Bitcoin mining difficulty is a measure of how challenging it is for Bitcoin miners to solve the cryptographic puzzles required to validate transactions and add new blocks to the blockchain.

Bitcoin Network Difficulty

Source: Blockchain

The difficulty adjusts approximately every two weeks to maintain an average block time of 10 minutes, regardless of the total network hashrate.

Bitcoin mining difficulty recently increased by 7.96%, reaching a record 126.27 trillion (T). Simultaneously, the seven-day average network hashrate hit 908.82 exahashes per second (EH/s). This shows a substantial increase in computational power deployed by Bitcoin miners worldwide.

The rising difficulty reflects growing competition among miners and the overall expansion of the network. However, it also means that each Bitcoin miner requires more energy and resources to solve blocks, potentially reducing mining efficiency, especially if the BTC price plateaus or falls.

A significant Bitcoin mining difficulty adjustment is projected for July 27th, 2025, with a forecasted decrease of approximately 6.69%.

This downward adjustment could be a welcome development for Bitcoin miners, improving operational efficiency and potentially boosting profit margins during challenging market periods.

Long-Term Holders (LTHs) represent Bitcoin investors who hold their coins for extended periods, often reflecting strong conviction in BTC’s future.

This behavior suggests most LTHs are not inclined to liquidate their BTC holdings, even at all-time high prices. Historical data indicates that phases with high LTH profits (e.g., 296% in mid-2024) often coincide with sustainable market rallies.

