Ethereum is trading just 2% below its ATH, but a new high could take time to materialize.

Institutional investment is surging, with ETF inflows hitting $1B+ in a single day.

Crypto traders remain divided on the timing of a breakout, with some calling for new highs in days.

Market sentiment is mixed, with retail skepticism paradoxically driving bullish momentum.

Ethereum price predictions remain strong, with betting platforms giving ETH a 65% chance of hitting $5K before August ends.

Ethereum reached a peak of $4,779 on Thursday, just 2.07% shy of its all-time high, before dipping back to $4,630 the following day. While this might appear to signal an imminent breakout, experts urge caution.

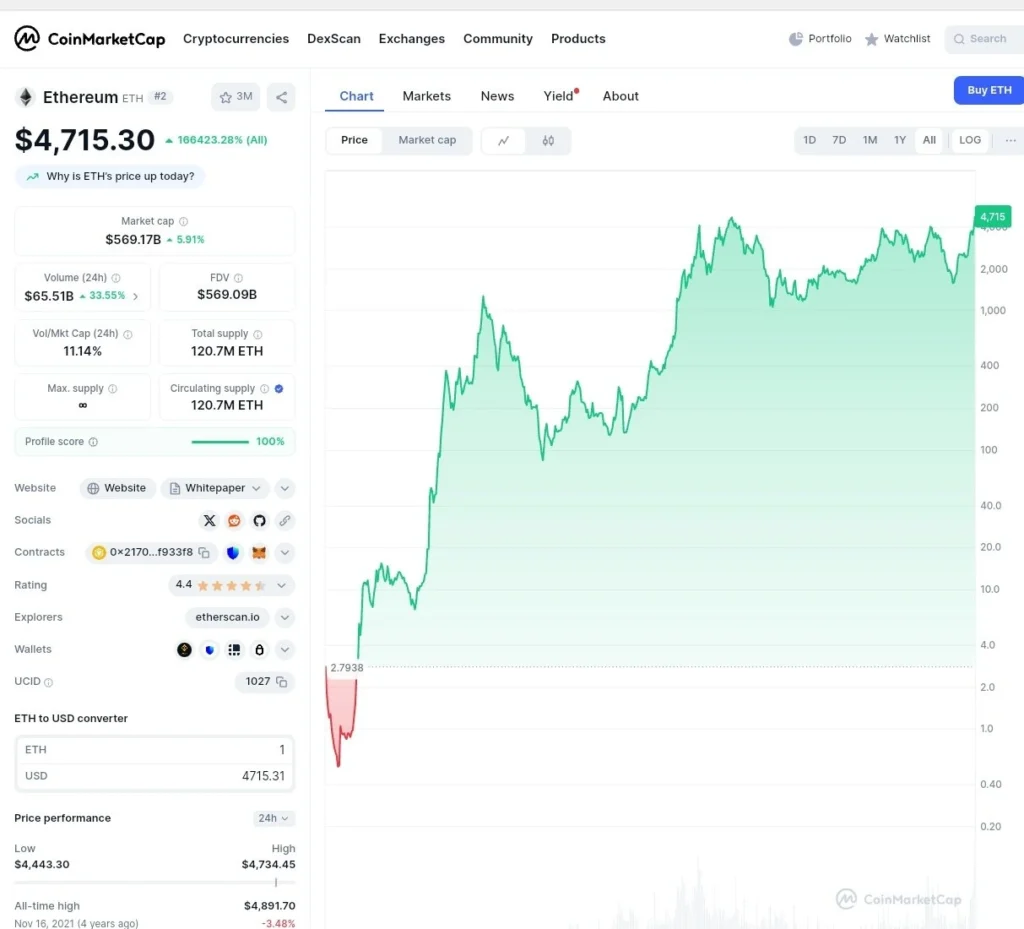

ETH’s Price On August 14th, 2025

Source: CoinMarketCap

Jake Kennis, an analyst at blockchain analytics platform Nansen, said:

“With ETH near its previous ATHs, we may consolidate for a bit, given the very large run-up in such a short time frame.”

This view has tempered overly bullish expectations, with Kennis suggesting a wait-and-see approach as Ethereum attempts to build stronger support before a fresh surge.

Despite short-term volatility, several factors are helping to build a strong foundation for ETH’s continued upward trend. These include growing institutional demand, strong inflows into ETH ETFs, and increasing acceptance by traditional investors.

Ethereum’s institutional interest has exploded in recent weeks. On a single day, spot Ether exchange-traded funds (ETFs) recorded $1.01 billion in net inflows, the highest daily figure to date.

