Dogecoin ETF (DOJE) and XRP ETF (XRPR) saw $54.7 million combined volume on their first trading day.

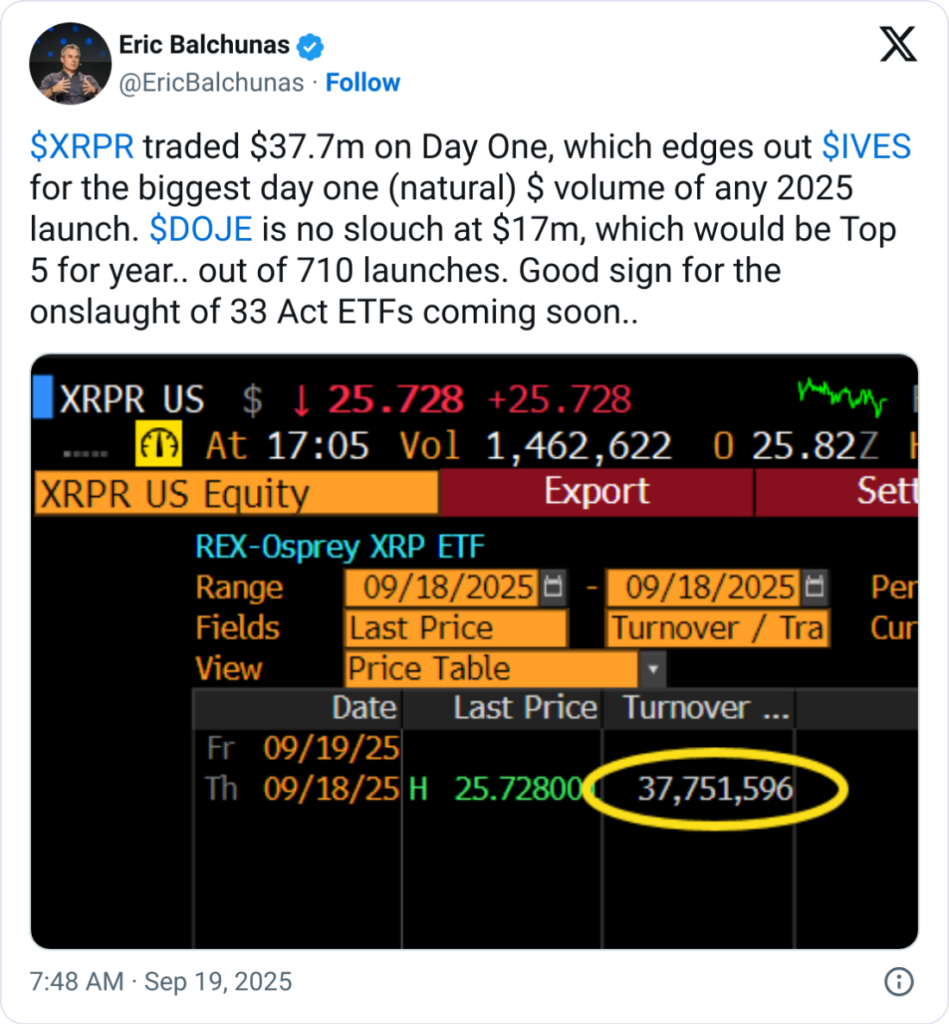

The XRP ETF led with $37.7 million, the highest debut of any ETF in 2025.

The Dogecoin ETF recorded $17 million, beating forecasts and ranking in the top five ETF launches this year.

Both ETFs are registered under the 40 Act, use indirect exposure, and do not hold crypto directly.

The launch signals strong market appetite for altcoin-related ETFs despite structural and regulatory complexities.

