Chainlink’s CCIP launch on Solana and institutional deals with JPMorgan and SWIFT are bullish drivers.

Despite the May oracle glitch, Coinbase’s Proof of Reserve integration shows ongoing trust.

LINK must maintain $14 support to avoid downside toward $13.22 or lower.

Macroeconomic events (like Fed decisions) could impact altcoin liquidity short-term.

Long-term outlook remains promising if partnerships evolve into sustained adoption.

One of the most influential developments is the launch of Chainlink’s CCIP on Solana, which occurred on May 19th.

This protocol allows secure cross-chain communication, unlocking access to over $18 billion in on-chain assets. CCIP opens the door for scalable DeFi and bridges the gap between siloed ecosystems.

Chainlink’s Top Use Cases

Source: Chainlink

JPMorgan has used Chainlink for tokenized asset transactions.

SWIFT is piloting interoperability via Chainlink’s oracle solutions.

World Economic Forum recognized Chainlink as a standard for cross-chain interoperability.

These institutional ties reinforce bullish long-term sentiment for LINK.

However, not all updates have been positive. On May 29th, an oracle malfunction led to over $532K in user losses, triggering concerns about network reliability.

Despite the setback, Coinbase integrated Chainlink’s Proof of Reserve feature for over $4.6 billion in cbBTC reserves, reaffirming confidence from major players.

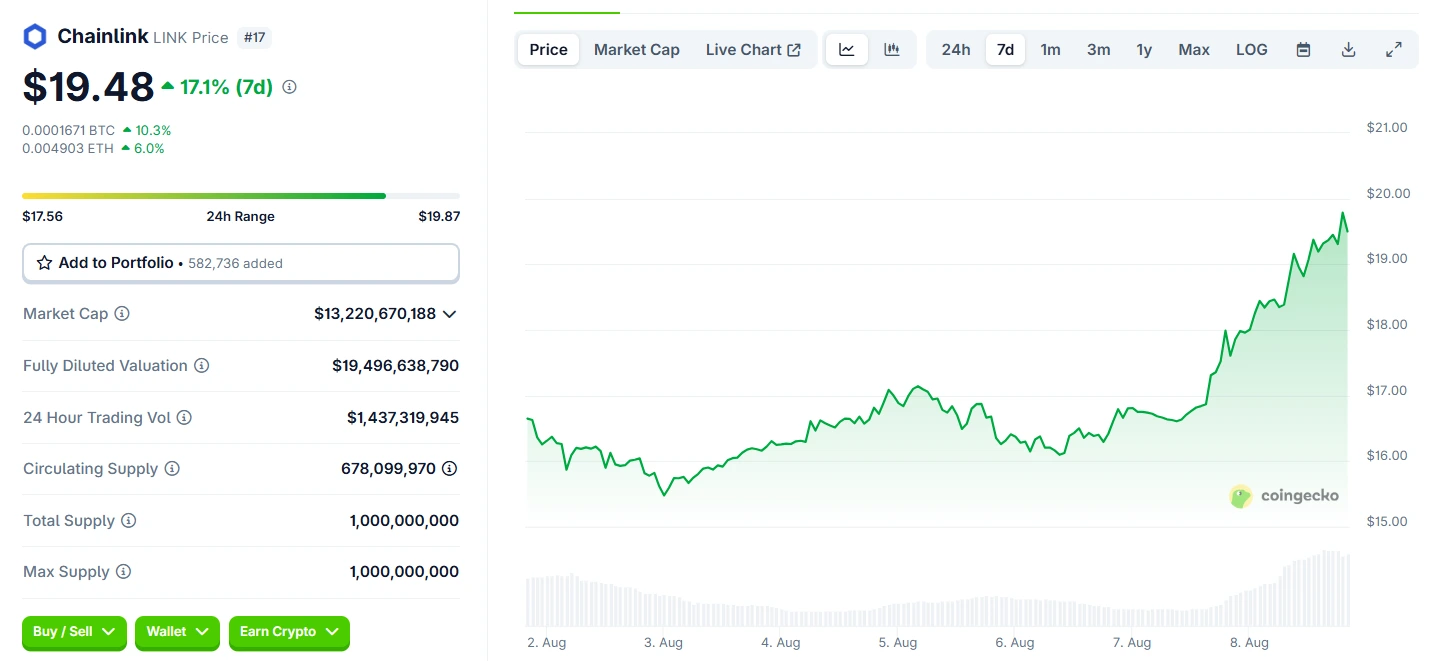

As of this writing, LINK trades at $19.48, sitting just below its 200-day EMA.