Simultaneously, corporate ETH holdings surpassed $13 billion, with firms like BitMine, SharpLink, and The Ether Machine taking prominent positions.

According to Kennis:

“ETH ETF inflows have even been surpassing BTC flows over the last few days, and this is an interesting trend”

These inflows are key in shaping a positive Ethereum price prediction for the months ahead.

Bitwise CIO Matt Hougan believes that Ethereum’s “narrative problem” has been solved.

He suggests that ETH is now being presented in ways traditional investors understand, namely, as a reliable, growth-oriented digital asset.

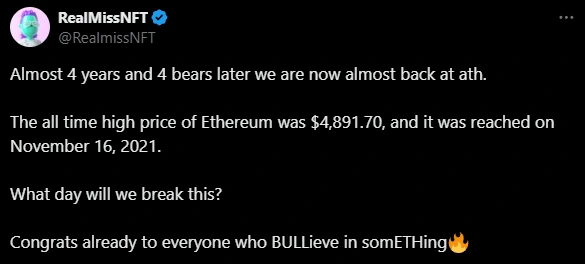

Crypto Twitter has been buzzing with speculation over when Ethereum might breach its previous high and set a new record.

Crypto trader Ardizor tweeted, “ETH is set to hit ATH in days,” while Pentoshi commented that a new high is likely “in the very near future.”

Meanwhile, more conservative voices, like Kennis, believe it could take several weeks or months, depending on market flows and sentiment.

Source: X (@RealmissNFT)

According to Polymarket, there’s a 65% chance Ethereum will hit $5,000 before the end of August, a figure that would mark a new all-time high and confirm bullish Ethereum price predictions.

Interestingly, Santiment says that retail traders aren’t fully convinced this rally will last. Ironically, this doubt might be exactly what’s fueling the rally, as crypto markets often move in the opposite direction of the majority sentiment.

Looking ahead, Ethereum’s price trajectory will likely be shaped by a few critical factors:

Continued institutional inflows

Sustained ETF growth

Macroeconomic conditions (such as interest rates and inflation)

Market sentiment from both retail and professional investors

As long as these factors remain favorable, many analysts agree that a new all-time high is not a question of if, but when.

Analysts are predicting a bullish long-term outlook for Ethereum, with many expecting ETH to reach $5,000 or higher by the end of August, provided current trends continue.

Estimates vary, some traders believe it could happen within days, while analysts like Jake Kennis suggest it may take weeks or months.

Ethereum ETFs and improved narratives have made it easier for traditional investors to gain exposure to ETH, increasing institutional inflows dramatically.

If you believe in Ethereum’s long-term fundamentals and current institutional momentum, many see this as a strategic entry point, especially before a confirmed breakout.

While no prediction is guaranteed, combining technical analysis, market sentiment, and institutional behavior provides valuable insights into potential future movements.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.040.40%

Figure Heloc(FIGR_HELOC)$1.040.40% Wrapped stETH(WSTETH)$3,688.912.56%

Wrapped stETH(WSTETH)$3,688.912.56% Wrapped eETH(WEETH)$3,273.122.71%

Wrapped eETH(WEETH)$3,273.122.71% USDS(USDS)$1.000.01%

USDS(USDS)$1.000.01% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.01%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.01% Hyperliquid(HYPE)$33.2329.59%

Hyperliquid(HYPE)$33.2329.59% Coinbase Wrapped BTC(CBBTC)$89,260.000.77%

Coinbase Wrapped BTC(CBBTC)$89,260.000.77% WETH(WETH)$3,011.702.68%

WETH(WETH)$3,011.702.68% Ethena USDe(USDE)$1.00-0.02%

Ethena USDe(USDE)$1.00-0.02% Canton(CC)$0.1550270.58%

Canton(CC)$0.1550270.58% USD1(USD1)$1.000.04%

USD1(USD1)$1.000.04% World Liberty Financial(WLFI)$0.1632863.41%

World Liberty Financial(WLFI)$0.1632863.41% USDT0(USDT0)$1.00-0.02%

USDT0(USDT0)$1.00-0.02% sUSDS(SUSDS)$1.080.14%

sUSDS(SUSDS)$1.080.14% Ethena Staked USDe(SUSDE)$1.22-0.03%

Ethena Staked USDe(SUSDE)$1.22-0.03% Rain(RAIN)$0.009906-0.85%

Rain(RAIN)$0.009906-0.85% MemeCore(M)$1.56-1.37%

MemeCore(M)$1.56-1.37%