SOL rebounded from $190 to $213, fueled by aggressive retail buying.

Traders appear to be positioning for a positive Solana ETF decision on Oct. 10th.

Retail longs peaked at 78.2%, while order books leaned heavily toward buyers.

To revisit $250, watch for rising open interest, futures volume, and global session returns.

The U.S. market session is currently leading the bullish momentum.

As the broader crypto market sold off last week, Solana’s cumulative volume delta (CVD) revealed an interesting trend. On Binance, retail-sized trades (between 100 to 1,000 SOL) were stacked heavily on the buy side.

Source: Velo

This buying behavior was mirrored on Coinbase, where even institutional-sized accounts (10,000 to 10 million SOL) took advantage of the dip.

Retail appetite for SOL remained undeterred, even as other altcoins faltered.

According to Hyblock’s True Retail Longs vs. Shorts metric, retail long positions surged from 54.3% to 78.2% at the height of the sell-off. That’s a strong sign that traders viewed the price dip as a buying opportunity, not a bearish signal.

Moreover, Solana’s aggregate spot order book bid-ask ratio rose to 0.47, confirming that buyers dominated the order book.

While momentum is building, hitting the $250 mark again will require more than just bullish sentiment.

CME Futures Open Interest (OI) peaked at $2.12 billion on Sept. 18, when SOL hit its yearly high of $253.

As of Sept. 26, OI had dropped to $1.72 billion, and futures volume had fallen to $400 million, down from $1.57 billion.

To revisit those highs, open interest and trading volume must climb back toward those levels.

Data from Hyblock shows aggregate OI currently remains below the previous peak of $3.65 billion.

For SOL to challenge $250 again, we need to see this number climb steadily, ideally before the Solana ETF decision on October 10th.

After dipping to $190.85 last week, SOL surged back to $213 on Monday, a near 12% gain over just three days.

SOL/USDT Hourly Chart

Source: TradingView

This sharp rebound suggests strong market confidence, likely driven by retail investors and institutional positioning ahead of the Solana ETF ruling.

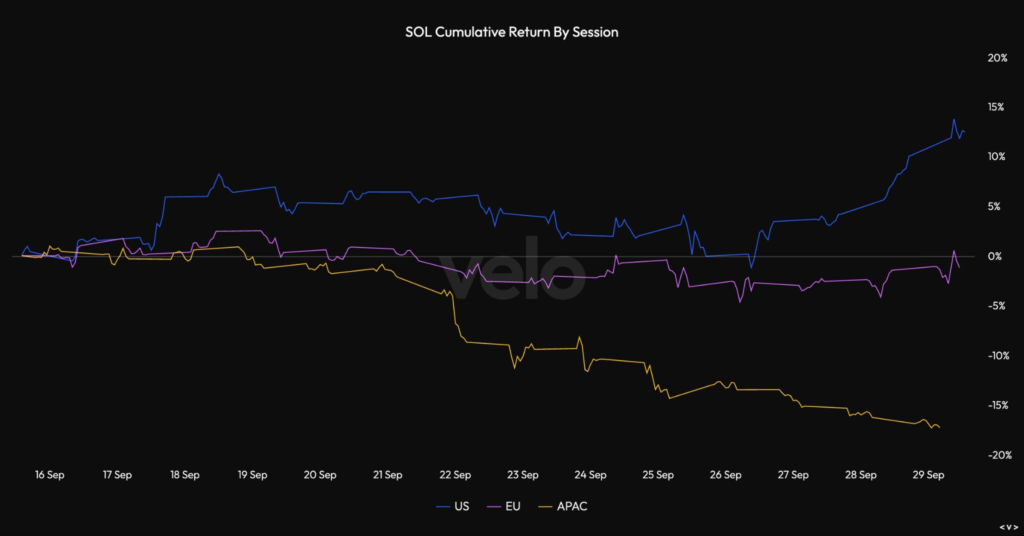

Another bullish signal is Solana’s cumulative return per session, segmented by region (U.S., APAC, and EU):

U.S. trading sessions have turned consistently positive since Friday.

If APAC and EU sessions follow this trend, it would further validate the idea of global rotation into SOL ahead of the ETF ruling.

For SOL to sustain its rally, buying activity must spread across time zones, not just be U.S.-centric.

The crypto community is closely watching the SEC’s decision on a Solana ETF, due by October 10th. A favorable outcome could:

Legitimize Solana as a mainstream institutional asset

Boost inflows from traditional investors

Spark a new all-time high (ATH) rally

Whether the Solana ETF approval happens or not, traders are clearly preparing for a volatility spike.

A Solana ETF (Exchange-Traded Fund) would allow investors to gain exposure to SOL price movements through traditional financial markets, without directly owning the token.

The final decision from the SEC is expected by October 10, 2025.

If momentum continues, and a positive ETF decision is announced, $250 could be back in play. However, it depends on market structure, open interest, and trading volume.

Stay updated via official SEC filings, CryptoWeekly, Crypto Twitter, and reliable platforms like CoinMarketCap or TradingView.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.000.00%

Figure Heloc(FIGR_HELOC)$1.000.00% Wrapped stETH(WSTETH)$3,778.54-4.05%

Wrapped stETH(WSTETH)$3,778.54-4.05% Wrapped eETH(WEETH)$3,351.16-4.07%

Wrapped eETH(WEETH)$3,351.16-4.07% USDS(USDS)$1.00-0.01%

USDS(USDS)$1.00-0.01% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.05%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.05% WETH(WETH)$3,085.65-4.03%

WETH(WETH)$3,085.65-4.03% Coinbase Wrapped BTC(CBBTC)$91,014.00-2.03%

Coinbase Wrapped BTC(CBBTC)$91,014.00-2.03% Ethena USDe(USDE)$1.00-0.22%

Ethena USDe(USDE)$1.00-0.22% Hyperliquid(HYPE)$21.77-8.07%

Hyperliquid(HYPE)$21.77-8.07% USDT0(USDT0)$1.000.00%

USDT0(USDT0)$1.000.00% sUSDS(SUSDS)$1.090.93%

sUSDS(SUSDS)$1.090.93% Canton(CC)$0.12351212.29%

Canton(CC)$0.12351212.29% World Liberty Financial(WLFI)$0.158289-3.76%

World Liberty Financial(WLFI)$0.158289-3.76% Ethena Staked USDe(SUSDE)$1.220.02%

Ethena Staked USDe(SUSDE)$1.220.02% USD1(USD1)$1.00-0.02%

USD1(USD1)$1.00-0.02% Rain(RAIN)$0.008870-2.21%

Rain(RAIN)$0.008870-2.21% MemeCore(M)$1.654.55%

MemeCore(M)$1.654.55%