AI agents are increasingly capable of managing crypto wallets and executing payments autonomously.

Security risks, including prompt injection, scams, and compliance gaps, remain major concerns.

Current systems use safeguards like model context protocols to limit the AI’s actions.

Users must stay vigilant and approve all transactions manually to maintain safety.

Over time, AI agents are likely to handle more complex financial tasks, improving portfolio management efficiency.

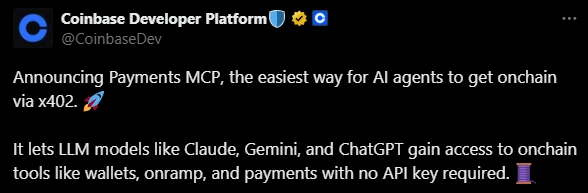

Recently, Coinbase introduced Payments MCP, a tool designed to allow AI agents to access on-chain financial tools in much the same way humans do.

When paired with large language models (LLMs) like Claude, Gemini, or Codex, these AI agents can access crypto wallets and execute payments autonomously.

Source: X (@CoinbaseDev)

According to the Coinbase Developer Platform, Payments MCP allows AI agents to pay for services, retrieve paywalled data, tip content creators, and manage certain business operations through the x402 protocol.

This protocol is an open, web-native payment system enabling instant stablecoin transfers. Coinbase stated:

“It marks a new phase of agentic commerce where AI agents can act in the global economy.”

AI agents could revolutionize how users interact with their crypto portfolios. From trading to payments, they can potentially streamline operations and reduce the manual effort traditionally required in DeFi.

However, the technology also introduces unique risks that users need to understand.

Aaron Ratcliff, Attributions Lead at Merkle Science, noted that giving AI agents access to crypto wallets introduces a “layer of trust” in a system designed to be trustless.

Ratcliff explained:

“Safe use depends on users understanding how to prompt AI, ensuring blockchain data is accurate, and keeping trading credentials secure. If credentials leak, the damage writes itself.”

While AI agents can enhance efficiency, improper handling or insufficient safeguards could make wallets vulnerable.

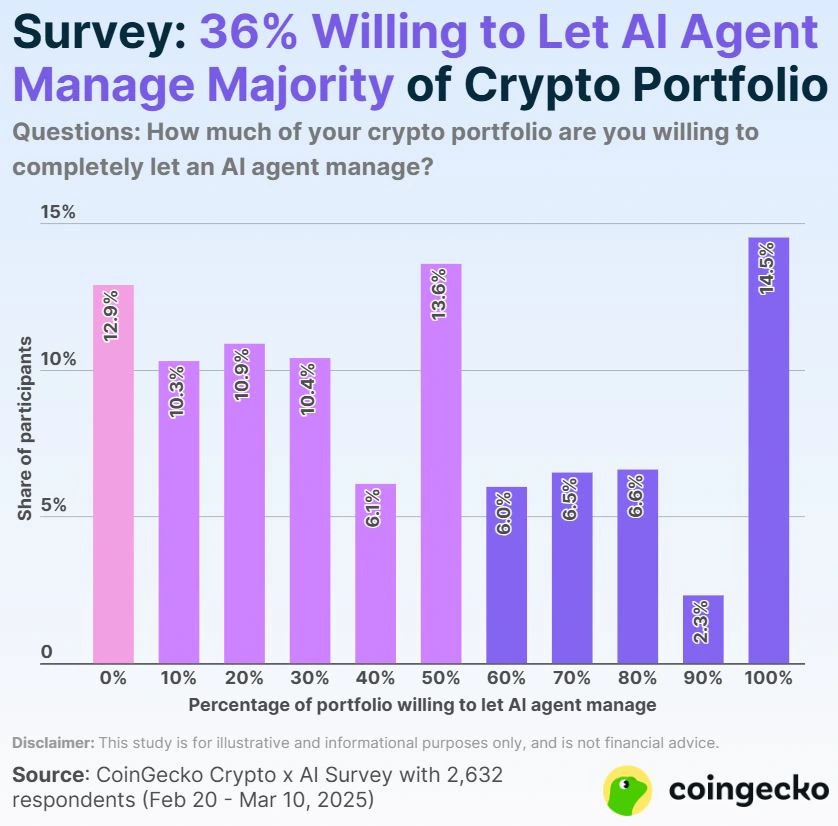

An April survey from CoinGecko revealed that 87% of crypto users would allow AI agents to manage at least 10% of their portfolios.

Source: CoinGecko

Despite this optimism, there are clear risks:

Prompt or instruction injection: Malicious actors could hijack AI systems through manipulated inputs.

Man-in-the-middle attacks: Hackers could intercept communications and redirect trades.

Scam interactions: AI agents might inadvertently trade scam tokens, fall into honeypots, or handle slippage poorly.

Compliance gaps: AI agents might send funds to sanctioned addresses without proper safeguards.

Sean Ren, co-founder of Sahara AI, highlighted that Coinbase’s tool uses model context protocols, which act as gatekeepers between AI agents and users’ wallets.

These protocols ensure AI agents can only perform approved actions, such as checking balances or preparing transactions for user approval.

Ren said:

“Even if someone attempts a prompt injection, the agent cannot autonomously move funds.”

However, Ren stressed that users must remain vigilant. AI agents can assist, but they cannot replace human oversight entirely. Users should always double-check transactions and approvals.

Brian Huang, CEO of Glider, explained that current AI agents excel at simple tasks like sending, swapping, or lending crypto. These tasks help onboard users and guide them through complex DeFi operations.

Huang said:

“Agents act like assistants, helping users navigate DeFi, which is otherwise too complicated to participate in.”

As the technology matures, AI agents could take on more advanced roles, including portfolio rebalancing, personalized financial advice, and dynamic risk management.

Their ability to process multiple variables simultaneously may surpass traditional human capabilities in managing crypto portfolios.

AI agents can manage certain actions, but users must remain vigilant and approve transactions manually. Complete autonomy is not recommended yet.

Risks include prompt injection, scams, man-in-the-middle attacks, poor slippage handling, and potential compliance issues.

Tools like Coinbase’s Payments MCP allow AI agents to access wallets via secure protocols, performing only approved actions such as checking balances or preparing transactions.

Yes, they can simplify DeFi interactions and provide guidance, but users should still understand the basics of wallet management.

Not entirely. While AI agents can enhance efficiency and analysis, human oversight is essential for security and decision-making.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.03-0.68%

Figure Heloc(FIGR_HELOC)$1.03-0.68% USDS(USDS)$1.000.01%

USDS(USDS)$1.000.01% Hyperliquid(HYPE)$31.903.78%

Hyperliquid(HYPE)$31.903.78% Canton(CC)$0.1675184.11%

Canton(CC)$0.1675184.11% Ethena USDe(USDE)$1.000.04%

Ethena USDe(USDE)$1.000.04% USD1(USD1)$1.000.00%

USD1(USD1)$1.000.00% Rain(RAIN)$0.0098450.57%

Rain(RAIN)$0.0098450.57% World Liberty Financial(WLFI)$0.1044281.15%

World Liberty Financial(WLFI)$0.1044281.15% MemeCore(M)$1.39-4.78%

MemeCore(M)$1.39-4.78% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Bittensor(TAO)$186.6319.62%

Bittensor(TAO)$186.6319.62% Falcon USD(USDF)$1.00-0.04%

Falcon USD(USDF)$1.00-0.04% Aster(ASTER)$0.71-0.27%

Aster(ASTER)$0.71-0.27% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00% Global Dollar(USDG)$1.000.03%

Global Dollar(USDG)$1.000.03%