Coinbase is building a crypto super app with integrated credit cards, payments, and Bitcoin rewards.

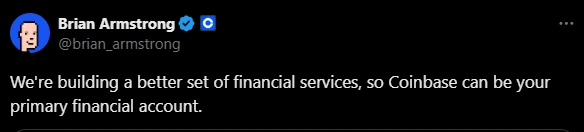

CEO Brian Armstrong wants Coinbase to be the primary financial account for users, replacing traditional banks.

A new credit card with 4% Bitcoin rewards is in development.

Regulatory clarity in the U.S. is helping fuel Coinbase’s expansion plans.

DeFi integrations like Morpho are allowing Coinbase users to earn up to 10.8% yield on USDC directly.

Coinbase’s vision of a crypto super app includes services like:

Seamless payments

High-yield savings

Bitcoin rewards programs

Armstrong criticized the inefficiencies of the traditional banking system, especially the excessive transaction fees consumers face. He said:

“It kind of boggles my mind. Like, why are we paying two to three percent every time we swipe our credit card? It’s just some bits of data flowing over the internet. It should be free or close to it.”

Source: X (@brian_armstrong)

He emphasized that blockchain infrastructure enables faster, cheaper, and more transparent transactions, making it an ideal replacement for legacy systems.

One of the standout features of Coinbase’s crypto super app will be a credit card that offers 4% back in Bitcoin (BTC).

The card aims to provide crypto-native incentives while functioning just like a traditional card, further bridging the gap between Web3 and mainstream finance.

With Bitcoin adoption continuing to rise and more people looking for alternatives to fiat-based banking systems, Coinbase is betting big on the idea that consumers want decentralized, digital-first financial tools.

The timing couldn’t be better. Armstrong noted that the U.S. regulatory environment is finally beginning to offer the clarity needed for innovation. He highlighted recent progress such as the GENIUS Act and the Senate’s work on market structure legislation.

President Donald Trump Signing The GENIUS Act Into Law

Source: Associated Press

He said:

“The freight train has left the station when it comes to regulatory clarity.”

Although Coinbase continues to collaborate with traditional financial institutions like JPMorgan and PNC, Armstrong expressed frustration with the uneven regulatory playing field, stating that legacy banks often operate under a different rulebook.

As part of the crypto super app strategy, Coinbase recently integrated with the Morpho decentralized lending protocol, enabling users to earn yields on USDC without relying on third-party DeFi platforms.

This direct-to-user approach can offer yields as high as 10.8%, all within the safety and user experience of the Coinbase ecosystem.

While some banking industry groups have criticized yield-bearing stablecoin programs, Coinbase insists these offerings are part of a modern, transparent alternative to traditional savings accounts, not a threat to the financial system.

A crypto super app is an all-in-one platform offering a wide range of financial services, including payments, credit cards, rewards, savings, and investing—powered by blockchain and cryptocurrencies. Think of it as a crypto-native version of a digital bank.

Coinbase aims to offer users a single app where they can:

Spend crypto with credit or debit cards

Earn Bitcoin rewards

Save with DeFi-powered interest accounts

Make peer-to-peer and business payments using blockchain

Yes. By integrating DeFi protocols like Morpho directly into the Coinbase platform, users can access yield opportunities without the complexity or risks of interacting with third-party apps. Security and compliance remain top priorities.

While no official launch date has been announced, Coinbase is actively developing a 4% Bitcoin rewards card as part of its super app rollout. Expect updates as regulatory progress continues.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.051.23%

Figure Heloc(FIGR_HELOC)$1.051.23% USDS(USDS)$1.000.03%

USDS(USDS)$1.000.03% Hyperliquid(HYPE)$30.274.11%

Hyperliquid(HYPE)$30.274.11% Ethena USDe(USDE)$1.000.02%

Ethena USDe(USDE)$1.000.02% Canton(CC)$0.163306-0.88%

Canton(CC)$0.163306-0.88% USD1(USD1)$1.000.09%

USD1(USD1)$1.000.09% Rain(RAIN)$0.0097793.47%

Rain(RAIN)$0.0097793.47% World Liberty Financial(WLFI)$0.1057333.61%

World Liberty Financial(WLFI)$0.1057333.61% MemeCore(M)$1.430.30%

MemeCore(M)$1.430.30% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Falcon USD(USDF)$1.000.01%

Falcon USD(USDF)$1.000.01% Aster(ASTER)$0.723.51%

Aster(ASTER)$0.723.51% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00% Global Dollar(USDG)$1.000.00%

Global Dollar(USDG)$1.000.00% HTX DAO(HTX)$0.0000021.13%

HTX DAO(HTX)$0.0000021.13%