Zora’s SocialFi boom on Ethereum L2 Base has sparked a wave of token launches, briefly surpassing Solana-native platforms in volume.

Base App’s rebrand enabled content creators to tokenize posts, attracting both users and controversy.

Critics question the lack of liquidity and long-term value of Zora tokens.

Solana still leads in user activity, transaction volume, and DeFi maturity.

For Base to rival Solana long-term, it must turn viral spikes into sustained ecosystems with real value and user retention.

Ethereum L2 Base is fast emerging as a serious contender to Solana’s grip on the token launch scene.

Driven by Zora’s viral SocialFi momentum, Base has climbed the leaderboard, but the bigger question remains: is this momentum sustainable, or just a fleeting blip in the broader crypto cycle?

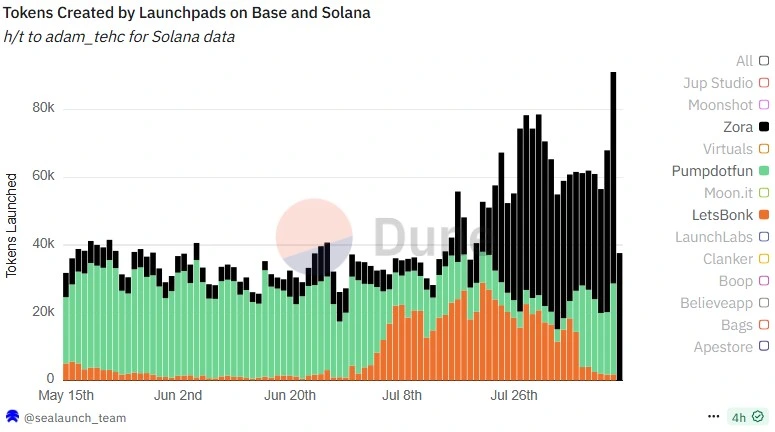

Base Token Launches Skyrocket Immediately After Coinbase’s App Rebrand

Source: Dune Analytics

For years, Solana has led in token launches thanks to its low fees, fast speeds, and vibrant memecoin culture. Platforms like Pump.fun and LetsBonk have made daily token creation routine, birthing tens of thousands of coins every 24 hours.

Now, Base, powered by Coinbase and anchored in the Ethereum L2 ecosystem, is staking its claim, not through memecoins alone, but via content-driven tokenization, viral posts, and creator engagement through platforms like Zora.

On July 16th, Coinbase rebranded its wallet into the Base App, enabling users to post, mint, and trade content.

Integrated platforms like Zora and Farcaster transformed the app into a SocialFi playground, and the results were immediate.

7,557 tokens launched on Base on rebrand day

Surged to 22,098 the next day

On July 24th, Zora saw 38,254 token launches, beating out Pump.fun and LetsBonk combined

This token explosion helped Zora dethrone Solana-native platforms, temporarily crowning it the industry’s top launchpad.

Despite the numbers, skepticism is building. Brian Huang, co-founder of Glider, argues many Zora tokens are illiquid and essentially worthless, warning that creators and fans are entering a market with no exit.

In his words:

“Most users have unknowingly entered a market with a flaw: no liquidity to sell, trapping both creators and their fans.”

But not all feedback is negative. Alexander Cutler, CEO of Base-native DEX Aerodrome, defended Zora’s model, noting it appeals to content-savvy Instagram users who get rewarded for everyday activity not just speculation.

Cutler said:

“I’ve onboarded more normies to it than anything in crypto, and they’re enjoying it.”

Zora’s momentum has ignited discussion about token volume vs. actual value. While Base’s token launch numbers are breaking records, liquidity remains a major hurdle.

Even Solana’s own memecoins have faced similar issues, nearly 99% of Pump.fun tokens have no liquidity or value. Still, Solana benefits from an ecosystem that has established liquidity, mature DeFi protocols, and an experienced developer community.

