$727 million flowed into U.S. spot Ethereum ETFs on July 17, smashing previous daily records.

BlackRock and Fidelity led the inflows, signaling massive institutional interest.

Spot ETH ETFs now hold more than 5 million ETH, equivalent to over 4% of the circulating supply.

Ethereum issuance was far outpaced by ETF purchases—highlighting a demand surge.

Altcoins rallied, with ETH up 30% in 14 days, while BTC lagged behind.

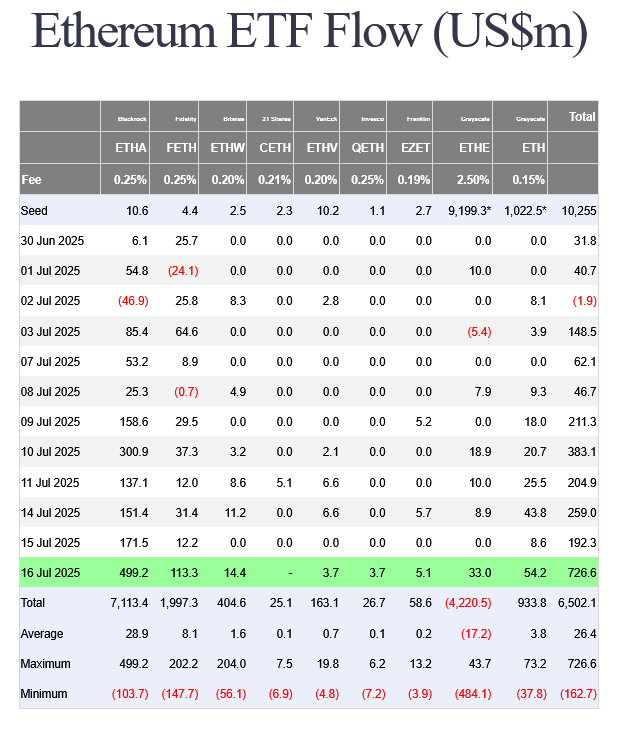

U.S. spot Ethereum ETFs have smashed previous records, with a massive $726.6 million in daily inflows recorded on Wednesday, July 17th.

Spot Ethereum ETFs Experienced Net Inflows Of Nearly $727M On Wednesday

Source: Farside Investors

These unprecedented figures signal a growing institutional appetite for Ethereum as investors pile into crypto-backed exchange-traded funds amid a broader altcoin rally.

According to Farside Investors, BlackRock and Fidelity led the charge, with BlackRock’s ETHA capturing the lion’s share of the inflows.

On July 17th, BlackRock’s Ethereum ETF (ETHA) reported a record-breaking $499 million in net inflows, nearly 70% of the day’s total. Close behind was Fidelity’s FETH, which brought in $113 million.

These massive investments helped push total spot Ethereum ETF holdings above 5 million ETH, or more than 4% of Ethereum’s total circulating supply, according to Trader T.

“This single-day surge overtook the previous record set on December 5, 2024, which stood at $428 million.”

In a clear sign of surging demand, Ethereum ETFs on Wednesday purchased nearly 107 times more ETH than was issued by the network, just $6.74 million worth of ETH was minted in that 24-hour period, according to Ultra Sound Money.

