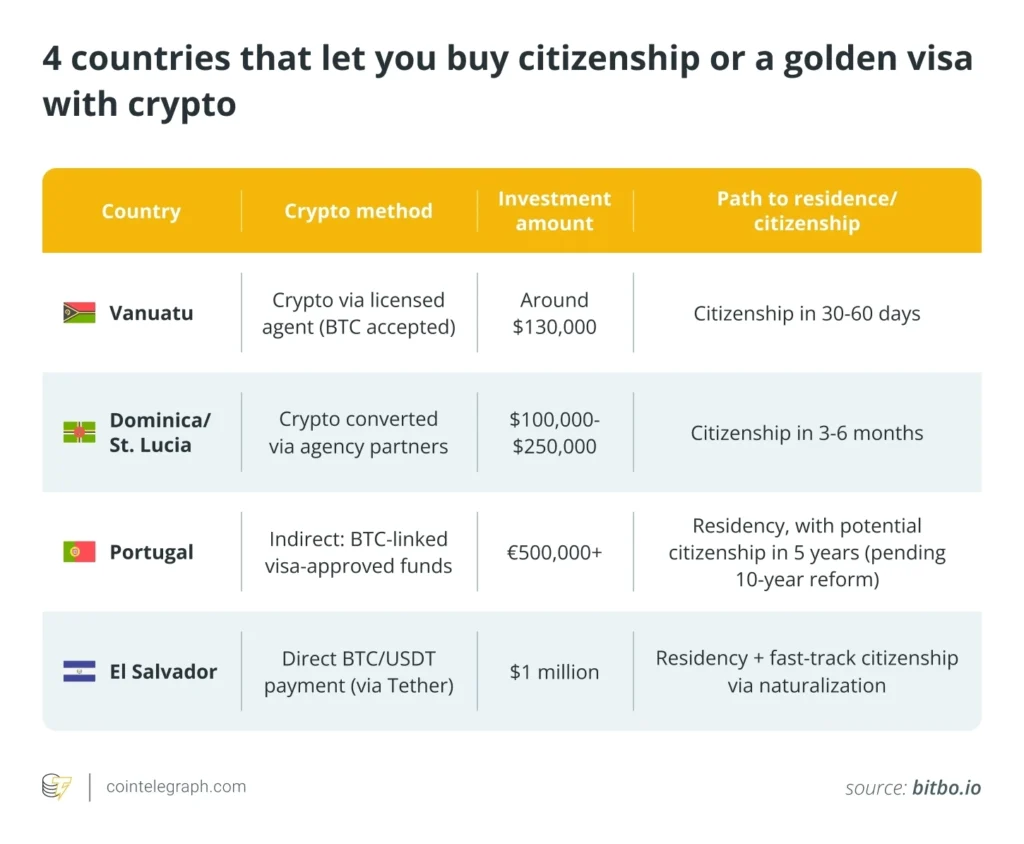

Crypto golden visa programs are becoming more accessible in 2025, with countries like El Salvador and Portugal leading the way.

Vanuatu, Dominica, and Saint Lucia offer remote, fast-track citizenship with crypto-funded investments.

Most countries still require fiat conversions, but licensed agents streamline the process for crypto holders.

Each program offers different benefits, from fast approvals to full EU access or tax-free regimes.

Due diligence, legal compliance, and professional guidance are essential when using crypto for migration purposes.

Nowadays, holding wealth in crypto has become a lifestyle. Now, that lifestyle can open the door to second citizenship or long-term residency through crypto-funded investment programs.

Source: CoinTelegraph

Vanuatu offers one of the fastest second passport programs in the world, typically completed within 30 to 60 days. Citizenship is granted through a donation starting at $130,000 for individuals and $180,000 for a family of four.

Although the government does not accept crypto directly, licensed agents do. Bitcoin (BTC), Ethereum (ETH), and stablecoins like USDT can be used, which agents convert to fiat to complete the transaction.

100% remote application process

No residency, interview, or language requirements

Dual citizenship allowed

Tax-free on income, wealth, capital gains, and inheritance

Visa-free travel to 90+ countries

Vanuatu remains a top choice for crypto nomads looking for fast, discreet crypto citizenship.

