On-chain experience matters, don’t just talk Web3, show it.

Be able to clearly explain your work in interviews.

Avoid using AI-generated resumes or applying blindly.

Target active sectors, not dead trends.

Crypto hiring is more selective now, but stronger than during past cycles.

The crypto job market has undergone a major transformation. As venture capital funding has dried up and attention has shifted toward AI, crypto companies have become increasingly selective with new hires.

Source: Jim Chang

Just how competitive is it?

Coinbase accepted only 0.3% of applicants for its recent internship program.

Many listings on CryptoJobsList attract over 200 applicants per role.

To succeed, candidates need to go beyond being just “crypto-curious”, they need to demonstrate genuine experience and passion for the space.

Proof of Search CEO Kevin Gibson explains that many candidates call themselves Web3-savvy but have little to show for it. Buying tokens or holding NFTs isn’t enough.

CryptoRecruit founder Neil Dundon said:

“If your resume says Web3 but your wallet says 0x000, I’ve got questions.”

To improve your chances in a crypto job interview:

Share your GitHub profile with actual project contributions.

Contribute to a DAO, create educational content, or participate in governance discussions.

Show real-world use of crypto tools, wallets, DeFi protocols, on-chain analytics, etc.

Even non-technical applicants (e.g., in marketing or operations) should show immersion in the ecosystem.

Many talented developers struggle to articulate their work. During interviews, it’s common for candidates to stumble on basic questions like:

“What’s the last thing you did on-chain?”

“How do you secure your wallet?”

Practice explaining your projects in plain language. Whether it’s smart contract development or community growth, recruiters want to know how you think and what you contributed.

Crypto firms value authenticity. AI-generated resumes or generic applications are easy to spot and often lead to automatic disqualification.

Tailor your resume to each company’s stack and mission.

Show you’ve used the platform or product you’re applying to.

Don’t shotgun your resume, quality over quantity matters.

According to CryptoJobsList, applicants still apply heavily to NFT marketplaces and play-to-earn games, which have lost hiring momentum. Recruiters noted:

“The speculative land-grab business model is done.”

In-Demand Roles: Rust developers, smart contract engineers, ZK (zero-knowledge) cryptography experts

