ZAR secured $12.9 million in funding, led by a16z, to expand stablecoin access in Pakistan.

The fintech startup targets unbanked citizens through local shops, kiosks, and agents.

Users can exchange cash for stablecoins linked to a Visa card for global use.

Pakistan ranks third globally in crypto adoption, highlighting strong market potential.

Regulatory developments, including PVARA, are creating a framework for safe digital asset use.

Andreessen Horowitz (a16z) is leading a $12.9 million funding round for ZAR, joined by several investors including Dragonfly Capital, VanEck Ventures, Coinbase Ventures, and Endeavor Catalyst. The investment highlights growing interest in fintech solutions aimed at emerging markets.

Founded just a year ago, ZAR aims to make dollar-backed stablecoins accessible to millions of Pakistanis who are currently outside the formal banking system.

ZAR Enables Users To Turn Cash Into Stablecoins Via Shops

Source: ZAR website

According to World Bank estimates, over 100 million adults in Pakistan remain unbanked out of a population of 240 million.

Unlike many crypto startups focused on apps or global exchanges, ZAR plans to distribute stablecoins through local stores, kiosks, and money agents, the same channels used for mobile top-ups and remittances.

This approach allows everyday consumers to access digital dollars without needing technical knowledge of blockchain or cryptocurrency.

By partnering with small retail shops, ZAR aims to integrate digital currency into familiar, everyday transactions.

ZAR was co-founded by Sebastian Scholl and Brandon Timinsky, who previously sold their mobile wallet startup, SadaPay, to Turkey’s Papara in 2024.

The company has raised $20 million in total funding so far and is exploring expansion into African markets by 2026, depending on the success of its Pakistan pilot.

The funding round coincides with Pakistan’s move toward digital asset regulation. The government recently launched the Pakistan Virtual Assets Regulatory Authority (PVARA) to oversee the country’s crypto industry.

Pakistan has also begun inviting international crypto businesses to apply for licenses under a new federal regime, signaling openness to global players in the digital asset space.

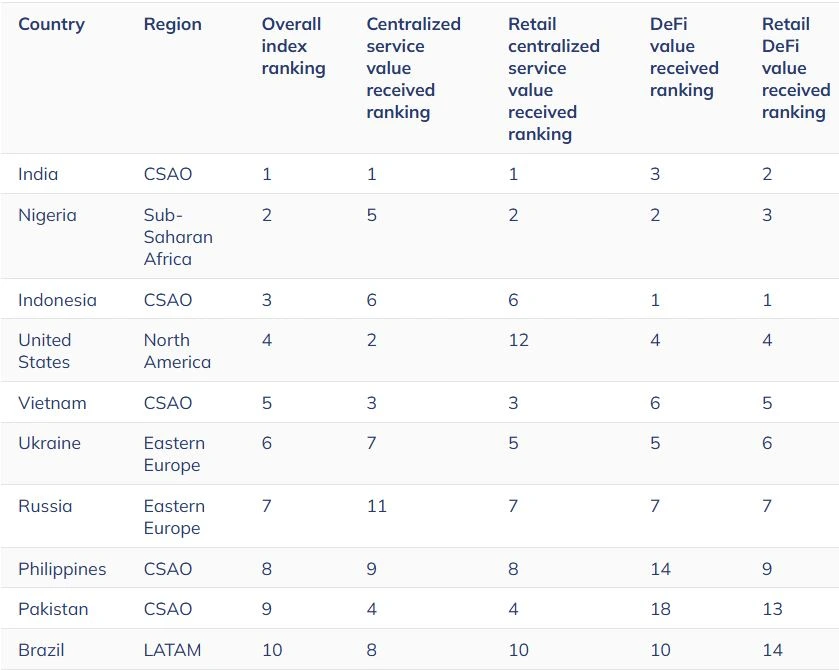

Pakistan has quickly become a leading market for cryptocurrency. According to the 2025 Global Crypto Adoption Index by Chainalysis, Pakistan ranks third worldwide, climbing six spots in recent years.

Source: Chainalysis

This surge underscores the strong appetite for digital financial solutions among the country’s population.

By combining stablecoins with accessible retail networks, ZAR offers a solution for millions of unbanked citizens to participate in the digital economy.

The startup’s model also provides a potential template for other emerging markets facing similar financial inclusion challenges.

ZAR is a fintech startup that enables Pakistanis to convert cash into dollar-backed stablecoins, accessible via mobile wallets linked to Visa cards.

Users visit local retail partners, scan a QR code, and exchange cash for stablecoins stored in a mobile wallet, which can be used globally.

Sebastian Scholl and Brandon Timinsky, previously founders of the mobile wallet startup SadaPay, lead ZAR.

ZAR has raised a total of $20 million, including a $12.9 million round led by a16z.

Pakistan has a large unbanked population and ranks third in global crypto adoption, making it an ideal market for digital financial inclusion solutions.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.04-0.38%

Figure Heloc(FIGR_HELOC)$1.04-0.38% USDS(USDS)$1.000.08%

USDS(USDS)$1.000.08% Hyperliquid(HYPE)$30.731.39%

Hyperliquid(HYPE)$30.731.39% Ethena USDe(USDE)$1.000.01%

Ethena USDe(USDE)$1.000.01% Canton(CC)$0.159527-4.64%

Canton(CC)$0.159527-4.64% USD1(USD1)$1.00-0.02%

USD1(USD1)$1.00-0.02% Rain(RAIN)$0.009719-1.53%

Rain(RAIN)$0.009719-1.53% World Liberty Financial(WLFI)$0.102286-3.32%

World Liberty Financial(WLFI)$0.102286-3.32% MemeCore(M)$1.42-0.48%

MemeCore(M)$1.42-0.48% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Falcon USD(USDF)$1.000.00%

Falcon USD(USDF)$1.000.00% Aster(ASTER)$0.701.65%

Aster(ASTER)$0.701.65% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00% Global Dollar(USDG)$1.000.01%

Global Dollar(USDG)$1.000.01% HTX DAO(HTX)$0.0000020.90%

HTX DAO(HTX)$0.0000020.90%