Chainlink CEO Sergey Nazarov met with SEC Chairman Paul Atkins and White House crypto advisor Patrick Witt, signaling high-level interest in Chainlink tokenization.

The SEC is now focusing on how to implement tokenization safely, not whether it should happen.

Nazarov believes real-world asset tokenization will soon eclipse cryptocurrency in market size.

Chainlink is working toward full legal compliance for on-chain asset transfers.

The SEC’s Project Crypto and collaboration with the CFTC show growing regulatory alignment.

Nazarov noted that regulators are now less concerned with whether blockchain innovations like tokenization should be integrated into the U.S. financial system, and more focused on how to implement them securely and efficiently.

Sergey Nazarov Talking About Chainlink Tokenization On CNBC

Source: CNBC

He said during an interview:

“The agency is moving away from debating permission to actively working on practical implementation.”

This marks a pivotal evolution in regulatory thinking, especially as Chainlink continues to power smart contracts with reliable real-world data feeds.

The Chainlink CEO emphasized that real-world asset (RWA) tokenization could soon outpace traditional cryptocurrency markets in terms of value.

He said:

“While cryptocurrencies define the majority of our industry’s value today, I personally feel very strongly that real-world asset tokenization in the institutional world will grow to be the majority of the market cap in our industry.”

This outlook places Chainlink tokenization at the center of a growing institutional shift toward digitizing everything from real estate and commodities to equities and bonds.

A major obstacle facing blockchain adoption is ensuring legally binding transfers of tokenized assets.

Nazarov explained that Chainlink is working closely with regulators and developers to align smart contract functions with legal standards.

Chainlink is aiming to help blockchain infrastructure comply with broker-dealer and transfer agent rules, a key step in enabling full asset tokenization.

Nazarov stated that he is hopeful that these frameworks will be in place by mid-next year, allowing for large-scale compliant tokenization.

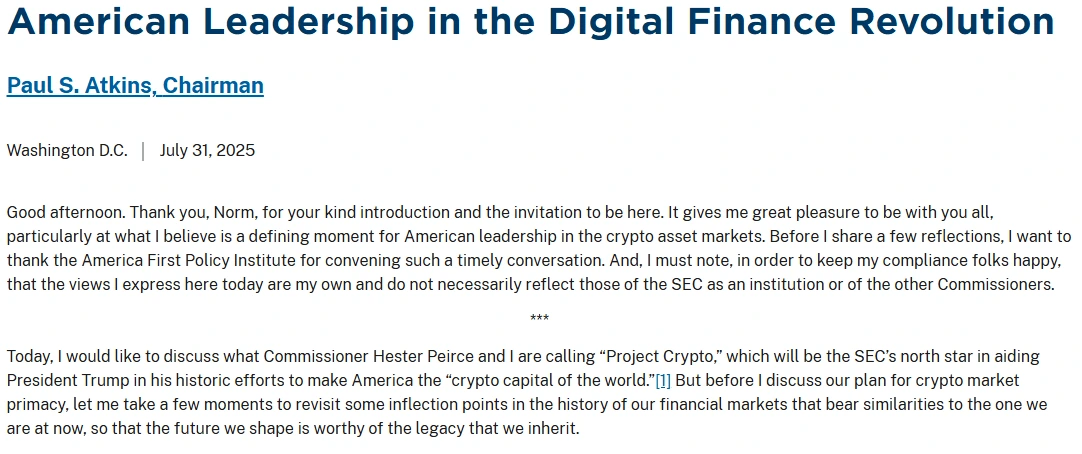

Chairman Atkins has already launched ‘Project Crypto’, a new SEC initiative focused on enabling blockchain innovation within existing regulatory structures.

An Excerpt From Paul Atkin’s Speech About ‘Project Crypto’

Source: www.sec.gov

This project, combined with support from agencies like the Commodity Futures Trading Commission (CFTC), is positioning the U.S. for leadership in blockchain-powered finance.

In a notable shift, the SEC and CFTC recently issued a joint statement supporting spot trading of select crypto assets and committed to collaborative regulation.

This is a stark contrast to the more adversarial stance under Atkins’ predecessor, Gary Gensler.

Beyond regulatory meetings, Chainlink’s technology was recently chosen by the U.S. Department of Commerce to distribute official economic data — including the Gross Domestic Product (GDP) report — via blockchain. This move represents a watershed moment for Chainlink tokenization and demonstrates federal confidence in Chainlink’s network infrastructure.

“Our industry has a very unique kind of moment in time right now, that if it uses it well, it can solidify its position in the U.S. and therefore the global economy,” Nazarov concluded.

Chainlink tokenization refers to the process of converting real-world assets (like stocks, real estate, or commodities) into blockchain-based tokens using Chainlink’s decentralized oracle network, which ensures data reliability and compliance.

Chainlink is collaborating with regulators like the SEC to ensure its infrastructure meets legal standards for asset transfers and broker-dealer operations. This is essential for institutional adoption of blockchain technology.

Project Crypto is a new initiative from the SEC under Chairman Paul Atkins, designed to integrate blockchain innovation into the financial system using existing laws and regulatory tools.

Sergey Nazarov believes compliant tokenization infrastructure could be operational by mid-next year, pending further collaboration with regulators.

The U.S. Department of Commerce used Chainlink to publish the GDP report on the blockchain, a sign of growing trust in Chainlink’s data integrity and technology.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.04-0.38%

Figure Heloc(FIGR_HELOC)$1.04-0.38% USDS(USDS)$1.00-0.01%

USDS(USDS)$1.00-0.01% Hyperliquid(HYPE)$31.948.73%

Hyperliquid(HYPE)$31.948.73% Ethena USDe(USDE)$1.00-0.03%

Ethena USDe(USDE)$1.00-0.03% Canton(CC)$0.1623640.24%

Canton(CC)$0.1623640.24% USD1(USD1)$1.00-0.06%

USD1(USD1)$1.00-0.06% Rain(RAIN)$0.0101123.47%

Rain(RAIN)$0.0101123.47% World Liberty Financial(WLFI)$0.1060700.73%

World Liberty Financial(WLFI)$0.1060700.73% MemeCore(M)$1.37-4.31%

MemeCore(M)$1.37-4.31% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Aster(ASTER)$0.743.97%

Aster(ASTER)$0.743.97% Falcon USD(USDF)$1.00-0.02%

Falcon USD(USDF)$1.00-0.02% Sky(SKY)$0.0700256.94%

Sky(SKY)$0.0700256.94% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00% Global Dollar(USDG)$1.000.02%

Global Dollar(USDG)$1.000.02%