A sustained hold above $14 could trigger a cup-and-handle breakout, targeting $18 to $19 in the near term.

Whale activity surged 299% ($101M) on May 30, indicating possible accumulation.

A breakdown below $14 opens the door to $13.22 (May 30 low), with further downside potential to $10.12.

Momentum remains weak, as indicated by the MACD histogram (-0.176) and RSI (45.95).

With Bitcoin dominance hovering around 63%, liquidity continues to favor BTC, leaving altcoins like LINK more vulnerable to volatility. The Crypto Fear & Greed Index sits at 61 (Greed), suggesting cautious optimism.

Upcoming U.S. Core PCE data and potential Fed rate adjustments may significantly affect risk asset appetite. However, regulatory clarity, especially concerning tokenized assets and oracle networks, could act as a tailwind for Chainlink.

LINK’s recent price behavior and on-chain metrics have sparked a range of predictions from analysts and traders.

Chainlink’s Current Price

Source: CoinGecko

Following the oracle glitch, short-term sentiment turned bearish, with LINK falling to $14.33, a 9.58% drop in 24 hours. However, long-term optimism persists:

Coinbase adoption of Proof of Reserve

Total Value Secured (TVS) rose over 50% in May, reaching $65B+

The glitch reignited concerns about Chainlink’s performance in low-liquidity environments. Analysts call for improved safeguards and redundancy features.

Large wallet transactions spiked 299%, moving 6.71M LINK on May 30th. This could reflect strategic accumulation or redistribution in response to market dips.

Support: $13.86 is a critical level. A hold here could trigger a short squeeze toward $17.40.

Resistance: $16 remains a key barrier. Failure to break it could bring LINK back toward $12.70.

Chainlink is considered a strong long-term project due to its real-world utility in DeFi, TradFi integrations, and its unique oracle technology. However, short-term volatility and macro risks still apply.

A break below $14 could send LINK toward $13.22, with a worst-case projection at $10.12, according to technical analysts.

If momentum returns and technical breakouts align, LINK could target $18–$19 in the near term, and potentially $30+ long term with strong institutional adoption.

Chainlink provides decentralized oracles that connect blockchains to real-world data—critical for DeFi, insurance, gaming, and tokenized assets.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.040.41%

Figure Heloc(FIGR_HELOC)$1.040.41% Wrapped stETH(WSTETH)$3,721.424.13%

Wrapped stETH(WSTETH)$3,721.424.13% Wrapped eETH(WEETH)$3,298.174.12%

Wrapped eETH(WEETH)$3,298.174.12% USDS(USDS)$1.000.02%

USDS(USDS)$1.000.02% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.01%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.01% Hyperliquid(HYPE)$34.0522.82%

Hyperliquid(HYPE)$34.0522.82% Coinbase Wrapped BTC(CBBTC)$89,831.002.16%

Coinbase Wrapped BTC(CBBTC)$89,831.002.16% WETH(WETH)$3,033.494.00%

WETH(WETH)$3,033.494.00% Ethena USDe(USDE)$1.000.04%

Ethena USDe(USDE)$1.000.04% Canton(CC)$0.16834713.97%

Canton(CC)$0.16834713.97% USD1(USD1)$1.000.05%

USD1(USD1)$1.000.05% World Liberty Financial(WLFI)$0.1648694.70%

World Liberty Financial(WLFI)$0.1648694.70% USDT0(USDT0)$1.000.02%

USDT0(USDT0)$1.000.02% sUSDS(SUSDS)$1.080.11%

sUSDS(SUSDS)$1.080.11% Ethena Staked USDe(SUSDE)$1.22-0.04%

Ethena Staked USDe(SUSDE)$1.22-0.04% Rain(RAIN)$0.009889-2.27%

Rain(RAIN)$0.009889-2.27% MemeCore(M)$1.54-0.47%

MemeCore(M)$1.54-0.47%