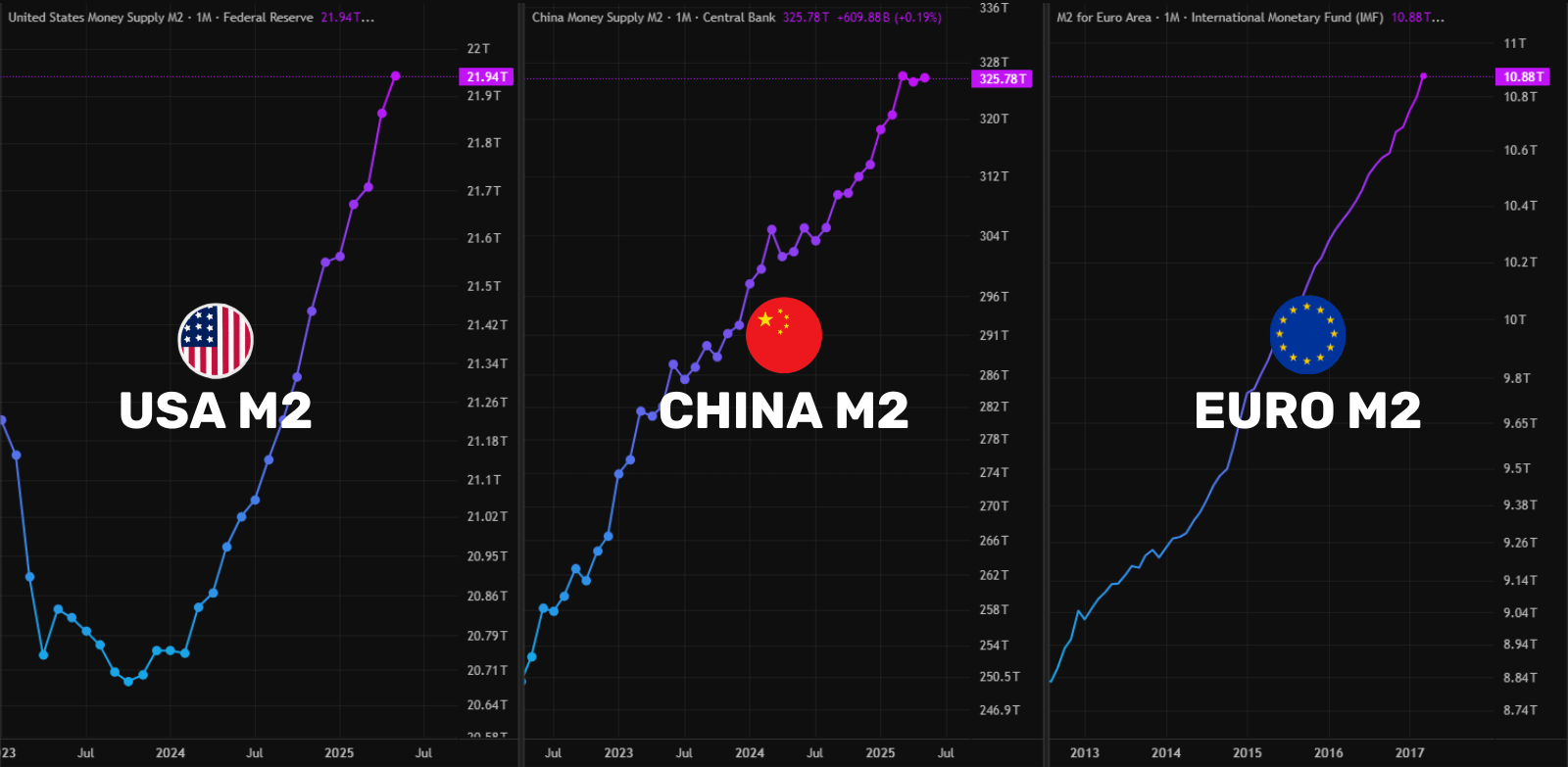

Alongside the technical factors influencing miners and holders, global liquidity levels are climbing. Measures like M2 money supply in the US, China, and Europe are also reaching all-time highs.

Source: X (@rektfencer)

This abundance of liquidity could funnel more investment into Bitcoin, boosting demand and prices in the short term. For Bitcoin miners, higher BTC prices combined with stable or decreasing mining difficulty could create an optimal profit environment.

One curious factor in this bull market is the relatively low Google search interest for Bitcoin compared to previous cycles. This subdued search activity may indicate a maturing investor base focused more on long-term strategy than short-term hype or Fear of Missing Out (FOMO).

For Bitcoin miners, this maturity signals potential stability in network participation, as less speculative trading may reduce market volatility that can adversely affect mining operations and profitability.

A Bitcoin miner is an individual or organization using specialized hardware to validate Bitcoin transactions, secure the network, and add new blocks to the blockchain in exchange for block rewards and transaction fees.

Mining difficulty adjusts to ensure that blocks are produced approximately every 10 minutes, maintaining network stability regardless of how many miners are active or how much computational power is deployed.

Higher difficulty means miners must expend more computing power (and energy) to solve blocks, which can lower profitability if BTC prices don’t increase proportionally.

A decrease in difficulty reduces the computational effort needed per block, improving miners’ efficiency and potentially increasing profits.

LTHs’ tendency to hold rather than sell during price surges indicates confidence and can support price stability and growth over time.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.04-0.40%

Figure Heloc(FIGR_HELOC)$1.04-0.40% USDS(USDS)$1.00-0.04%

USDS(USDS)$1.00-0.04% Hyperliquid(HYPE)$30.801.70%

Hyperliquid(HYPE)$30.801.70% Ethena USDe(USDE)$1.00-0.08%

Ethena USDe(USDE)$1.00-0.08% Canton(CC)$0.161922-0.97%

Canton(CC)$0.161922-0.97% USD1(USD1)$1.00-0.04%

USD1(USD1)$1.00-0.04% Rain(RAIN)$0.0098540.46%

Rain(RAIN)$0.0098540.46% World Liberty Financial(WLFI)$0.1050331.54%

World Liberty Financial(WLFI)$0.1050331.54% MemeCore(M)$1.450.01%

MemeCore(M)$1.450.01% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Aster(ASTER)$0.721.82%

Aster(ASTER)$0.721.82% Falcon USD(USDF)$1.00-0.02%

Falcon USD(USDF)$1.00-0.02% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00% Global Dollar(USDG)$1.00-0.01%

Global Dollar(USDG)$1.00-0.01% HTX DAO(HTX)$0.0000021.76%

HTX DAO(HTX)$0.0000021.76%