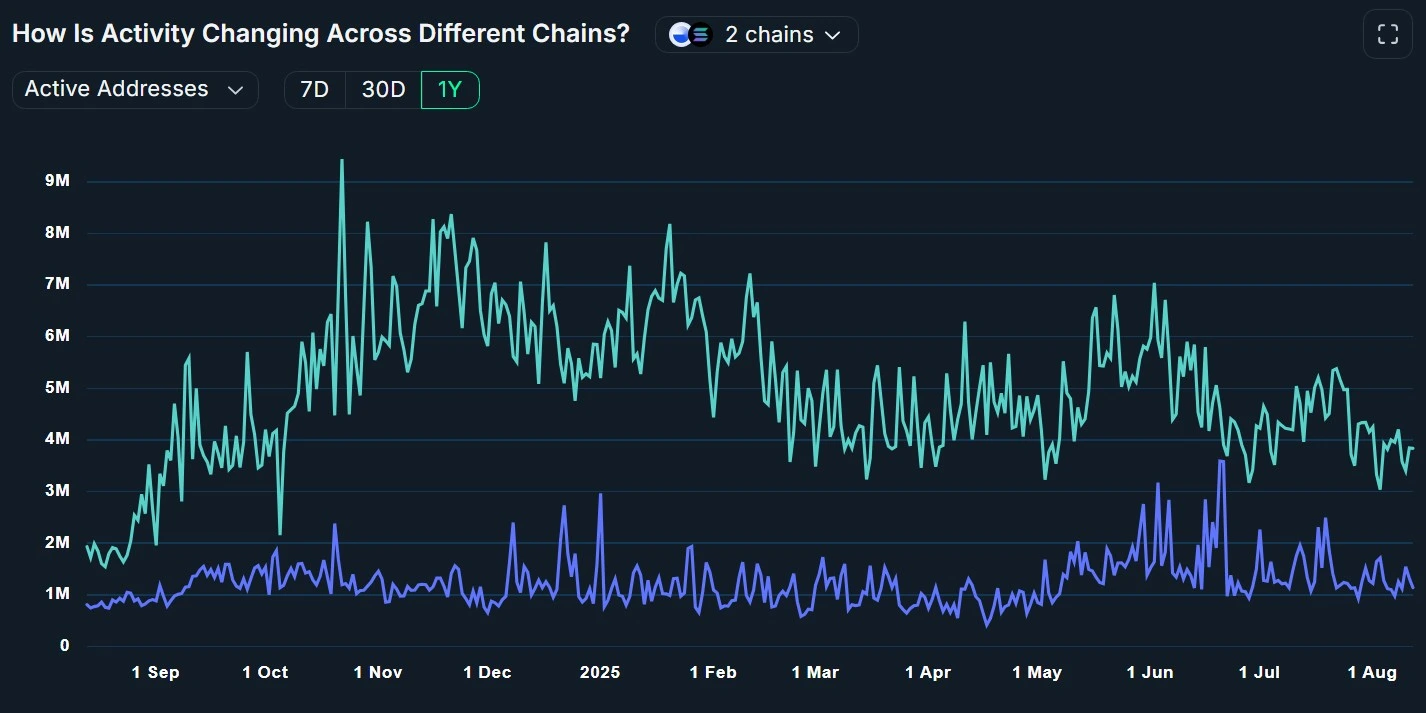

In terms of network activity, according to Nansen:

Solana: Highest daily active users, transactions, and throughput

Ethereum L2 Base: Surging but still behind in ecosystem depth

Solana’s Activity Still Outpaces Base, Despite Zora’s Rise

Source: Nansen

Solana’s upcoming Firedancer validator client (currently in hybrid form via Frankendancer) aims for 1 million TPS, far beyond Base’s recent 959 TPS peak during a high-volume event.

Zora’s popularity has even caught the attention of prominent Solana figures, including Zion Thomas (aka Ansem), a top memecoin investor now exploring Base’s SocialFi space.

Still, critics like Huang ask whether tokenizing posts is just a vanity metric and suggest that simple tipping mechanisms might create more sustainable value for creators.

Source: X (@blknoiz06)

Huang stated:

“Why not just let fans tip creators directly? Instead, we have this convoluted process that may boost Base’s numbers but lacks long-term value.”

Base is an Ethereum Layer 2 network built by Coinbase to offer lower fees and faster transaction speeds while remaining secured by Ethereum.

Zora enables users to tokenize social media content. On Base, it has become a major driver of SocialFi activity and token launches.

Solana’s infrastructure is more mature, with liquidity pools, DeFi apps, and developer support that currently outpaces Base.

Most are not, due to minimal liquidity. Critics argue they serve more as content experiments than viable crypto assets.

Not yet. While Base is showing potential, Solana’s depth and speed keep it in the lead. Base must evolve beyond novelty to truly compete.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.040.64%

Figure Heloc(FIGR_HELOC)$1.040.64% USDS(USDS)$1.000.00%

USDS(USDS)$1.000.00% Hyperliquid(HYPE)$30.062.67%

Hyperliquid(HYPE)$30.062.67% Ethena USDe(USDE)$1.000.00%

Ethena USDe(USDE)$1.000.00% Canton(CC)$0.1602891.75%

Canton(CC)$0.1602891.75% USD1(USD1)$1.000.00%

USD1(USD1)$1.000.00% Rain(RAIN)$0.009465-1.99%

Rain(RAIN)$0.009465-1.99% World Liberty Financial(WLFI)$0.1199013.10%

World Liberty Financial(WLFI)$0.1199013.10% MemeCore(M)$1.33-2.56%

MemeCore(M)$1.33-2.56% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Aster(ASTER)$0.733.82%

Aster(ASTER)$0.733.82% Falcon USD(USDF)$1.000.02%

Falcon USD(USDF)$1.000.02% Bittensor(TAO)$181.792.55%

Bittensor(TAO)$181.792.55% Global Dollar(USDG)$1.000.01%

Global Dollar(USDG)$1.000.01% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00%