GAIN Act prioritizes U.S. access to AI and HPC chips, directly impacting companies like Nvidia.

The act could restrict chip exports, complicating global hardware supply chains.

Crypto miners in the U.S. face increased pressure from both tariffs and potential hardware shortages.

The act has cleared the Senate but is not yet law.

If passed, it would mark a significant shift in U.S. tech and defense policy.

The GAIN Act mandates that U.S.-based chipmakers prioritize domestic orders of AI and high-performance computing (HPC) chips before fulfilling international demand.

Page 1 Of The 2026 NDAA

Source: US Congress

In essence, it compels companies like Nvidia to supply U.S. buyers before exporting their advanced processors abroad.

Domestic First Requirement: Chipmakers must fulfill all U.S. orders before applying for an export license.

Congressional Oversight: Congress can deny export licenses for high-end AI chips.

License Mandates: All chips containing an “advanced integrated circuit” require an export license.

As the leading U.S. manufacturer of AI chips, Nvidia is directly impacted by the GAIN Act.

The company’s high-performance processors, such as the Blackwell line, have been in high demand worldwide, with production often booked out for months in advance.

This backlog has frustrated U.S.-based AI startups and research institutions, which often lose access to critical hardware due to international competition.

While the GAIN Act bolsters AI and HPC development domestically, it casts a shadow over the already struggling crypto mining industry, particularly in the United States.

Crypto mining operations, especially those relying on advanced GPUs and ASICs, depend on a steady and affordable hardware supply chain.

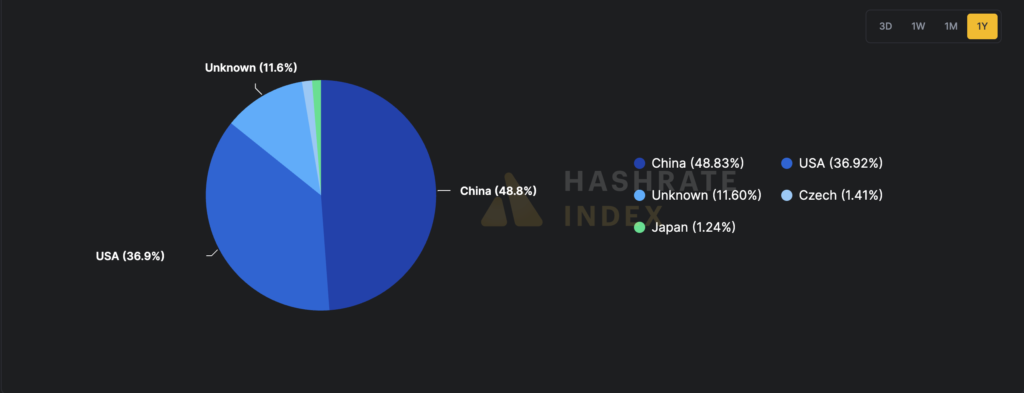

Bitcoin Mining Pools By Country

Source: Hashrate Index

If chips are rerouted to serve domestic AI applications first, miners may face shortages and higher prices.

Tariffs on Chinese goods, reintroduced in 2024, have already driven up the cost of importing mining hardware.

CleanSpark, a major U.S. mining firm, incurred $185 million in liabilities due to accusations that imported equipment originated from China.

IREN, another miner, faced a $100 million bill tied to trade duty penalties.

These financial blows make it difficult for U.S. miners to stay competitive, especially when mining hardware becomes more accessible and cheaper outside the United States due to export limitations.

While the Senate has passed the GAIN Act as an amendment to the 2026 NDAA, it must still pass the House of Representatives and be signed by the U.S. President before becoming law.

This leaves room for negotiation and potential revisions. There’s no guarantee the final bill will include all current provisions of the GAIN Act.

If enacted, the GAIN Act could:

Strengthen the U.S. position in the global AI race.

Ensure U.S. research labs, military, and tech firms have priority access to essential computing resources.

Solidify Nvidia’s role as a national security asset.

However, it also risks reducing the competitiveness of U.S.-based crypto mining operations and could further escalate global trade tensions, especially with China.

The GAIN Act is a proposed U.S. law requiring chipmakers to prioritize domestic AI and HPC chip sales before exporting.

Yes. Nvidia, as a major AI chipmaker, would be required to fulfill all U.S. orders before selling its advanced processors abroad.

Not yet. It has passed the Senate but still needs approval from the House and the President.

It may increase hardware costs and limit availability for crypto miners, making operations more expensive and less competitive in the U.S.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.04-0.39%

Figure Heloc(FIGR_HELOC)$1.04-0.39% USDS(USDS)$1.000.00%

USDS(USDS)$1.000.00% Hyperliquid(HYPE)$31.521.67%

Hyperliquid(HYPE)$31.521.67% Ethena USDe(USDE)$1.00-0.03%

Ethena USDe(USDE)$1.00-0.03% Canton(CC)$0.164141-0.31%

Canton(CC)$0.164141-0.31% USD1(USD1)$1.00-0.08%

USD1(USD1)$1.00-0.08% Rain(RAIN)$0.0102543.65%

Rain(RAIN)$0.0102543.65% World Liberty Financial(WLFI)$0.104655-2.78%

World Liberty Financial(WLFI)$0.104655-2.78% MemeCore(M)$1.40-1.81%

MemeCore(M)$1.40-1.81% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Aster(ASTER)$0.721.90%

Aster(ASTER)$0.721.90% Falcon USD(USDF)$1.00-0.01%

Falcon USD(USDF)$1.00-0.01% Sky(SKY)$0.0693834.12%

Sky(SKY)$0.0693834.12% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00% Global Dollar(USDG)$1.00-0.01%

Global Dollar(USDG)$1.00-0.01%