Bitcoin surged above $122,000, now within 1% of its all-time high.

Trump’s executive order allowing crypto in retirement plans is a major catalyst.

ETF inflows of $773 million show strong institutional demand.

Market sentiment remains stable, with Fear & Greed Index at 70.

Total crypto market cap has hit a new high of $4.14 trillion.

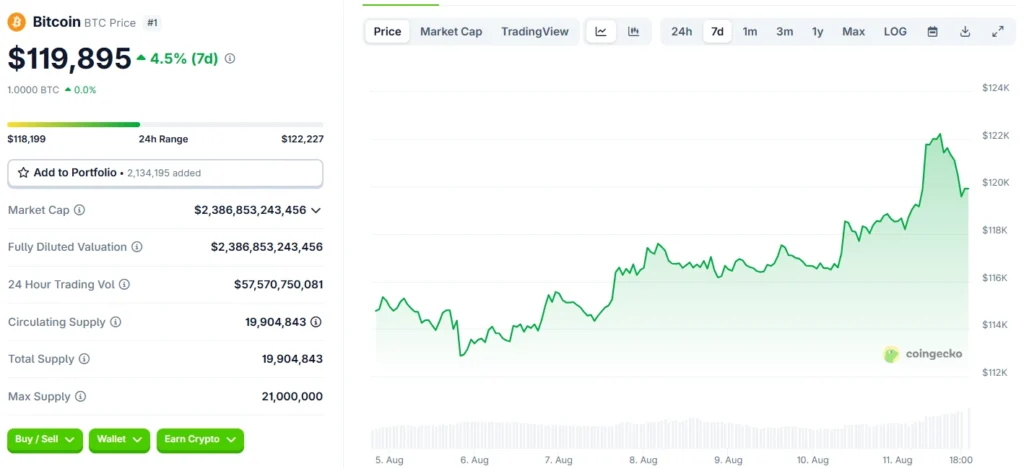

After trading in a narrow range for several weeks, Bitcoin (BTC) surged 3.3% in the early hours of Monday, hitting $122,150 according to TradingView. This price movement brings Bitcoin within 1% of its all-time high of $123,000.

Source: CoinGecko

Henrik Andersson, Chief Investment Officer at Apollo Crypto, described the breakout as inevitable. According to Andersson:

“In our view, it was just a matter of time before it would break up. In this time, we have seen positive ETF flows, more treasury companies buying Bitcoin, and a number of positive developments coming out of the White House.”

One of the key drivers behind the rally is a recent executive order by U.S. President Donald Trump, allowing cryptocurrency investments in 401(k) retirement plans.

This development is monumental, potentially unlocking up to $9 trillion in retirement capital to flow into crypto markets. This regulatory shift also signals growing mainstream acceptance and a long-term bullish case for Bitcoin.

Bitcoin Exchange-Traded Fund (ETF) issuers collectively acquired $773 million worth of BTC over the final three trading days of last week, according to Farside Investors.

The consistent inflow into ETFs is a critical indicator of institutional interest and a strong tailwind for Bitcoin price predictions.

Adding to the bullish sentiment, MicroStrategy co-founder Michael Saylor teased further Bitcoin purchases. On social media platform X, he hinted:

“If you don’t stop buying Bitcoin, you won’t stop making money.”

MicroStrategy already holds over $76.8 billion in Bitcoin, and further accumulation would reinforce Bitcoin’s scarcity narrative.

Despite the rally, the Crypto Fear & Greed Index remains in the “Greed” territory with a score of 70 out of 100. While optimistic, it doesn’t signal market euphoria, a common precursor to corrections.

Source: alternative.me

Additionally, Google search interest for Bitcoin has only seen a modest uptick, scoring 48 out of 100 in recent days. The all-time high in search volume still belongs to the week of Nov. 10th–16th, shortly after the U.S. presidential election.

This relatively calm sentiment suggests that the current rally may have more room to run before overheating.

While Bitcoin stole the spotlight, Ethereum (ETH) also saw healthy gains, rising 1.8% in 24 hours to hit $4,271. ETH has nearly tripled since April, climbing from $1,435 to its current price.

These rallies have helped push the total cryptocurrency market capitalization to $4.14 trillion, marking a new all-time high, according to CoinGecko.

The Global Crypto Market Cap

Source: CoinGecko

Given the strong fundamentals and institutional backing, many analysts believe Bitcoin is poised for further upside.

If bullish momentum continues, Bitcoin could test, and potentially surpass, its $123,000 all-time high within the coming days.

Should ETF inflows continue and more regulatory clarity emerge, some analysts are projecting a Bitcoin price prediction in the range of $150,000–$180,000 by early 2026.

The recent rally was triggered by a combination of bullish ETF inflows, pro-crypto regulatory developments in the U.S., and renewed interest from major players like Michael Saylor’s MicroStrategy.

While Bitcoin is nearing all-time highs, sentiment indicators suggest the market is not yet overheated. As always, conduct your own research and consider long-term holding strategies.

If momentum holds, Bitcoin could break its $123,000 high and potentially target $130,000 in the short term.

By allowing crypto in retirement plans, the executive order could bring trillions in new capital into the space, significantly boosting Bitcoin’s adoption and price.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.030.36%

Figure Heloc(FIGR_HELOC)$1.030.36% Wrapped stETH(WSTETH)$3,586.99-0.96%

Wrapped stETH(WSTETH)$3,586.99-0.96% Wrapped eETH(WEETH)$3,180.96-0.96%

Wrapped eETH(WEETH)$3,180.96-0.96% USDS(USDS)$1.000.00%

USDS(USDS)$1.000.00% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.06%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.06% Coinbase Wrapped BTC(CBBTC)$88,559.00-0.86%

Coinbase Wrapped BTC(CBBTC)$88,559.00-0.86% WETH(WETH)$2,927.25-0.97%

WETH(WETH)$2,927.25-0.97% Ethena USDe(USDE)$1.000.00%

Ethena USDe(USDE)$1.000.00% Canton(CC)$0.1546593.22%

Canton(CC)$0.1546593.22% Hyperliquid(HYPE)$22.51-3.85%

Hyperliquid(HYPE)$22.51-3.85% USD1(USD1)$1.00-0.02%

USD1(USD1)$1.00-0.02% World Liberty Financial(WLFI)$0.170885-3.81%

World Liberty Financial(WLFI)$0.170885-3.81% USDT0(USDT0)$1.000.02%

USDT0(USDT0)$1.000.02% sUSDS(SUSDS)$1.08-0.29%

sUSDS(SUSDS)$1.08-0.29% Ethena Staked USDe(SUSDE)$1.220.03%

Ethena Staked USDe(SUSDE)$1.220.03% Rain(RAIN)$0.0099310.24%

Rain(RAIN)$0.0099310.24% MemeCore(M)$1.630.11%

MemeCore(M)$1.630.11%