Benjamin Chow, co-founder of Meteora, faces RICO charges for allegedly orchestrating a $57M memecoin scam.

The operation used celebrity names like Melania Trump and Javier Milei to lure investors.

Blockchain analysis uncovered centralized wallets coordinating token creation and liquidity manipulation.

Multiple tokens, including $LIBRA and $MELANIA, followed a recycled pump-and-dump strategy.

The case underscores the growing risk of memecoin scams in decentralized finance.

According to the Second Amended Class Action Complaint, Chow and his partners operated the so-called Meteora-Kelsier Enterprise, allegedly a “fraud factory” disguised as a DeFi protocol.

Using the Meteora liquidity-pooling system on Solana, the group allegedly launched multiple pump-and-dump schemes involving tokens such as $M3M3, $LIBRA, $MELANIA, $ENRON, and $TRUST.

Source: Court Listener

Plaintiffs Omar Hurlock, Anuj Mehta, and John Winslow claim that Chow’s team exploited technical features like whitelists and freeze/thaw toggles to secure the majority of token supplies before public launch.

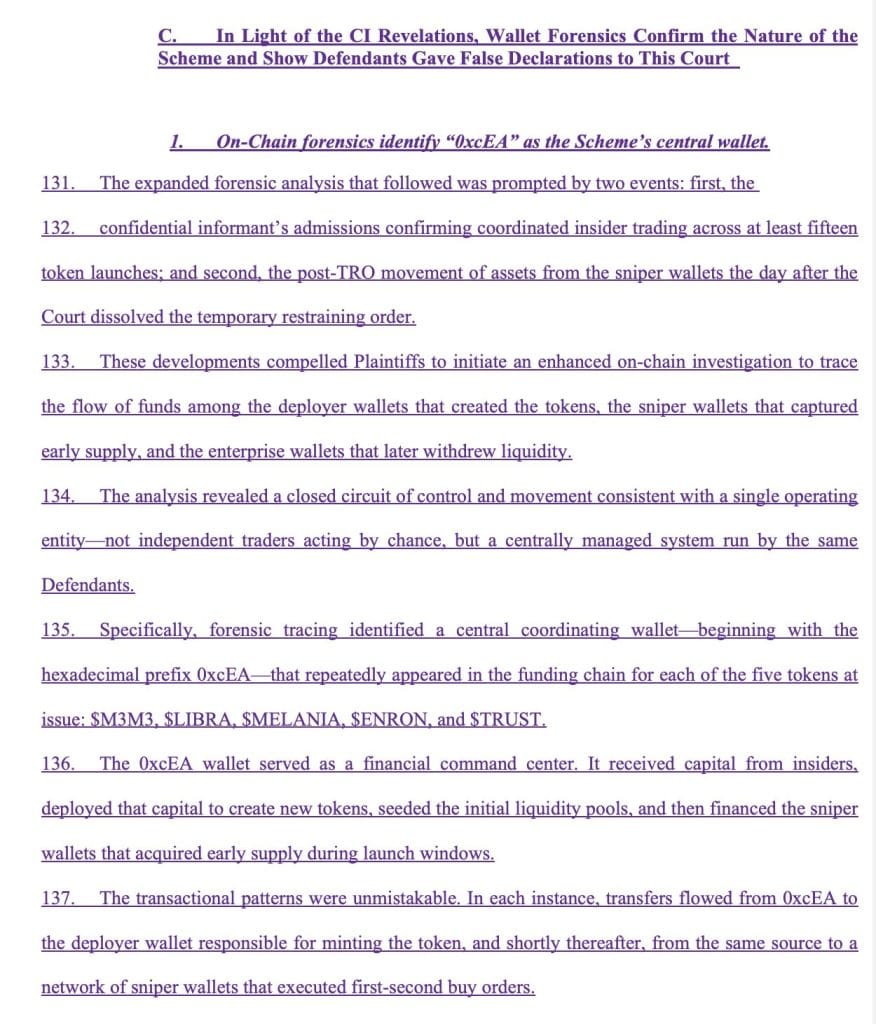

A forensic blockchain analysis revealed a central coordinating wallet (prefix 0xcEA) that financed deployer wallets, created tokens, and seeded liquidity pools, all while funding sniper wallets designed to capture early token allocations.

The lawsuit outlines a six-step strategy allegedly used across all Meteora-linked tokens.

Each project began with a celebrity-driven story, such as Melania Trump’s or Javier Milei’s endorsement, to generate hype.

Developers allegedly pre-purchased massive token supplies via whitelisted wallets before launch.

