)$0.0000021.97%