The UK’s FCA will lift the crypto ETN ban for retail investors starting October 8th, 2025.

Products must be listed on FCA-approved UK exchanges.

Major players like BlackRock and Bitwise are preparing offerings.

Delays are possible as the FCA only began accepting prospectuses in late September.

Crypto ETFs remain banned for UK retail investors under current regulations.

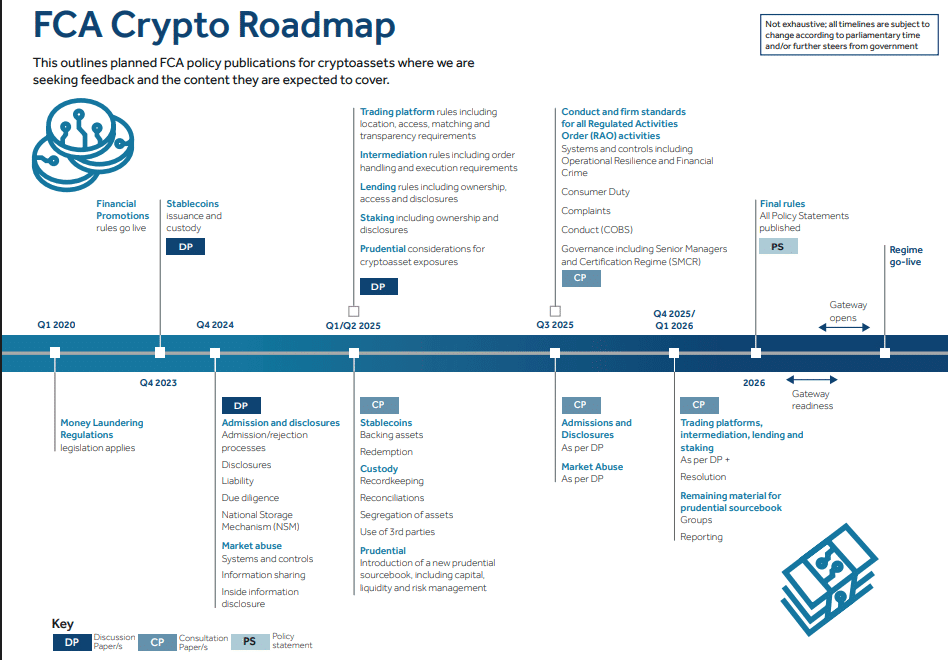

According to a regulatory notice released on August 1st, the FCA will officially lift its ban on crypto ETNs for retail investors starting Wednesday, October 8th.

This reversal comes nearly five years after the initial prohibition was enacted in 2019. Under the new rules, crypto ETNs will be allowed only if they are listed on an FCA-approved, UK-based investment exchange.

Source: X (@AtlasPulse)

However, it’s important to note that the FCA’s stance on crypto exchange-traded funds (ETFs) remains unchanged. ETFs, which differ from ETNs in structure and asset backing, will continue to be off-limits for UK retail investors.

The FCA’s decision has prompted a wave of responses from both traditional asset managers and crypto-native firms.

BlackRock, the world’s largest asset manager, is reportedly evaluating how to make its iShares Bitcoin exchange-traded product available to UK retail traders following the lifting of the crypto ETN ban.

Bitwise CEO Hunter Horsley, whose firm’s European operations are headquartered in London, expressed optimism about the shift. In a recent post on X, Horsley said:

“Excited to be able to serve more investors in our home market in Europe at long last.”

Meanwhile, Ian Taylor, board adviser at the digital asset trade group CryptoUK, noted the UK has been an “outlier” when it comes to access to ETNs.

He hopes the reversal will “improve consumer protections” and serve as a stepping stone toward broader access to regulated crypto investment products.

While the policy change officially takes effect next week, retail investors may still face delays in accessing these products.

The Financial Times reported that firms like CoinShares and Bitwise may need several days, possibly up to a week, to get their offerings to market.

The delays stem from the FCA’s late start in accepting prospectuses (beginning September 23rd), giving the regulator limited time to review documentation and provide feedback.

Firms looking to list must have their ETNs approved on a Recognised Investment Exchange, and the FCA has emphasized it will continue scrutinizing such products closely.

Despite the positive momentum around ETNs, the FCA made it clear that the ban on ETFs remains firmly in place.

In its August statement, the agency said that ETFs marketed to UK retail investors are not permitted to invest directly in crypto assets under the existing fund framework.

Source: FCA

As per the FCA’s official statement:

“This framework would need to be updated before retail investors could access crypto asset ETFs.”

This contrasts with regulatory developments in the United States, where the Securities and Exchange Commission (SEC) approved spot Bitcoin ETFs in January 2024.

However, the SEC’s current operations are limited due to federal budget constraints, affecting its ability to process new ETF filings.

A crypto Exchange-Traded Note (ETN) is a debt security tied to the performance of a cryptocurrency. Unlike ETFs, ETNs do not hold the asset directly but offer investors price exposure.

The FCA cited concerns over high volatility, market manipulation, and the complexity of crypto ETNs as reasons to protect retail investors.

The ban on crypto ETNs for retail investors will be officially lifted on October 8, 2025.

No. Crypto ETFs remain banned under current UK regulations. The FCA has stated that the existing framework would need updating before ETFs could be permitted for retail use.

ETNs are debt instruments that track the price of an asset but don’t hold it directly. ETFs typically hold the underlying asset, offering direct exposure and different risk profiles.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.041.34%

Figure Heloc(FIGR_HELOC)$1.041.34% Wrapped stETH(WSTETH)$3,325.09-8.09%

Wrapped stETH(WSTETH)$3,325.09-8.09% USDS(USDS)$1.00-0.01%

USDS(USDS)$1.00-0.01% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.05%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.05% Wrapped eETH(WEETH)$2,945.78-8.17%

Wrapped eETH(WEETH)$2,945.78-8.17% Hyperliquid(HYPE)$28.81-11.97%

Hyperliquid(HYPE)$28.81-11.97% Coinbase Wrapped BTC(CBBTC)$82,196.00-6.78%

Coinbase Wrapped BTC(CBBTC)$82,196.00-6.78% Ethena USDe(USDE)$1.00-0.03%

Ethena USDe(USDE)$1.00-0.03% Canton(CC)$0.1732166.44%

Canton(CC)$0.1732166.44% WETH(WETH)$2,714.54-8.06%

WETH(WETH)$2,714.54-8.06% USD1(USD1)$1.00-0.09%

USD1(USD1)$1.00-0.09% USDT0(USDT0)$1.00-0.01%

USDT0(USDT0)$1.00-0.01% sUSDS(SUSDS)$1.09-0.32%

sUSDS(SUSDS)$1.09-0.32% World Liberty Financial(WLFI)$0.148631-7.52%

World Liberty Financial(WLFI)$0.148631-7.52% Ethena Staked USDe(SUSDE)$1.22-0.02%

Ethena Staked USDe(SUSDE)$1.22-0.02% Rain(RAIN)$0.009218-5.57%

Rain(RAIN)$0.009218-5.57% MemeCore(M)$1.48-4.06%

MemeCore(M)$1.48-4.06%