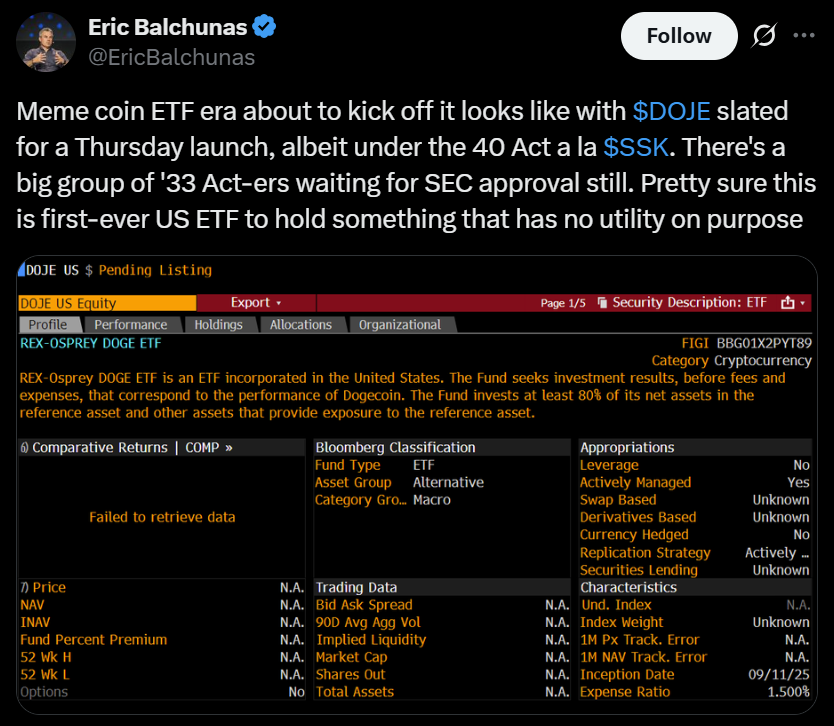

Two new ETFs tracking DOGE and XRP officially hit the U.S. market, attracting significant investor interest and blowing past trading volume estimates on day one. The funds were launched under a collaboration between asset managers REX Shares and Osprey Funds.

According to Bloomberg ETF analyst Eric Balchunas, it’s rare for new ETFs to attract more than $1 million in daily trading volume on their first day. Yet the Dogecoin ETF and XRP ETF managed a combined $54.7 million in trading, clearly indicating robust demand.

Source: Eric Balchunas

Eric said:

“That is way more than I would have thought. Most ETFs trade under $1 million on Day One.”

He called the impressive debut a promising signal for other pending crypto ETFs, particularly those tied to altcoins and staking strategies.

The REX-Osprey Dogecoin ETF (ticker: DOJE) was also a breakout performer. While analysts had predicted a modest $2.5 million in trading volume, DOJE smashed expectations early in the day.

$6 million traded in the first hour

$17 million total trading volume by market close

Ranked among the top five ETF launches of 2025

“That’s shockingly solid,” said Balchunas. “It completely destroyed my expectations.”

The Dogecoin ETF mirrors the XRP ETF in structure: it holds foreign ETF shares and a Cayman-based subsidiary that gains price exposure to DOGE, rather than directly holding the coin itself.

The REX-Osprey XRP ETF (ticker: XRPR) took the lead, generating $37.7 million in trading volume on day one, making it the largest debut ETF launch of 2025 so far in terms of monetary volume.

Source: Eric Balchunas

$24 million traded within the first 90 minutes

Outperformed all previous XRP futures ETFs by a factor of five

The XRP ETF does not directly hold the cryptocurrency. Instead, it invests in a Cayman Islands-based subsidiary and purchases shares in international funds that track XRP’s market price.

Both XRPR and DOJE were registered under the Investment Company Act of 1940 (the “40 Act”), which differs from the more common Securities Act of 1933 (the “33 Act”) used for previous Bitcoin and Ether ETFs.

Faster approval timeline (75 days under the 40 Act vs. 240 days under the 33 Act)

Limitations on holdings: these ETFs do not hold actual crypto directly

Instead, they utilize Cayman subsidiaries and international ETF exposure

While some analysts speculated that the 40 Act structure might reduce investor interest, the market clearly showed otherwise.

The launch of these ETFs comes at a time when the Securities and Exchange Commission (SEC) is beginning to ease its stance on crypto-related financial products.

On the same week as the XRPR and DOJE launches, the SEC approved new listing standards for crypto ETFs, which could accelerate approvals for other altcoin-based ETFs in the pipeline.

The Dogecoin ETF (DOJE) is an exchange-traded fund launched by REX Shares and Osprey Funds that provides investors with exposure to Dogecoin’s market price through indirect holdings.

No, the fund does not hold DOGE directly. Instead, it invests in a Cayman Islands-based subsidiary that holds positions in foreign Dogecoin-tracking ETFs.

The DOJE ETF saw a $17 million trading volume on its debut—far exceeding analyst expectations and placing it among the top ETF launches of the year.

As with any crypto-related investment, the Dogecoin ETF carries volatility and regulatory risks. Additionally, its indirect structure may introduce complexity or tracking errors.

Yes, it is registered under the Investment Company Act of 1940 and was launched following SEC approval.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.020.00%

Figure Heloc(FIGR_HELOC)$1.020.00% USDS(USDS)$1.000.08%

USDS(USDS)$1.000.08% Hyperliquid(HYPE)$30.20-1.14%

Hyperliquid(HYPE)$30.20-1.14% Ethena USDe(USDE)$1.000.01%

Ethena USDe(USDE)$1.000.01% Canton(CC)$0.1617050.26%

Canton(CC)$0.1617050.26% USD1(USD1)$1.00-0.03%

USD1(USD1)$1.00-0.03% Rain(RAIN)$0.009668-1.54%

Rain(RAIN)$0.009668-1.54% World Liberty Financial(WLFI)$0.1007140.20%

World Liberty Financial(WLFI)$0.1007140.20% MemeCore(M)$1.395.72%

MemeCore(M)$1.395.72% Bittensor(TAO)$196.407.24%

Bittensor(TAO)$196.407.24% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Aster(ASTER)$0.730.67%

Aster(ASTER)$0.730.67% Falcon USD(USDF)$1.000.12%

Falcon USD(USDF)$1.000.12% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00% Global Dollar(USDG)$1.00-0.01%

Global Dollar(USDG)$1.00-0.01%