Binance has launched its “Crypto as a Service” model, aiming to onboard institutional clients into the crypto space.

The Binance CaaS model enables banks and securities institutions to integrate crypto offerings using Binance’s infrastructure.

This move supports broader trends in institutional adoption and could shape future regulatory frameworks.

Binance’s focus on compliance, branding flexibility, and backend support makes CaaS a strong offering in the competitive institutional crypto landscape.

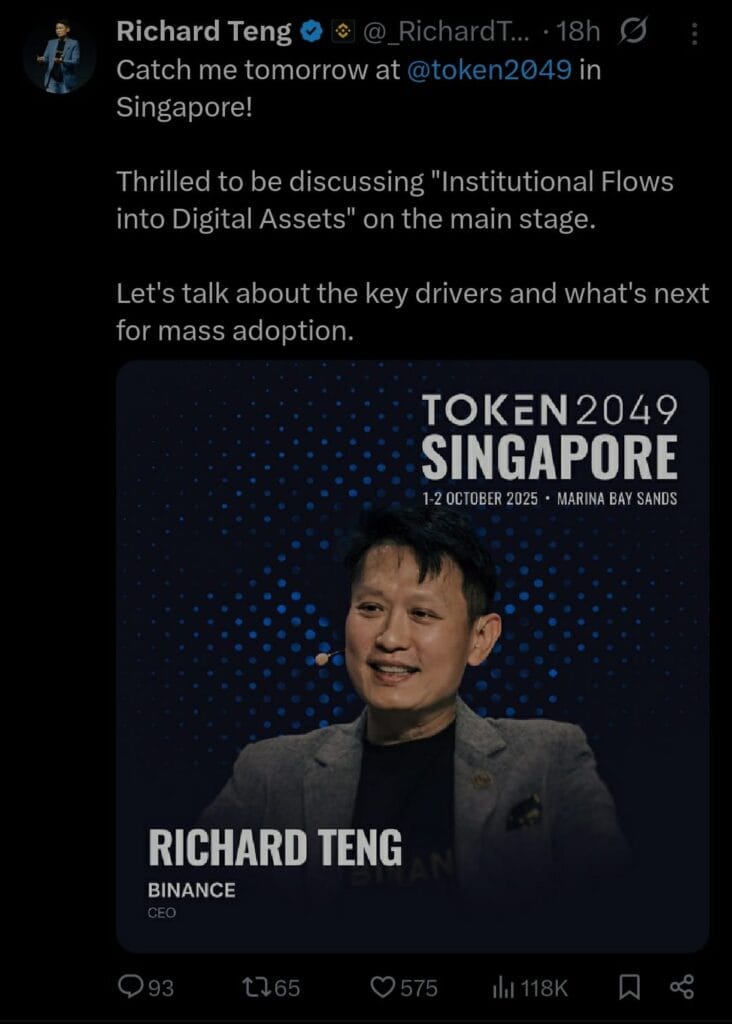

Speaking at Token2049 in Singapore, Richard Teng stated the Crypto as a Service (CaaS) model is an enterprise-grade solution allowing institutions to:

Integrate Binance’s trading and custody infrastructure into their existing systems

Offer crypto services to clients under their own brand

Maintain regulatory compliance while leveraging Binance’s backend capabilities

Source: X (@_RichardTeng)

Banks can offer crypto products with full branding control, using Binance’s backend without compromising brand identity.

CaaS provides easy-to-integrate API solutions that reduce time to market and lower operational costs.

Binance’s infrastructure aligns with various global compliance standards, ensuring institutions meet local and international regulatory demands.

The Binance CaaS model represents a pivotal strategy aimed at enabling financial institutions to adopt, offer, and manage digital assets with minimal friction.

The service allows banks and traditional finance entities to access Binance’s robust infrastructure while maintaining control over their customer interfaces and compliance processes.

In Teng’s words:

“Binance is increasing its collaboration with various capital institutions. We will launch the Crypto as a Service model to open up to institutional clients in need, such as banks and security institutions.”

This model reinforces Binance’s vision of bridging the gap between DeFi and traditional financial systems, unlocking a new phase in digital asset evolution.

Historically, institutional players have been cautious in approaching crypto due to compliance, infrastructure, and reputational risks.

Binance’s CaaS model addresses these barriers by offering plug-and-play crypto services that seamlessly integrate into existing banking systems.

