Crypto debanking continues in the U.S. despite pro-crypto political leadership.

Companies like Unicoin report ongoing account closures by major banks without explanation.

Operation Chokepoint 3.0 is believed to be targeting crypto and fintech firms through indirect financial restrictions.

An executive order from President Trump may soon address unfair debanking practices.

Legal experts warn that meaningful change depends on future regulatory clarity and enforceable laws.

For years, digital asset companies have been subjected to abrupt account closures and service denials from major U.S. banks.

These actions are typically framed under “de-risking” policies but are widely seen by the crypto industry as part of a covert, policy-driven crackdown, known informally as Operation Chokepoint 2.0.

The original Operation Choke Point, launched during the Obama administration, targeted “high-risk” industries through indirect pressure on banks. Now, industry insiders warn of a resurgence in crypto debanking, even as pro-crypto politicians take office.

Many had hoped that the 2024 election of President Donald Trump, along with his crypto-friendly policy team, would mark the end of debanking practices.

His administration has signaled strong support for digital assets, pushing for modernized anti-money laundering (AML) regulations and reduced compliance burdens for crypto businesses.

But optimism is giving way to frustration.

Andreessen Horowitz general partner Alex Rampell recently warned that what he calls “Operation Chokepoint 3.0” is now underway.

In a public statement, Rampell accused large financial institutions of hiking fees and restricting data access to fintech and crypto firms like Coinbase and Robinhood.

Source: a16z.com

Similarly, Unicoin CEO Alex Konanykhin told Cointelegraph that his company and its subsidiaries have experienced direct and unexplained debanking at the hands of major U.S. banks.

Konanykhin listed five banks that had severed ties with his company:

Citibank

Chase

Wells Fargo

City National Bank of Florida

TD Bank

Although a Chase spokesperson declined to comment on specific cases, they acknowledged support for the administration’s efforts to reduce regulatory burdens.

Konanykhin emphasized the scale of the issue, stating that Unicoin was debanked by four separate banks in 2025 alone.

For a publicly reporting company with six years of audited financials and over 4,000 shareholders, this level of disruption is not just inconvenient, it’s a systemic threat.

According to a recent Bloomberg report, President Trump is preparing to sign an executive order aimed at halting debanking practices.