Dominica: Donate $200,000+ to the Economic Diversification Fund

Saint Lucia: Invest $240,000+ in government bonds or $300,000+ in real estate

Applications are typically processed in 4 to 9 months, with no physical presence required.

Agencies such as Apex Capital Partners and Citizenship Bay accept BTC and USDT as payment. Funds are converted and managed through a legal process that meets KYC/AML standards.

Visa-free access to the EU, UK, Singapore, Hong Kong

Entire families eligible under one application

Remote processing with minimal bureaucracy

These programs offer a solid middle ground for those looking to buy citizenship with crypto in a stable jurisdiction.

Portugal’s golden visa remains a popular route for EU residency. As of 2025, the focus has shifted from real estate to regulated investment funds, requiring a €500,000 minimum investment.

Residency leads to citizenship after five years (pending a proposed extension to ten years).

While Portugal doesn’t accept direct crypto payments, several investment funds now cater to crypto investors:

Funds with partial exposure to blockchain startups

The “Golden Crypto Fund” (up to 35% BTC/crypto ETFs)

Custom fund offers pegged to 3 BTC value

All require fiat conversion via licensed intermediaries but are structured with crypto investors in mind.

Only 7 days/year residency required

Crypto gains tax-free if held long-term

EU travel and work rights

Family inclusion available

Portugal offers one of the most attractive crypto golden visa options in Europe.

Launched in late 2023, this program offers citizenship through a $1 million investment in BTC or USDT. No fiat required.

The application starts with a $999 crypto deposit, with the remaining $999,001 invested in approved national development projects.

Tether facilitates the infrastructure, allowing direct crypto payments. This makes El Salvador the first country with a fully crypto-native migration process.

Fast approval (6 weeks)

Entire families included

No physical presence required

Citizenship granted via accelerated naturalization

For investors seeking citizenship with Bitcoin, El Salvador sets a global precedent.

Yes, countries like El Salvador and Vanuatu allow you to use Bitcoin to fund your citizenship-by-investment application—either directly or via licensed agents.

Minimums range from $130,000 in Vanuatu to $1 million in El Salvador, depending on the program and the number of family members included.

Not all. Some countries accept direct crypto payments (like El Salvador), while others require licensed agents to convert crypto into fiat (like Vanuatu or Portugal).

Yes, these are official government-backed programs. However, you must undergo AML/KYC compliance checks, and work with authorized agents or lawyers is strongly recommended.

Yes, but it’s now based on investment funds, research, or business formation, rather than real estate. Crypto-backed funds are available through intermediaries.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.030.00%

Figure Heloc(FIGR_HELOC)$1.030.00% Wrapped stETH(WSTETH)$3,813.532.48%

Wrapped stETH(WSTETH)$3,813.532.48% USDS(USDS)$1.00-0.04%

USDS(USDS)$1.00-0.04% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.00%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.00% WETH(WETH)$3,124.892.54%

WETH(WETH)$3,124.892.54% Hyperliquid(HYPE)$30.66-1.05%

Hyperliquid(HYPE)$30.66-1.05% Wrapped eETH(WEETH)$3,384.072.54%

Wrapped eETH(WEETH)$3,384.072.54% Ethena USDe(USDE)$1.000.07%

Ethena USDe(USDE)$1.000.07% Coinbase Wrapped BTC(CBBTC)$91,326.002.10%

Coinbase Wrapped BTC(CBBTC)$91,326.002.10% sUSDS(SUSDS)$1.08-0.04%

sUSDS(SUSDS)$1.08-0.04% World Liberty Financial(WLFI)$0.149719-1.31%

World Liberty Financial(WLFI)$0.149719-1.31% USDT0(USDT0)$1.00-0.04%

USDT0(USDT0)$1.00-0.04% Ethena Staked USDe(SUSDE)$1.210.00%

Ethena Staked USDe(SUSDE)$1.210.00% Bittensor(TAO)$285.501.46%

Bittensor(TAO)$285.501.46% USD1(USD1)$1.000.02%

USD1(USD1)$1.000.02%