China signaled willingness to revisit rare earth export policies and ease trade tensions.

Trump issued a softer-than-usual statement, indicating potential for renewed negotiations.

The US-China crypto impact was immediate and harsh, but recent developments offer hope of recovery.

Investment analysts remain cautiously optimistic, with some predicting market rebounds as early as this week.

The upcoming APEC summit could be a critical turning point for trade, diplomacy, and crypto markets.

On Sunday, both the Chinese Ministry of Commerce and U.S. President Donald Trump issued statements that suggested a softening stance on trade policies, especially in light of recent turmoil caused by China’s rare earth export control measures.

In a translated release, China’s Ministry of Commerce stated that it is “ready to strengthen dialogue” with trading partners, including the U.S., and expressed a willingness to revisit the new rare earth mineral export rules.

The Ministry even hinted at possible “license exemptions” to facilitate more stable trade relations and reinforce global supply chains.

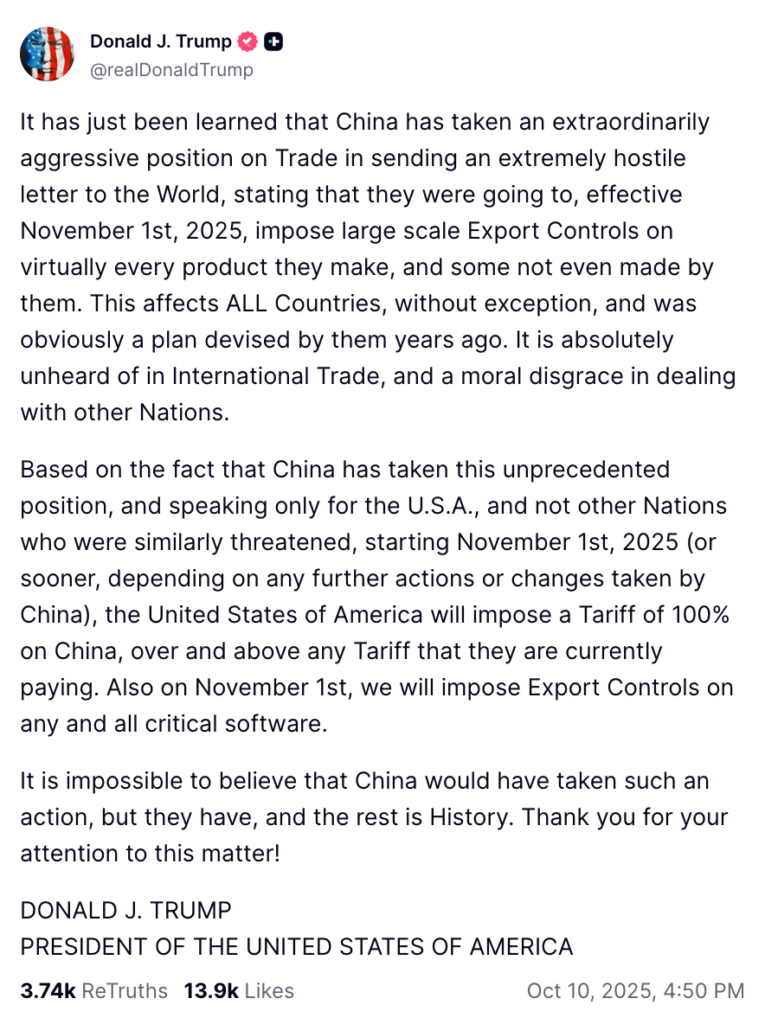

On the same day, U.S. President Donald Trump took to social media to offer an uncharacteristically conciliatory message.

Source: X (@realDonaldTrump)

While lacking the formal tone of a press release, Trump’s remarks were interpreted by analysts as a clear signal of possible de-escalation.

The US-China crypto impact has been stark in recent months.

China’s initial announcement of rare earth export restrictions triggered a swift and dramatic downturn in crypto markets, culminating in the largest 24-hour liquidation in the industry’s history.

But the latest tone shift offers a glimmer of hope.

Investment strategists from The Kobeissi Letter noted the powerful influence of Trump’s public statements:

“If President Trump responds and de-escalates on Sunday, markets are set for a big jump on Monday. The reactivity of markets to Trump’s posts remains incredibly high.”

Crypto investors are now watching closely for signs of recovery as the political narrative continues to evolve.

Despite the diplomatic signals, Trump had previously stated there was “no reason” to meet with Chinese President Xi Jinping at the upcoming Asia-Pacific Economic Cooperation (APEC) summit in Seoul, set to begin on October 31st.

Following China’s rare earth control announcement, Trump responded with additional 100% tariffs on Chinese imports, a sharp escalation that raised eyebrows across economic sectors, including digital assets.

Source: X (@realDonaldTrump)

However, not all experts are convinced the summit will be skipped. Jeff Park, advisor at crypto investment firm Bitwise, insists the meeting will go ahead:

“It has nothing to do with tariffs. Trump thrives on photo ops and historic moments. This meeting is guaranteed to happen.”

If true, such a face-to-face discussion could mark a turning point for both geopolitical relations and the US-China crypto impact.

The crypto market reacts strongly to geopolitical tensions. Trade policies between the U.S. and China influence global investor confidence, cross-border capital flows, and even crypto mining operations.

Rare earth minerals are essential in the production of tech components, including those used in EVs, smartphones, and even crypto mining hardware. China’s control over these exports can significantly disrupt global supply chains.

Yes. Reduced uncertainty and improved investor sentiment often lead to increased crypto buying, especially during de-escalation periods between major global powers.

Key events include the outcome of the APEC summit, further statements from U.S. or Chinese officials, and any updates to tariffs or rare earth policies.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.041.43%

Figure Heloc(FIGR_HELOC)$1.041.43% USDS(USDS)$1.00-0.12%

USDS(USDS)$1.00-0.12% Hyperliquid(HYPE)$29.500.26%

Hyperliquid(HYPE)$29.500.26% Ethena USDe(USDE)$1.00-0.04%

Ethena USDe(USDE)$1.00-0.04% Canton(CC)$0.162419-2.67%

Canton(CC)$0.162419-2.67% USD1(USD1)$1.00-0.02%

USD1(USD1)$1.00-0.02% Rain(RAIN)$0.009787-3.40%

Rain(RAIN)$0.009787-3.40% World Liberty Financial(WLFI)$0.1053913.10%

World Liberty Financial(WLFI)$0.1053913.10% MemeCore(M)$1.43-2.32%

MemeCore(M)$1.43-2.32% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Falcon USD(USDF)$1.000.05%

Falcon USD(USDF)$1.000.05% Aster(ASTER)$0.711.73%

Aster(ASTER)$0.711.73% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00% Global Dollar(USDG)$1.00-0.02%

Global Dollar(USDG)$1.00-0.02% HTX DAO(HTX)$0.0000020.67%

HTX DAO(HTX)$0.0000020.67% Ripple USD(RLUSD)$1.000.01%

Ripple USD(RLUSD)$1.000.01%