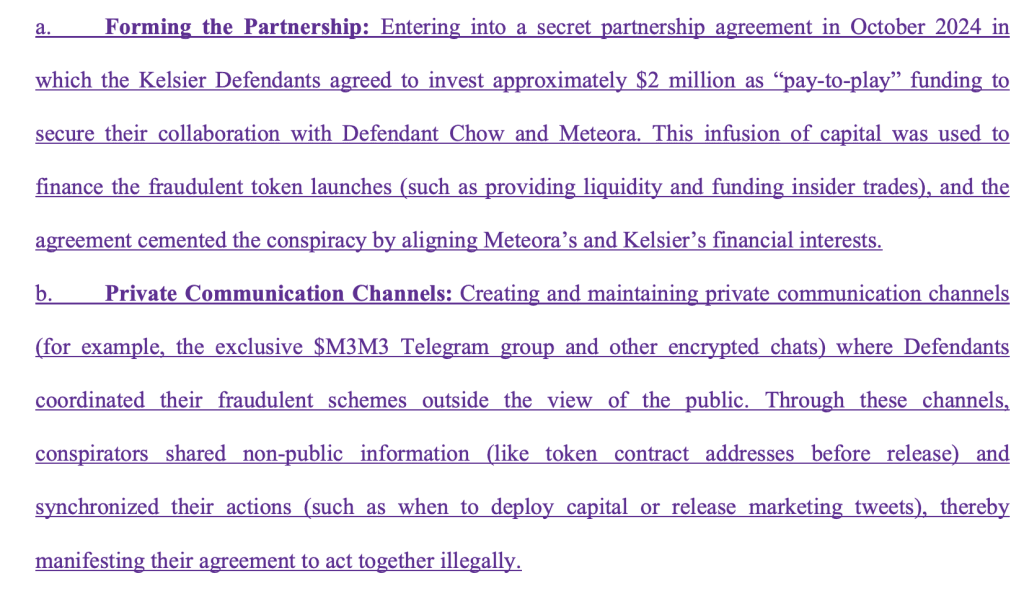

A network of undisclosed paid influencers and KOLs created hype, promoting the tokens as legitimate celebrity-backed projects.

Using Meteora’s liquidity pool controls, insiders paused trading, allowing themselves to secure favorable positions before reopening markets.

Once public trading began, insiders dumped their holdings, withdrawing liquidity and collapsing token prices.

After each rug pull, the same team relaunched the scam under new token names and narratives, repeating the cycle.

The $LIBRA memecoin scam erupted when Javier Milei’s verified social media account shared the token’s contract address in February 2025, coinciding with the token’s public pool opening.

Marketed as a patriotic project meant to fund Argentine small businesses, $LIBRA attracted a retail buying frenzy.

Within hours, the deployer wallet withdrew over $110 million in USDC liquidity, causing the token’s value to plummet as Milei’s team deleted promotional posts.

The $MELANIA coin, marketed as the official memecoin of Melania Trump, promised “anti-dumping” vesting features. But wallets tied to the Meteora-Kelsier cluster reportedly acquired one-third of the supply within minutes.

After paid promotion and a brief surge, the price collapsed by over 90%, mirroring previous scams. Hayden Davis, CEO of Kelsier Ventures, admitted in an interview:

“We sniped our own coin to prevent snipers from sniping our own coin.”

In February 2025, Benjamin Chow resigned from Meteora following the $LIBRA controversy. While some, like Jupiter co-founder Meow, defended his character, others cited his “lack of judgment.”

A leaked video showed Chow expressing regret:

“I feel so sick, because I gave him Melania. I enabled the guy that should not have been enabled.”

Prosecutors now allege Chow directed smart contract configurations, managed liquidity pools, and authorized selective freezing of trades to manipulate token markets.

Kelsier Labs reportedly invested $2 million in Meteora as part of a “pay-to-play” deal.

Source: Court Listener

The class action lists seven causes of action, including:

Fraud and conspiracy to defraud

RICO violations for racketeering and wire fraud

Deceptive trade practices under New York law

Unjust enrichment through illicit token gains

This case arrives amid increasing scrutiny of Trump family crypto projects, which allegedly generated $1 billion in pre-tax gains last year.

Both $TRUMP and $MELANIA tokens have since plunged in value, with $MELANIA’s market cap falling from $2 billion to $790 million.

It’s a class action case alleging that Meteora’s founder, Benjamin Chow, used celebrity-endorsed tokens to run a $57 million fraud scheme.

Melania Trump and Argentine President Javier Milei were featured—though neither is confirmed to have knowingly participated.

Through insider token manipulation, paid promotions, and liquidity withdrawals that caused massive token crashes.

No. He resigned in February 2025, though prosecutors allege his technical involvement continued afterward.

Always verify token origins, audit smart contracts, and avoid hype-driven launches that rely on celebrity names.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.051.23%

Figure Heloc(FIGR_HELOC)$1.051.23% USDS(USDS)$1.00-0.08%

USDS(USDS)$1.00-0.08% Hyperliquid(HYPE)$31.288.83%

Hyperliquid(HYPE)$31.288.83% Ethena USDe(USDE)$1.00-0.01%

Ethena USDe(USDE)$1.00-0.01% Canton(CC)$0.1669711.26%

Canton(CC)$0.1669711.26% USD1(USD1)$1.000.10%

USD1(USD1)$1.000.10% Rain(RAIN)$0.0099681.32%

Rain(RAIN)$0.0099681.32% World Liberty Financial(WLFI)$0.1091009.36%

World Liberty Financial(WLFI)$0.1091009.36% MemeCore(M)$1.432.11%

MemeCore(M)$1.432.11% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Aster(ASTER)$0.7210.16%

Aster(ASTER)$0.7210.16% Falcon USD(USDF)$1.00-0.05%

Falcon USD(USDF)$1.00-0.05% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00% Global Dollar(USDG)$1.00-0.01%

Global Dollar(USDG)$1.00-0.01% HTX DAO(HTX)$0.0000021.91%

HTX DAO(HTX)$0.0000021.91%