The BTCFi (Bitcoin Finance) and DePIN (Decentralized Physical Infrastructure Networks) sectors have experienced over 203% growth in the past 90 days, according to CoinMarketCap’s AI tracker.

![]()

CoinMarketCap’s AI Crypto Tracker

Source: CoinMarketCap

More than $839 million in Bitcoin has been bridged to alternative layer-1 chains such as Solana and Sui, where Bitcoin-backed yield campaigns have seen massive engagement. For instance, Sui’s total value locked (TVL) surged to $2.19 billion, with staking incentives pushing 74 million SUI into locked status, a 45% increase in just one month.

The emergence of assets like zBTC and tBTC highlights growing demand for wrapped Bitcoin capable of participating in DeFi protocols. Liquid staking strategies offer potential yield from idle Bitcoin, although smart contract risks remain a concern.

The $220 million Cetus exploit in May underscores the vulnerabilities of smart contract-based systems in high-yield environments.

Meanwhile, Babylon Network is poised to shake up the sector further with its Bitcoin-native staking module, scheduled for launch in Q3 2025.

In a major development for the AI crypto narrative, the GENIUS Act, recently signed into law by President Trump, has opened the floodgates for institutional stablecoin flows. With over $5 billion in capital inflow, the Act signals growing regulatory clarity.

According to CMC AI data, the U.S. crypto market cap jumped 18% in just 30 days, reaching $3.1 trillion.

The supply of USDC hit an all-time high of $145 billion, now comprising 87% of decentralized exchange (DEX) volume. Meanwhile, Coinbase’s “Everything App” is pushing forward PayFi innovation, positioning the U.S. at the forefront of digital payments.

Another major catalyst is BlackRock’s ETH ETF, which includes staking support and is currently awaiting SEC approval following a Nasdaq filing on July 15th.

Perhaps the most exciting frontier in the AI crypto narrative is the rise of autonomous AI agents. These self-operating programs are revolutionizing how trades are executed and strategies deployed.

