Eric Trump’s Ethereum commentary went viral as ETH crossed $4,000.

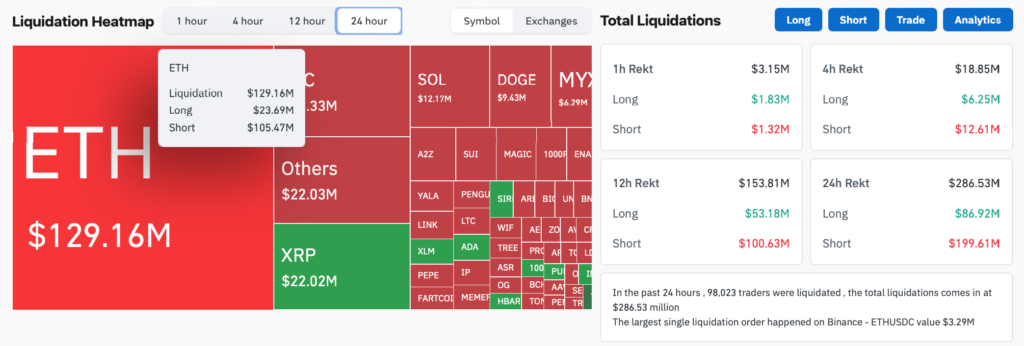

$105 million in Ether shorts were liquidated in a single day.

The $4,100 resistance level is now seen as a major pivot point.

Institutional ETF inflows are adding fuel to the bullish momentum.

Price predictions range from $10,000 to $16,000 for Ethereum.

According to data from CoinGlass, Ethereum shorts accounted for over 53% of the total $199.61 million liquidated across the entire crypto market on Friday.

ETH’s Total Liquidations

Source: CoinGlass

In just 24 hours, Ether’s total liquidations reached $129.16 million, highlighting the intensity of the market movement. ETH climbed as high as $4,060, marking a 4.6% daily gain, before stabilizing around $4,015, according to Nansen data.

Crypto trader Ash Crypto noted that $4,100 has become the next major resistance level for Ethereum.

In his words:

“If ETH breaks $4,100, it could trigger a short squeeze which will send ETH to $4,400–$4,500 in just a few hours.”

Analysts across the crypto sector have highlighted rising optimism for Ethereum, largely due to the growing institutional demand and the success of spot Ethereum ETFs.

According to Farside Investors, these ETFs have seen inflows of $537 million over just four trading days, reflecting a growing appetite among traditional investors for crypto exposure.

Crypto trader Ted summarized the mood among many traders:

“It’s never been this bullish in my opinion,” emphasizing the combination of ETF momentum, institutional demand, and macro sentiment.

With Ethereum’s recent surge past $4,000, price predictions are flying fast. Crypto trader Moustache remarked:

“I know it sounds wild, but I think ETH will go to $10,000+.”

Meanwhile, Tom Lee, co-founder of Fundstrat, compared Ethereum’s current position to Bitcoin’s legendary 2017 bull run.

“Ethereum is having its Bitcoin 2017 moment. It could go as high as $16,000,” Lee said in a recent interview.

Source: X (@intocryptoverse)

While Eric Trump has previously shown interest in crypto, his latest commentary marks one of the more high-profile public endorsements of Ethereum and Bitcoin by a Trump family member.

His post has reignited speculation about Donald Trump’s evolving stance on crypto, especially as digital assets become a central issue in the 2024 U.S. elections.

Eric Trump commented on Ethereum after it broke above $4,000, calling out bearish traders and warning them to stop betting against ETH and BTC. His remarks coincided with massive short liquidations in the crypto market.

Over $105 million in Ethereum short positions were liquidated in 24 hours, accounting for 53% of all crypto short liquidations.

Analysts suggest that if Ethereum breaks $4,100, it could rally to $4,400–$4,500 quickly. Some even predict long-term targets of $10,000 or higher.

Yes, institutional interest through spot ETH ETFs is driving bullish sentiment. Inflows totaling $537 million over four days suggest strong investor confidence.

While not a crypto figure traditionally, Eric Trump’s massive online following and political influence could amplify crypto narratives and attract new retail interest.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.032.62%

Figure Heloc(FIGR_HELOC)$1.032.62% Wrapped stETH(WSTETH)$3,605.56-8.05%

Wrapped stETH(WSTETH)$3,605.56-8.05% USDS(USDS)$1.00-0.01%

USDS(USDS)$1.00-0.01% Wrapped eETH(WEETH)$3,195.80-8.03%

Wrapped eETH(WEETH)$3,195.80-8.03% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.03%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.03% WETH(WETH)$2,942.77-7.99%

WETH(WETH)$2,942.77-7.99% Coinbase Wrapped BTC(CBBTC)$89,458.00-3.63%

Coinbase Wrapped BTC(CBBTC)$89,458.00-3.63% Ethena USDe(USDE)$1.00-0.13%

Ethena USDe(USDE)$1.00-0.13% Hyperliquid(HYPE)$21.21-10.62%

Hyperliquid(HYPE)$21.21-10.62% USDT0(USDT0)$1.000.00%

USDT0(USDT0)$1.000.00% Canton(CC)$0.1240956.18%

Canton(CC)$0.1240956.18% sUSDS(SUSDS)$1.090.07%

sUSDS(SUSDS)$1.090.07% World Liberty Financial(WLFI)$0.160667-2.39%

World Liberty Financial(WLFI)$0.160667-2.39% Ethena Staked USDe(SUSDE)$1.220.03%

Ethena Staked USDe(SUSDE)$1.220.03% USD1(USD1)$1.00-0.04%

USD1(USD1)$1.00-0.04% Rain(RAIN)$0.008478-6.45%

Rain(RAIN)$0.008478-6.45% MemeCore(M)$1.623.74%

MemeCore(M)$1.623.74%