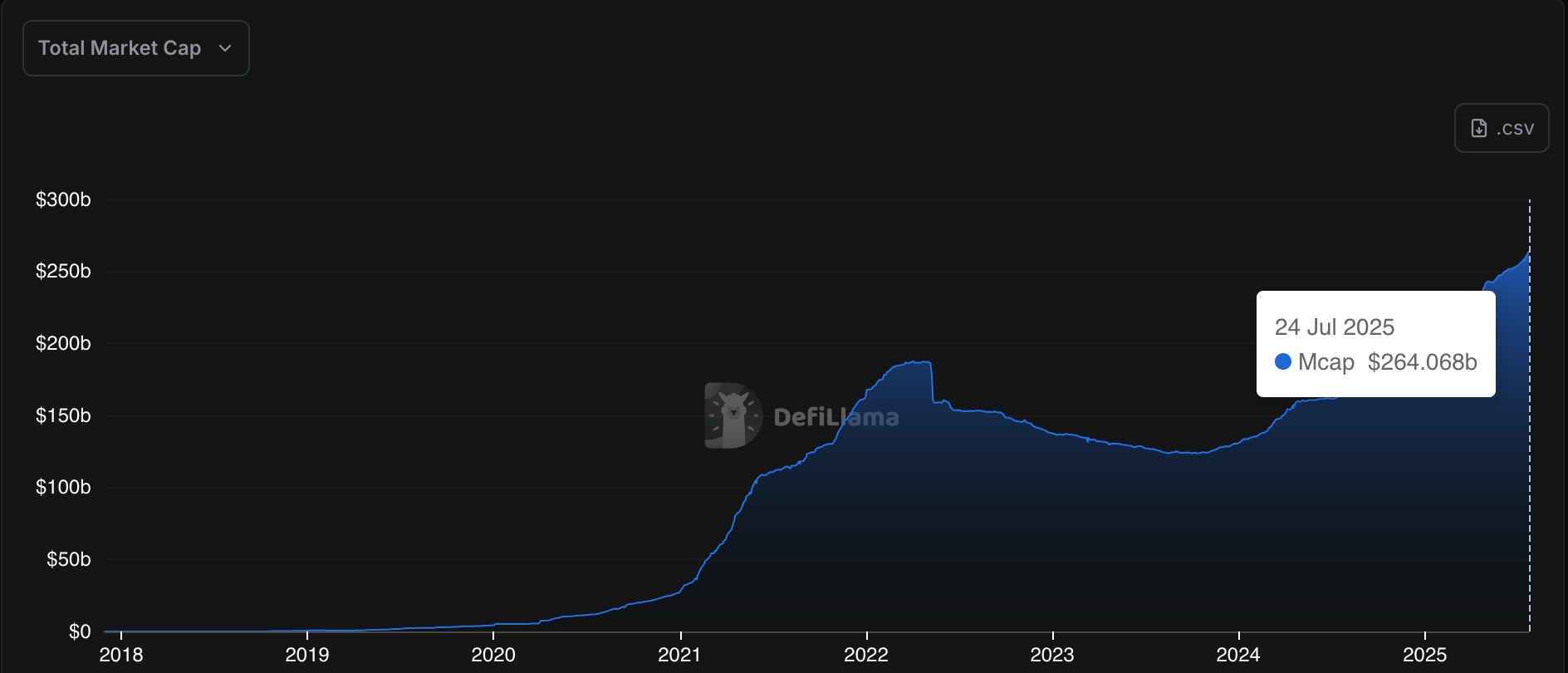

The ink is barely dry on the newly signed GENIUS Act, but its impact is already reshaping the digital asset landscape. In the week following its passage, the stablecoin market cap swelled by $4 billion, crossing $264 billion, according to data from DefiLlama.

President Donald Trump Signing The GENIUS Act Into Law

Source: Associated Press

This explosive growth is more than a market uptick, it reflects a structural shift. By providing a clear federal framework for fiat-backed stablecoins, the US crypto legislation eliminates the long-standing threat of regulatory uncertainty, particularly from the SEC.

Financial institutions, ranging from banks to asset managers, are no longer standing on the sidelines. They’re entering the arena, launching compliant stablecoin products and seeking regulatory alignment under the new law.

