The SEC has delayed decisions on Truth Social, Solana, and XRP ETFs until October 2025.

These delays reflect the agency’s cautious approach to SEC ETF regulation and digital asset products.

October is shaping up to be a critical month for crypto ETF approvals, including decisions on SOL, XRP, and in-kind redemptions.

The U.S. crypto ETF market continues to grow, with BlackRock leading in AUM and institutional appeal.

These developments signal the SEC’s ongoing struggle to balance innovation and investor protection.

In a series of notices filed on August 18th, the SEC announced updated timelines for several pending crypto ETF decisions:

Truth Social Bitcoin and Ethereum ETF (NYSE Arca): Decision postponed to October 8th

21Shares and Bitwise Solana ETFs (Cboe BZX Exchange): Delayed until October 16th

21Shares Core XRP Trust: Final decision now due by October 19th

Source: www.sec.gov

These extensions are part of the SEC’s standard review process but come amid growing anticipation for broader crypto ETF approvals in the U.S.

The Truth Social ETF, submitted on June 24th, is structured as a commodity-based trust. It directly holds Bitcoin (BTC) and Ethereum (ETH) and issues shares backed by these assets.

Though it carries the Truth Social brand, the social media platform associated with President Donald Trump, the ETF operates similarly to other spot crypto products already trading.

This ETF could offer retail and institutional investors a way to gain direct exposure to BTC and ETH without needing to manage private keys or wallets.

Also under review are 21Shares and Bitwise’s spot Solana (SOL) ETFs, which, if approved, would become the first Solana-based ETFs in the United States.

Solana has gained massive popularity for its high-speed blockchain and low transaction fees. The proposed ETFs would:

Hold SOL tokens directly

Track Solana’s price performance

Offer regulated access to a leading altcoin

By using Cboe BZX as the listing exchange, these products could appeal to institutional investors seeking alternatives to Bitcoin and Ethereum.

The 21Shares Core XRP Trust was originally filed in February 2025 and later amended. Its 180-day decision deadline was due this week, but the SEC exercised its authority to extend the review by another 60 days, pushing the new deadline to October 19th.

This trust would hold XRP directly and provide an investment vehicle that mirrors its spot market value — potentially bringing more legitimacy and market access to XRP investors.

The SEC has been actively postponing ETF decisions throughout 2025, following a long-standing pattern.

Earlier this year, several altcoin-based ETFs, including those tied to XRP, Litecoin (LTC), and Dogecoin (DOGE), have been subject to extended review periods.

Notably, the CoinShares spot Litecoin ETF was delayed earlier this year, with a new ruling expected in the same October window.

Separately, the SEC is reviewing Bitwise’s request to allow in-kind creations and redemptions for its Bitcoin and Ethereum ETFs, a move that would enable investors to trade ETF shares directly for the underlying crypto assets, rather than cash.

That decision is expected in September, and its outcome could shape future ETF structures.