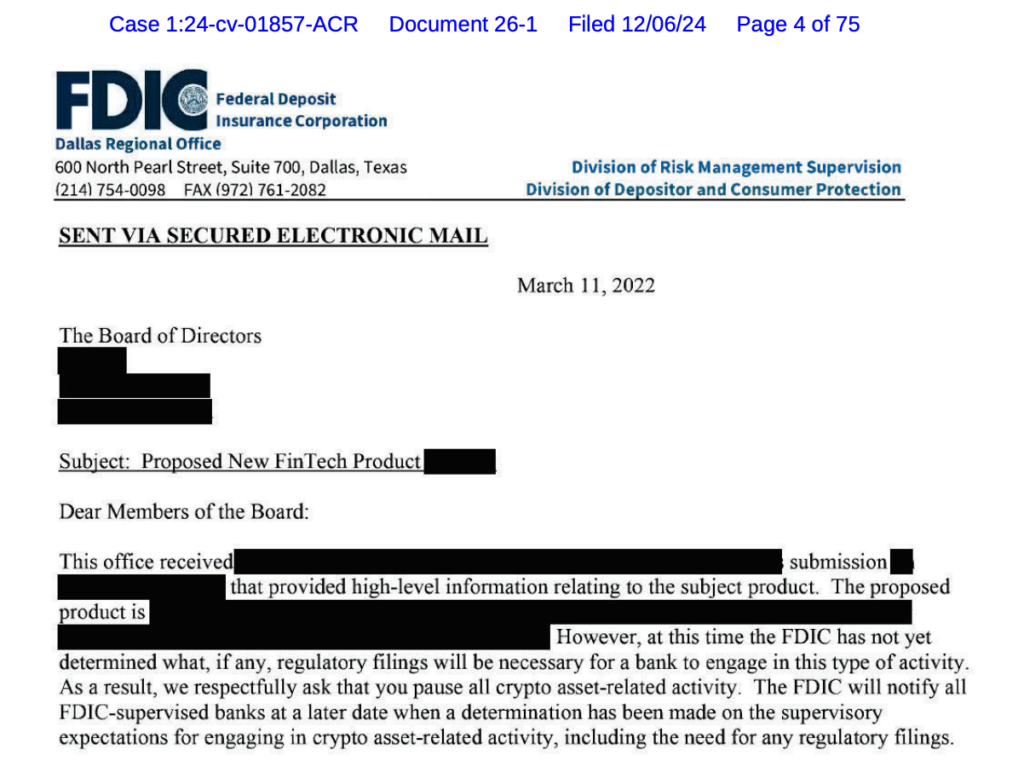

A Redacted FDIC Letter From 2022 To A Company Requesting It To Halt Its Crypto Activities

Source: FDIC

The order will instruct federal regulators to:

Identify financial institutions engaged in debanking

Investigate complaints related to unjust account closures

Penalize non-compliant banks

Reinstate clients unfairly denied services

Konanykhin welcomed the move, saying:

“The President knows the pain of de-banking first-hand and seems determined to stop this form of economic warfare against American businesses.”

He added that ending crypto debanking could restore the U.S. as a global leader in digital innovation.

Konanykhin believes that if the executive order is implemented effectively, the American crypto industry could flourish on a global scale:

“Ending the War on Crypto will boost the American crypto industry. It may become as impactful internationally as Hollywood is in entertainment or Silicon Valley in IT.”

Despite these high-level policy shifts, some experts caution that real reform will depend on the final legal wording of crypto-related regulations.

Elizabeth Blickley, partner at Fox Rothschild LLP, pointed to the recently passed Genius Act, which gives the Federal Reserve’s Stablecoin Certification Review Committee 180 days to draft a comprehensive regulatory framework.

But she warned that progress could stall:

“Most bills never make it out of committee, and any final regulation will likely face litigation from both sides of the debate.”

Until clear legal protections are in place, banks are expected to remain cautious.

Crypto debanking refers to the practice of financial institutions denying services or closing accounts of businesses involved in cryptocurrency, often citing compliance or regulatory risks.

While banks have discretion to manage risk, critics argue that coordinated or unexplained account closures without due process may violate fair access principles and warrant legal scrutiny.

Originally launched by the U.S. Department of Justice in 2013, Operation Choke Point was aimed at limiting banking access for “high-risk” businesses. The term is now used informally to describe similar tactics applied to crypto firms.

President Trump is reportedly preparing an executive order directing regulators to penalize banks that unlawfully debank crypto or politically-affiliated entities.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.041.35%

Figure Heloc(FIGR_HELOC)$1.041.35% Wrapped stETH(WSTETH)$3,425.99-6.72%

Wrapped stETH(WSTETH)$3,425.99-6.72% USDS(USDS)$1.000.00%

USDS(USDS)$1.000.00% Wrapped eETH(WEETH)$3,038.20-7.06%

Wrapped eETH(WEETH)$3,038.20-7.06% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.01%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.01% Hyperliquid(HYPE)$32.39-2.44%

Hyperliquid(HYPE)$32.39-2.44% Canton(CC)$0.1785395.12%

Canton(CC)$0.1785395.12% Coinbase Wrapped BTC(CBBTC)$83,918.00-5.90%

Coinbase Wrapped BTC(CBBTC)$83,918.00-5.90% Ethena USDe(USDE)$1.00-0.01%

Ethena USDe(USDE)$1.00-0.01% WETH(WETH)$2,796.04-6.98%

WETH(WETH)$2,796.04-6.98% USD1(USD1)$1.000.01%

USD1(USD1)$1.000.01% USDT0(USDT0)$1.000.01%

USDT0(USDT0)$1.000.01% sUSDS(SUSDS)$1.080.45%

sUSDS(SUSDS)$1.080.45% World Liberty Financial(WLFI)$0.157160-4.26%

World Liberty Financial(WLFI)$0.157160-4.26% Ethena Staked USDe(SUSDE)$1.22-0.05%

Ethena Staked USDe(SUSDE)$1.22-0.05% Rain(RAIN)$0.009475-4.85%

Rain(RAIN)$0.009475-4.85% MemeCore(M)$1.530.01%

MemeCore(M)$1.530.01%