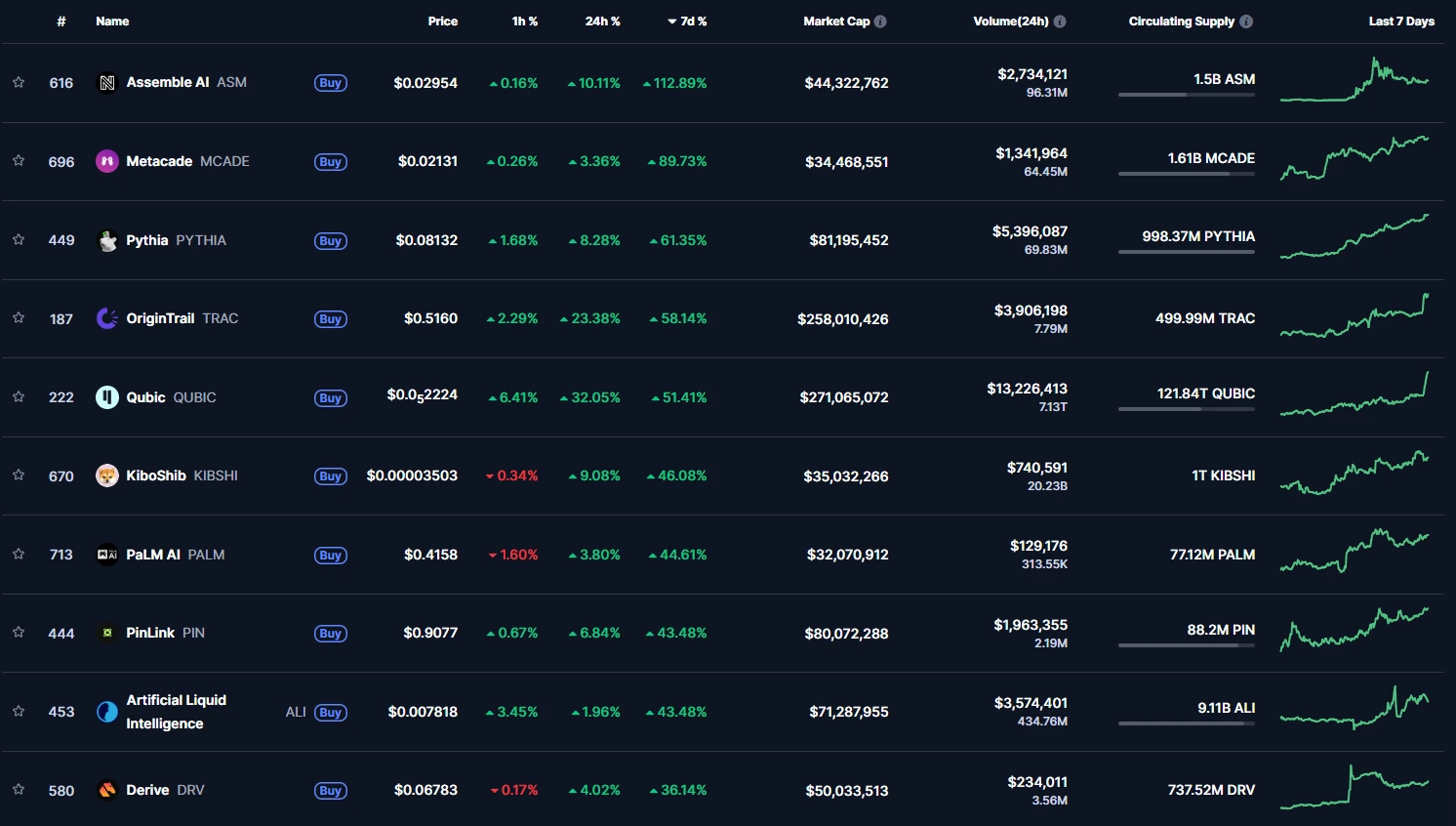

Top 10 AI Agents Based On Weekly Performance

Source: CoinMarketCap

The sector has grown to a $5.3 billion market cap, marking a 66% increase over 90 days, driven by surging demand for AI-powered infrastructure.

Virtuals Protocol posted a 390% increase in FDV, generating $2.3 million in epoch-based revenue. Similarly, Axelrod’s AI bots delivered yields up to 523% APR, outperforming many manual strategies.

Despite these promising gains, MEV extraction remains a key threat. Projects like Spectral Labs are working on solutions, including the upcoming Syntax Agent Marketplace, which aims to offer a secure and scalable environment for AI bot deployment.

While not dominating headlines, RWA tokenization continues to lay the foundation for long-term value creation. Platforms bridging real estate, bonds, and commodities into blockchain-native assets are positioning themselves as critical infrastructure.

This trend ties closely into the AI crypto narrative, as intelligent automation will be essential to scaling and managing these tokenized ecosystems.

The AI crypto narrative refers to the growing integration of artificial intelligence into blockchain applications—from autonomous trading agents to smart regulation tools and AI-powered asset management.

BTCFi enables Bitcoin to participate in DeFi ecosystems, generating yield through wrapped tokens and staking protocols. It’s a key step toward unlocking Bitcoin’s $1 trillion market cap for more dynamic use cases.

The GENIUS Act brings regulatory clarity to stablecoins, encouraging institutional inflows and supporting innovation in U.S.-based crypto infrastructure.

While AI bots offer high returns, they’re still susceptible to risks like MEV extraction, smart contract vulnerabilities, and market manipulation. Users should evaluate the platforms and code integrity before deploying capital.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.03-0.82%

Figure Heloc(FIGR_HELOC)$1.03-0.82% Wrapped stETH(WSTETH)$3,698.1710.63%

Wrapped stETH(WSTETH)$3,698.1710.63% USDS(USDS)$1.000.04%

USDS(USDS)$1.000.04% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.07%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.07% Hyperliquid(HYPE)$33.1111.97%

Hyperliquid(HYPE)$33.1111.97% WETH(WETH)$3,032.3310.58%

WETH(WETH)$3,032.3310.58% Wrapped eETH(WEETH)$3,280.2310.57%

Wrapped eETH(WEETH)$3,280.2310.57% Ethena USDe(USDE)$1.00-0.04%

Ethena USDe(USDE)$1.00-0.04% Coinbase Wrapped BTC(CBBTC)$91,860.008.24%

Coinbase Wrapped BTC(CBBTC)$91,860.008.24% World Liberty Financial(WLFI)$0.1613955.24%

World Liberty Financial(WLFI)$0.1613955.24% sUSDS(SUSDS)$1.080.11%

sUSDS(SUSDS)$1.080.11% Ethena Staked USDe(SUSDE)$1.210.08%

Ethena Staked USDe(SUSDE)$1.210.08% USDT0(USDT0)$1.000.03%

USDT0(USDT0)$1.000.03% Canton(CC)$0.078343-1.85%

Canton(CC)$0.078343-1.85% Bittensor(TAO)$286.3211.72%

Bittensor(TAO)$286.3211.72% USD1(USD1)$1.00-0.04%

USD1(USD1)$1.00-0.04%