Growing Sectors: Stablecoins, DeFi infrastructure, real-world asset tokenization

Cooling Off: Metaverse land sales, NFT marketplaces

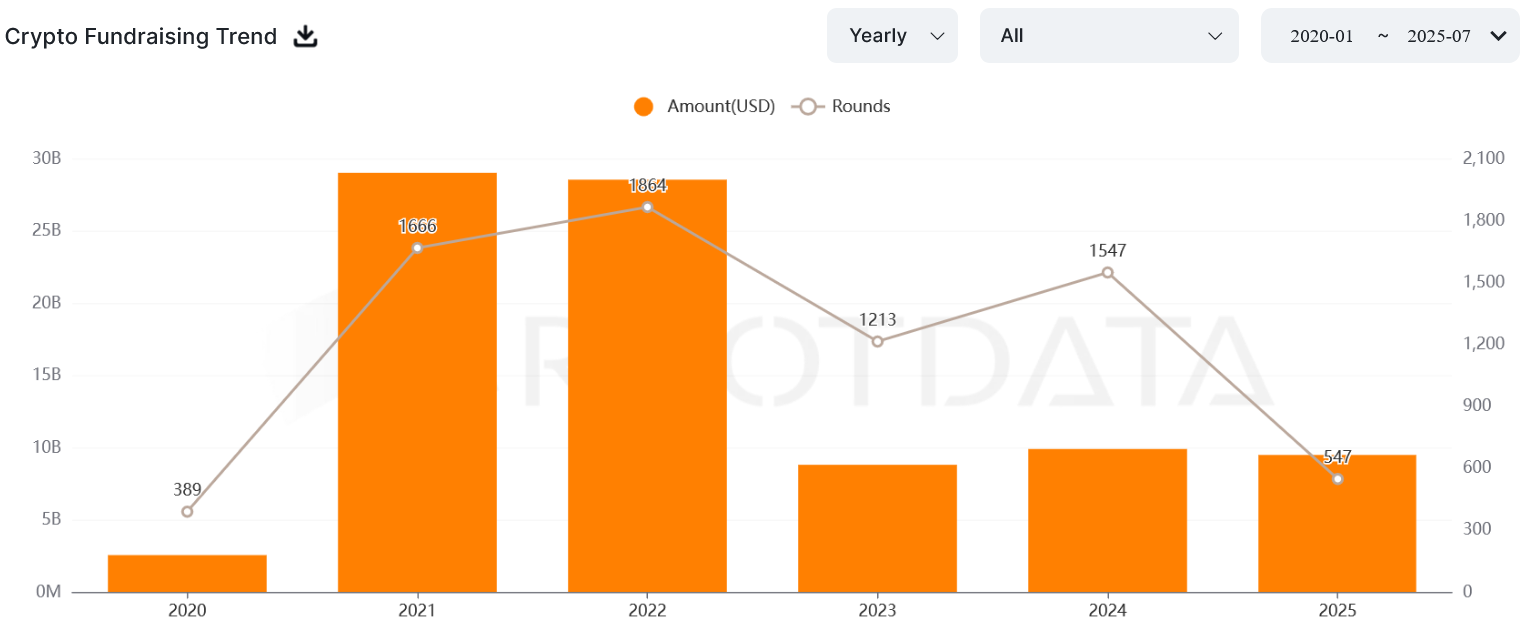

The 2022 collapse of FTX hurt crypto’s reputation, just as AI took off. Since then:

Talent and funding have shifted heavily toward AI.

Crypto fundraising has declined significantly since its 2021–2022 peak.

Only 547 funding rounds occurred in 2025 so far, the lowest since 2020.

Zackary Shelly, head of talent at Dragonfly, shared that crypto hiring is seasonal and closely tied to market sentiment:

January 2025: 60% surge in new job listings

February: Listings dropped as crypto prices dipped

March: 750 roles cut, mostly in BD, marketing, and customer support

Tech roles remain relatively stable, even in downturns.

The Crypto Sector’s Funding tally & Round Count Since 2022

Source: RootData

Neil Dundon urges companies and candidates alike to change their approach:

“The best candidates aren’t scrolling job boards, they’re building. If you want to get hired, do the work worth noticing.”

Start by:

Publishing open-source projects

Joining online hackathons or bounty programs

Networking in crypto-specific forums and DAOs

Learn the company’s product and ecosystem.

Be ready to discuss your on-chain activity or past projects.

Practice communicating technical concepts in simple terms.

Not necessarily. While developers are in high demand, there are roles in marketing, finance, operations, and community management. But you must still understand the ecosystem deeply.

Yes. Many companies can spot AI-written applications and reject them immediately. Always personalize your resume and cover letter.

Focus on DeFi, stablecoins, real-world asset tokenization, and zero-knowledge tech. Avoid chasing hype sectors that peaked in 2021.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.03-0.77%

Figure Heloc(FIGR_HELOC)$1.03-0.77% Wrapped stETH(WSTETH)$3,598.97-1.87%

Wrapped stETH(WSTETH)$3,598.97-1.87% Wrapped eETH(WEETH)$3,191.94-1.89%

Wrapped eETH(WEETH)$3,191.94-1.89% USDS(USDS)$1.000.01%

USDS(USDS)$1.000.01% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.02%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.02% Hyperliquid(HYPE)$31.27-6.90%

Hyperliquid(HYPE)$31.27-6.90% Coinbase Wrapped BTC(CBBTC)$87,854.00-1.08%

Coinbase Wrapped BTC(CBBTC)$87,854.00-1.08% WETH(WETH)$2,936.48-1.87%

WETH(WETH)$2,936.48-1.87% Ethena USDe(USDE)$1.00-0.08%

Ethena USDe(USDE)$1.00-0.08% Canton(CC)$0.1634564.74%

Canton(CC)$0.1634564.74% USD1(USD1)$1.00-0.04%

USD1(USD1)$1.00-0.04% USDT0(USDT0)$1.00-0.01%

USDT0(USDT0)$1.00-0.01% World Liberty Financial(WLFI)$0.161258-0.13%

World Liberty Financial(WLFI)$0.161258-0.13% sUSDS(SUSDS)$1.09-0.05%

sUSDS(SUSDS)$1.09-0.05% Ethena Staked USDe(SUSDE)$1.22-0.06%

Ethena Staked USDe(SUSDE)$1.22-0.06% Rain(RAIN)$0.0097550.78%

Rain(RAIN)$0.0097550.78% MemeCore(M)$1.54-1.36%

MemeCore(M)$1.54-1.36%