Early adopters of the Binance CaaS model may benefit from:

Diversifying revenue streams through crypto-related products

Enhancing customer retention with innovative offerings

Positioning as forward-thinking leaders in financial innovation

The launch of the Binance CaaS model also aligns with broader regulatory and market trends. As institutional interest grows, regulators are stepping up efforts to establish clearer crypto frameworks.

Binance’s move may act as a catalyst for:

Accelerated regulatory clarity in key jurisdictions

Increased institutional-grade infrastructure development

Expansion of crypto compliance standards

According to Coincu Research, Binance’s strategy reflects a wider industry trend of embedding digital assets into mainstream financial protocols, a pattern also observed during prior institutional developments like Coinbase’s custody launch.

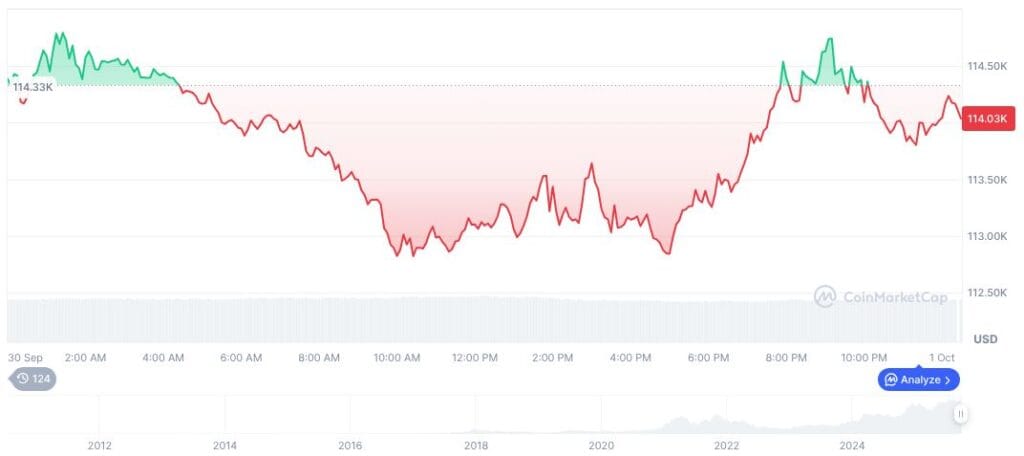

As of October 1st, 2025, Bitcoin (BTC) trades at $114,474.09, showing a 6.18% increase over the past 30 days.

The market cap stands at approximately $2.28 trillion, with a 24-hour trading volume of $57.49 billion, a decrease of 5.57%, according to CoinMarketCap.

Bitcoin’s Daily Chart

Source: CoinMarketCap

This market behavior reflects heightened interest and confidence from both retail and institutional investors, likely influenced by strategic moves like Binance’s CaaS rollout.

It provides a turnkey solution for banks and financial institutions to integrate crypto services, including trading, custody, and wallet management, using Binance’s infrastructure.

Yes. Binance ensures that its CaaS infrastructure supports regulatory compliance, helping institutions meet both local and international legal requirements.

While Binance has previously offered custodial and OTC services, CaaS is a more holistic solution, offering end-to-end crypto capabilities that institutions can integrate directly into their ecosystems.

The model primarily targets banks, securities firms, and other financial institutions interested in entering the crypto space without building infrastructure from scratch.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.03-0.68%

Figure Heloc(FIGR_HELOC)$1.03-0.68% USDS(USDS)$1.000.08%

USDS(USDS)$1.000.08% Hyperliquid(HYPE)$31.932.50%

Hyperliquid(HYPE)$31.932.50% Ethena USDe(USDE)$1.000.01%

Ethena USDe(USDE)$1.000.01% Canton(CC)$0.1644971.41%

Canton(CC)$0.1644971.41% USD1(USD1)$1.00-0.01%

USD1(USD1)$1.00-0.01% Rain(RAIN)$0.0098740.30%

Rain(RAIN)$0.0098740.30% World Liberty Financial(WLFI)$0.1041090.46%

World Liberty Financial(WLFI)$0.1041090.46% MemeCore(M)$1.40-4.07%

MemeCore(M)$1.40-4.07% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Bittensor(TAO)$186.5519.48%

Bittensor(TAO)$186.5519.48% Falcon USD(USDF)$1.000.03%

Falcon USD(USDF)$1.000.03% Aster(ASTER)$0.71-0.39%

Aster(ASTER)$0.71-0.39% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00% Global Dollar(USDG)$1.000.00%

Global Dollar(USDG)$1.000.00%