Paxos mistakenly minted 300 trillion PYUSD tokens due to an internal error.

The tokens, worth a notional $300 trillion, were burned within 22 minutes.

No user funds were affected, and the incident posed no long-term risk.

PYUSD held its dollar peg, showing resilience in the face of unexpected technical glitches.

The event highlights the importance of robust internal controls in stablecoin issuance and blockchain operations.

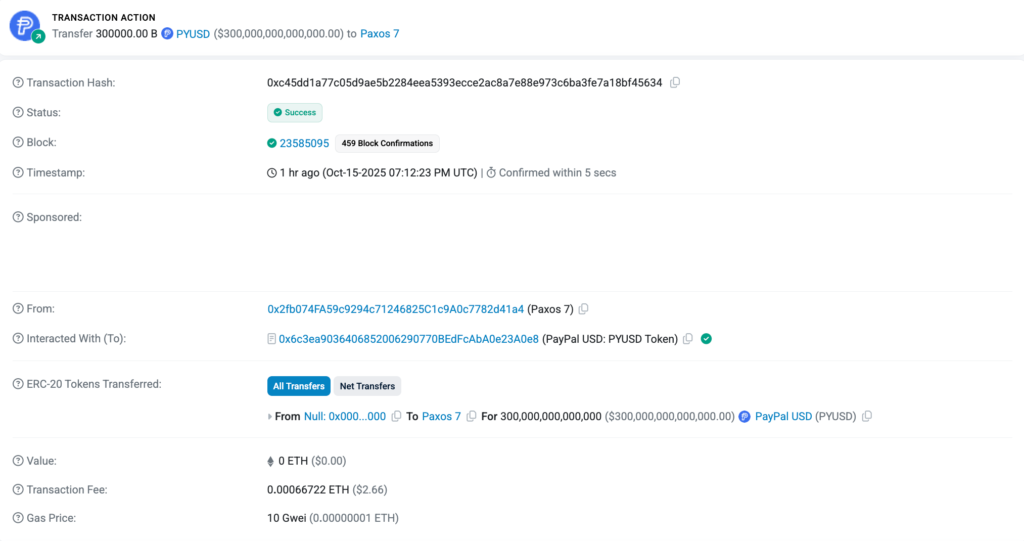

On October 16th, 2025, at 7:12 PM UTC, Paxos minted 300 trillion PYUSD stablecoins, briefly flooding the blockchain with tokens representing a theoretical $300 trillion USD.

Within 22 minutes, the entire sum was sent to a burn address, effectively removing the tokens from circulation.

The 300 Trillion PYUSD Mint

Source: Etherscan

The rapid mint-and-burn prompted Chaos Labs founder Omer Goldberg to announce that Aave would temporarily freeze trading of the PYUSD stablecoin to assess any potential risks.

The sheer scale of the mint raised concerns, even though no direct impact on users was reported.

Shortly after the event, Paxos issued a statement via X, clarifying the situation:

“This was an internal technical error. There is no security breach. Customer funds are safe. We have addressed the root cause.”

Despite the magnitude of the error, the PYUSD stablecoin managed to hold its $1 peg, although analytics platform Nansen reported a brief 0.5% price dip immediately following the event.

PYUSD’s Price Immediately After The Mint & Burn

Source: Nansen

Market Cap: Over $2.3 billion

Ranking: 6th largest stablecoin (as of October 2025)

Peg: 1:1 with the US dollar

Issuer: Paxos, in partnership with PayPal

PYUSD ranks behind industry giants like USDT, USDC, USDe, DAI, and USD1 in terms of market capitalization.

To put it in perspective, the $300 trillion accidentally minted is more than double the combined global GDP, according to the International Monetary Fund (IMF).

While this mint-and-burn was accidental, crypto projects have intentionally burned massive token quantities in the past:

OKX Exchange: Burned over 65 million OKB tokens in August 2025 to limit supply.

Bonk (BONK): Burned 1.7 trillion tokens in December 2024, though the total value was only about $50 million.

World Liberty Financial: Burned 47 million tokens in 2025 in an attempt to counter a price slide.

Still, the PYUSD stablecoin burn stands out due to its mind-boggling nominal value, $300 trillion, albeit temporary.

PYUSD is a U.S. dollar-pegged stablecoin launched by PayPal and issued by Paxos, designed to facilitate secure and efficient crypto payments.

The tokens were minted due to an internal technical error by Paxos. The issue has been resolved, and the funds were never circulated.

No. Paxos confirmed that no customer funds were at risk, and no security breach occurred.

The stablecoin briefly dropped by about 0.5% but quickly returned to its $1 peg.

Yes. Paxos has addressed the error, and Aave’s temporary freeze was a precautionary move. The system remains stable.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.04-0.39%

Figure Heloc(FIGR_HELOC)$1.04-0.39% USDS(USDS)$1.000.00%

USDS(USDS)$1.000.00% Hyperliquid(HYPE)$31.521.67%

Hyperliquid(HYPE)$31.521.67% Ethena USDe(USDE)$1.00-0.03%

Ethena USDe(USDE)$1.00-0.03% Canton(CC)$0.164141-0.31%

Canton(CC)$0.164141-0.31% USD1(USD1)$1.00-0.08%

USD1(USD1)$1.00-0.08% Rain(RAIN)$0.0102543.65%

Rain(RAIN)$0.0102543.65% World Liberty Financial(WLFI)$0.104655-2.78%

World Liberty Financial(WLFI)$0.104655-2.78% MemeCore(M)$1.40-1.81%

MemeCore(M)$1.40-1.81% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Aster(ASTER)$0.721.90%

Aster(ASTER)$0.721.90% Falcon USD(USDF)$1.00-0.01%

Falcon USD(USDF)$1.00-0.01% Sky(SKY)$0.0693834.12%

Sky(SKY)$0.0693834.12% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00% Global Dollar(USDG)$1.00-0.01%

Global Dollar(USDG)$1.00-0.01%