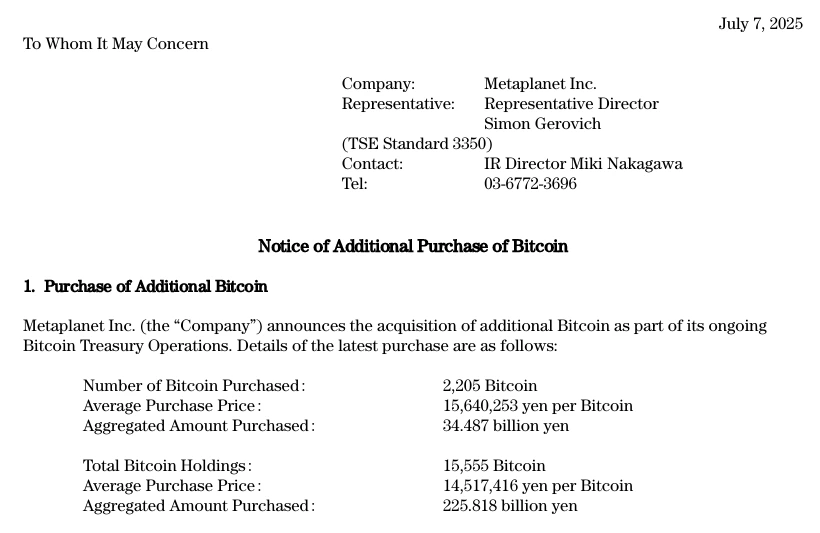

In a regulatory filing on Monday, Metaplanet disclosed that it acquired the 2,204 Bitcoins at an average price of 15,640,253 Japanese yen per Bitcoin, roughly $107,700 per BTC.

Metaplanet’s Purchase Of An Additional 2,204 BTC

Source: Metaplanet Inc.

This latest purchase increases the company’s total Bitcoin holdings to 15,555 BTC. The firm’s average purchase price per Bitcoin now stands at approximately $99,985.

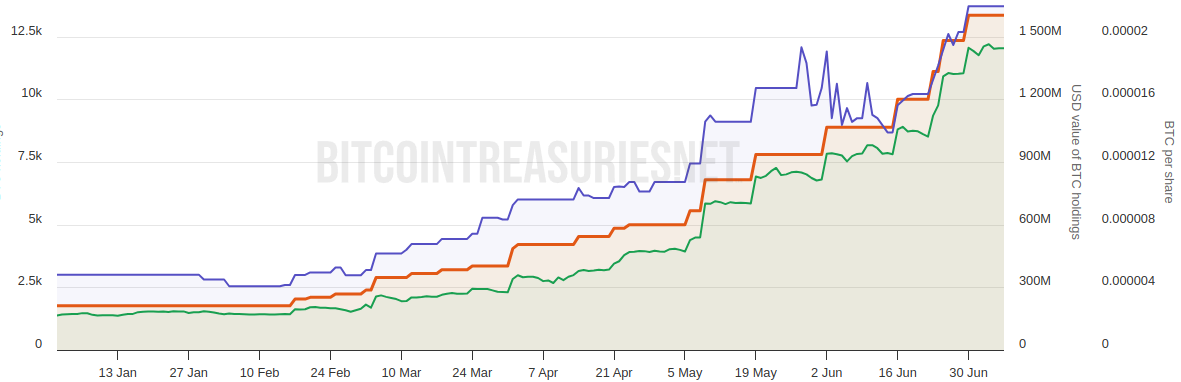

According to data from BitcoinTreasuries.NET, Metaplanet ranks as the fifth-largest corporate Bitcoin holder worldwide.

The company surpassed the electric vehicle manufacturer Tesla in late June after acquiring 1,234 BTC, boosting its total to 12,345 BTC, while Tesla’s holdings stood at 11,509 BTC.

Metaplanet Is Now The 5th Biggest Corporate BTC Holder Worldwide

Source: BitcoinTreasuries.NET

Additionally, Metaplanet outpaced Bitcoin miner CleanSpark, which holds 12,502 BTC, through a separate acquisition of 1,005 BTC valued at $108 million, disclosed on June 30.

The rise of corporate Bitcoin treasury accumulation continues, highlighted by major players increasing their stakes.

The world’s largest corporate Bitcoin holder, Strategy, announced on June 30th that it purchased an additional 4,980 BTC for $531.1 million.

This move increased the firm’s holdings to an impressive 597,325 BTC, acquired at an average price of about $70,982 per coin, totaling around $42.4 billion invested.

While corporate Bitcoin treasuries continue to grow, some experts question the long-term sustainability of this strategy.

James Check, lead analyst at Glassnode, expressed skepticism about the longevity of the corporate Bitcoin treasury trend. In a recent commentary, Check suggested that the “easy upside” for companies entering this space might already be behind us.

A report from venture capital firm Breed, published in late June, echoed these concerns. It warned that only a handful of Bitcoin treasury companies will avoid falling into what it calls a “death spiral,” highlighting the risks associated with latecomers entering the Bitcoin treasury game.

A corporate Bitcoin treasury refers to a company holding Bitcoin as part of its corporate reserves or treasury assets, often to diversify holdings or hedge against traditional financial risks.

Many companies view Bitcoin as a potential store of value and a hedge against inflation. They believe holding Bitcoin can diversify assets and possibly yield long-term gains.

Metaplanet ranks fifth globally in corporate Bitcoin holdings and has shown aggressive accumulation strategies, surpassing Tesla and CleanSpark in recent months.

Yes, Bitcoin’s price volatility and regulatory uncertainties make this strategy risky. Experts caution that late entrants to the Bitcoin treasury space may face challenges sustaining growth.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.040.63%

Figure Heloc(FIGR_HELOC)$1.040.63% Wrapped stETH(WSTETH)$3,454.47-6.30%

Wrapped stETH(WSTETH)$3,454.47-6.30% USDS(USDS)$1.00-0.01%

USDS(USDS)$1.00-0.01% Wrapped eETH(WEETH)$3,063.18-6.21%

Wrapped eETH(WEETH)$3,063.18-6.21% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.00%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.00% Hyperliquid(HYPE)$30.76-10.25%

Hyperliquid(HYPE)$30.76-10.25% Coinbase Wrapped BTC(CBBTC)$84,574.00-5.12%

Coinbase Wrapped BTC(CBBTC)$84,574.00-5.12% Canton(CC)$0.17992712.03%

Canton(CC)$0.17992712.03% Ethena USDe(USDE)$1.00-0.03%

Ethena USDe(USDE)$1.00-0.03% WETH(WETH)$2,818.51-6.27%

WETH(WETH)$2,818.51-6.27% USD1(USD1)$1.000.00%

USD1(USD1)$1.000.00% USDT0(USDT0)$1.00-0.03%

USDT0(USDT0)$1.00-0.03% sUSDS(SUSDS)$1.080.38%

sUSDS(SUSDS)$1.080.38% World Liberty Financial(WLFI)$0.157359-4.17%

World Liberty Financial(WLFI)$0.157359-4.17% Ethena Staked USDe(SUSDE)$1.22-0.01%

Ethena Staked USDe(SUSDE)$1.22-0.01% Rain(RAIN)$0.009489-4.72%

Rain(RAIN)$0.009489-4.72% MemeCore(M)$1.53-2.22%

MemeCore(M)$1.53-2.22%