In a recent interview with Yahoo Finance, Coinbase CEO Brian Armstrong voiced his openness to competition in the stablecoin space. “Everybody should be able to create stablecoins,” he said, an attitude increasingly echoed by traditional finance.

Since the GENIUS Act became law, firms like Anchorage Digital, WisdomTree, and even major U.S. banks have announced stablecoin-related initiatives, signaling a clear shift in the market landscape.

Stablecoins are designed to maintain a steady value, typically pegged to the U.S. dollar. However, their underlying mechanisms can vary dramatically.

Total Stablecoin Market Capitalization

Source: DefiLlama

Here are the four primary types:

These are backed 1:1 by fiat reserves such as cash or U.S. Treasuries. They dominate the market, accounting for about 85% of all stablecoins. Top examples include:

Combined, these two hold over $227 billion in market cap. Under the US crypto legislation, fiat-backed issuers must:

These are overcollateralized with crypto assets such as ETH or tokenized BTC. The leader in this space is DAI, with a market cap of around $4.35 billion.

These adjust their supply automatically to maintain a peg but have proven unstable, most infamously during the Terra (LUNA) collapse. The GENIUS Act effectively sidelines this category for now.

Backed by assets like gold (e.g., PAXG), these stablecoins offer an inflation hedge but face hurdles in adoption due to custodial and liquidity challenges.

The GENIUS Act, signed into law on July 18, is already sparking action across Wall Street and Silicon Valley.

The only federally chartered crypto bank, Anchorage Digital, announced a partnership with Ethena Labs to issue USDtb, a stablecoin designed to meet GENIUS Act standards.

Asset management firm WisdomTree launched USDW, a fiat-backed stablecoin aimed at enabling dividend-paying tokenized assets. It’s one of the first SEC-registered stablecoins compliant with the new law.

The GENIUS Act is newly enacted US crypto legislation that provides a federal legal framework specifically for fiat-backed stablecoins. It mandates full reserves, audits, and licensing for compliant issuers.

Within a week of the Act’s signing, the stablecoin market grew by $4 billion, signaling investor confidence and institutional involvement due to newfound regulatory clarity.

The Act primarily affects fiat-backed stablecoins like USDT and USDC. Algorithmic stablecoins are largely excluded for now and may be regulated separately in the future.

Stablecoins offer a low-volatility digital asset that facilitates instant payments, tokenized dividends, and more efficient trading. With regulatory uncertainty removed, institutions now see them as viable financial tools.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.040.39%

Figure Heloc(FIGR_HELOC)$1.040.39% Wrapped stETH(WSTETH)$3,682.502.56%

Wrapped stETH(WSTETH)$3,682.502.56% Wrapped eETH(WEETH)$3,265.632.53%

Wrapped eETH(WEETH)$3,265.632.53% USDS(USDS)$1.00-0.01%

USDS(USDS)$1.00-0.01% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.03%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.03% Hyperliquid(HYPE)$33.5620.06%

Hyperliquid(HYPE)$33.5620.06% Coinbase Wrapped BTC(CBBTC)$89,334.001.86%

Coinbase Wrapped BTC(CBBTC)$89,334.001.86% WETH(WETH)$3,003.332.64%

WETH(WETH)$3,003.332.64% Ethena USDe(USDE)$1.000.02%

Ethena USDe(USDE)$1.000.02% Canton(CC)$0.1660788.77%

Canton(CC)$0.1660788.77% USD1(USD1)$1.00-0.01%

USD1(USD1)$1.00-0.01% World Liberty Financial(WLFI)$0.1657005.27%

World Liberty Financial(WLFI)$0.1657005.27% USDT0(USDT0)$1.00-0.02%

USDT0(USDT0)$1.00-0.02% sUSDS(SUSDS)$1.090.18%

sUSDS(SUSDS)$1.090.18% Ethena Staked USDe(SUSDE)$1.22-0.04%

Ethena Staked USDe(SUSDE)$1.22-0.04% Rain(RAIN)$0.009803-2.25%

Rain(RAIN)$0.009803-2.25% MemeCore(M)$1.561.06%

MemeCore(M)$1.561.06%