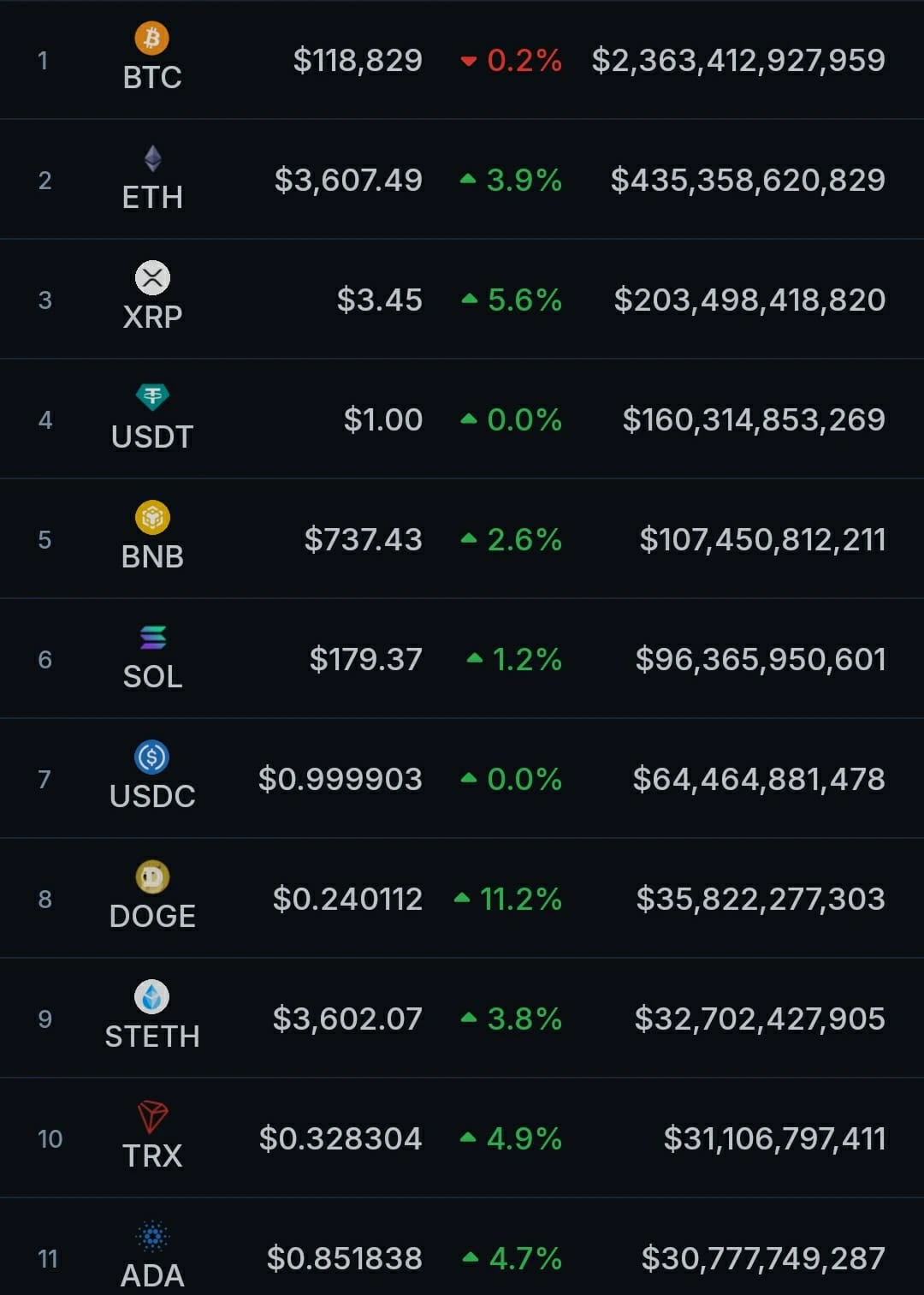

The excitement around Ethereum ETFs appears to have spilled into the broader crypto market.

Over the last 24 hours, Ethereum (ETH) traded at $3,346, rising by 7.2% and extending its 14-day rally to over 30%, per CoinGecko data.

Crypto Market Overview

Source: CoinGecko

Crypto analyst Matthew Hyland commented that Bitcoin dominance may have peaked, especially if ETH continues its upward trend.

Currently, Bitcoin’s market dominance sits at 61%, but Hyland suggested that if it drops to 45%, altcoins could surge even further.

XRP: +7.6%

BNB: +3.4%

Solana (SOL): +5.2%

Dogecoin (DOGE): +6.9%

Tron (TRX): +3.2%

Cardano (ADA): +3.5%

Bitcoin (BTC): +0.7%

A spot Ethereum ETF is a financial product that directly holds ETH tokens and allows investors to gain exposure to Ethereum without having to manage wallets or private keys.

Institutional investors are increasingly bullish on Ethereum due to its long-term utility in decentralized finance (DeFi), upcoming protocol upgrades, and broader adoption. ETFs offer a regulated and simplified way to gain exposure.

As of July 17, U.S. Ethereum ETFs collectively hold over 5 million ETH, which is more than 4% of the total circulating supply.

Massive ETF inflows reduce the available supply on the market, which increases buying pressure and contributes to price rallies—this effect has already pushed ETH up over 30% in the last two weeks.

Yes. Corporate treasuries now hold more than $5.33 billion worth of ETH, with many increasing their stakes in the past month.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.030.05%

Figure Heloc(FIGR_HELOC)$1.030.05% USDS(USDS)$1.000.01%

USDS(USDS)$1.000.01% Hyperliquid(HYPE)$28.44-1.88%

Hyperliquid(HYPE)$28.44-1.88% Ethena USDe(USDE)$1.00-0.01%

Ethena USDe(USDE)$1.00-0.01% Canton(CC)$0.159959-3.43%

Canton(CC)$0.159959-3.43% USD1(USD1)$1.00-0.02%

USD1(USD1)$1.00-0.02% Rain(RAIN)$0.009658-4.64%

Rain(RAIN)$0.009658-4.64% World Liberty Financial(WLFI)$0.1174820.46%

World Liberty Financial(WLFI)$0.1174820.46% MemeCore(M)$1.35-12.18%

MemeCore(M)$1.35-12.18% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Falcon USD(USDF)$1.000.05%

Falcon USD(USDF)$1.000.05% Bittensor(TAO)$180.97-5.44%

Bittensor(TAO)$180.97-5.44% Aster(ASTER)$0.69-1.78%

Aster(ASTER)$0.69-1.78% Pi Network(PI)$0.186997-0.25%

Pi Network(PI)$0.186997-0.25% Global Dollar(USDG)$1.00-0.03%

Global Dollar(USDG)$1.00-0.03%