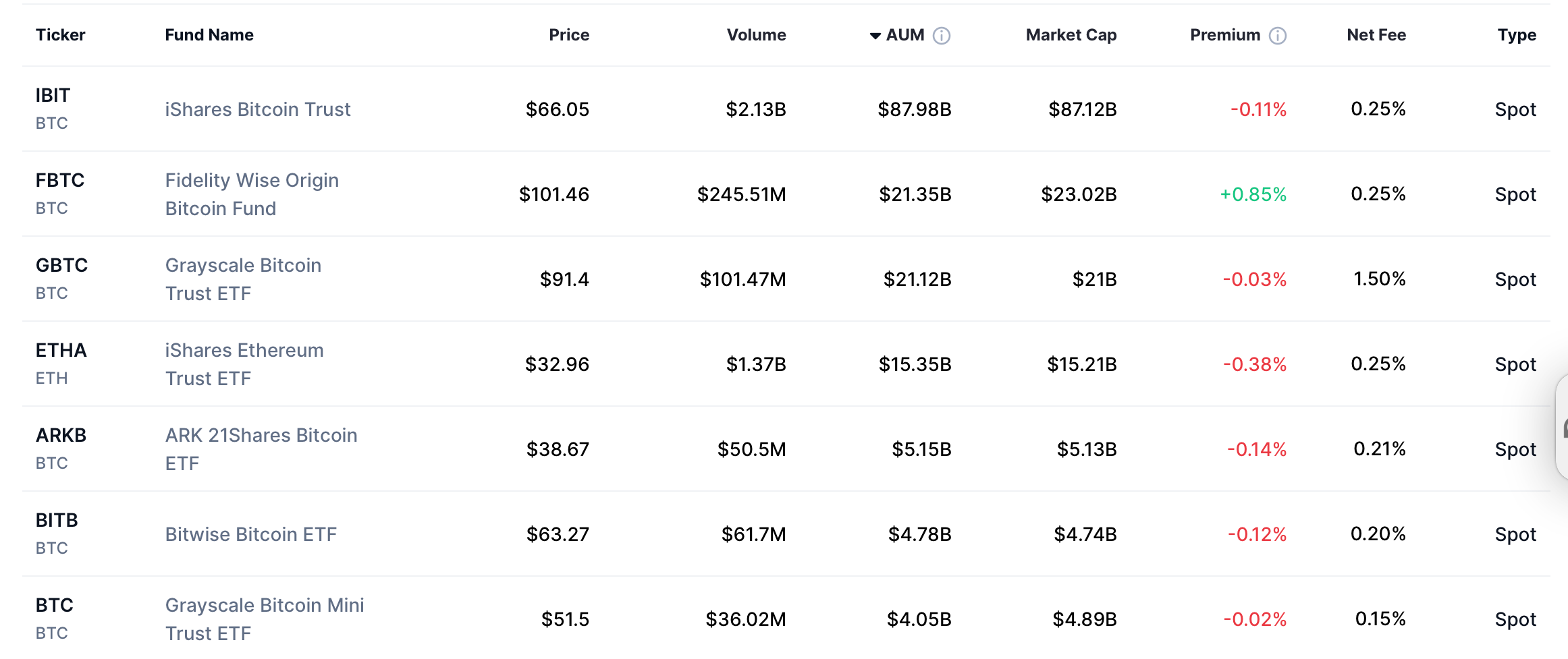

As of now, the U.S. market includes:

Over a dozen spot Bitcoin ETFs

Multiple Ethereum ETFs

An increasing number of pending applications for SOL, XRP, and other altcoins

U.S. Spot Bitcoin ETF Assets

Source: CoinMarketCap

BlackRock’s iShares Bitcoin Trust leads the market with more than $87 billion in assets under management (AUM).

Its institutional backing, liquidity, and brand reputation have given it a competitive edge, overshadowing smaller ETF offerings.

The SEC typically uses its full extension period to:

Review the product structure

Solicit public comments

Ensure compliance with securities laws

According to Bloomberg ETF analyst James Seyffart, early approvals are rare. In his words:

“The SEC typically takes the full time to respond to a 19b-4 filing. Almost all of these filings have final due dates in October.”

The SEC often uses the full time allowed by law to conduct detailed reviews, gather public feedback, and assess market impact. This cautious stance is typical of its broader regulatory approach.

Current deadlines are:

October 8th – Truth Social BTC/ETH ETF

October 16th – Solana ETFs from 21Shares and Bitwise

October 19th – 21Shares Core XRP Trust

Delays can stall institutional adoption and affect market sentiment. However, they also indicate that the SEC is taking crypto ETF regulation seriously.

While there is growing momentum and industry pressure, the SEC’s final decisions remain uncertain and could result in either approval or further deferral.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.040.23%

Figure Heloc(FIGR_HELOC)$1.040.23% Wrapped stETH(WSTETH)$2,818.32-0.73%

Wrapped stETH(WSTETH)$2,818.32-0.73% USDS(USDS)$1.00-0.01%

USDS(USDS)$1.00-0.01% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.00%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.00% Hyperliquid(HYPE)$35.087.06%

Hyperliquid(HYPE)$35.087.06% Wrapped eETH(WEETH)$2,497.54-0.79%

Wrapped eETH(WEETH)$2,497.54-0.79% Canton(CC)$0.1847231.44%

Canton(CC)$0.1847231.44% Ethena USDe(USDE)$1.00-0.04%

Ethena USDe(USDE)$1.00-0.04% Coinbase Wrapped BTC(CBBTC)$76,204.00-2.63%

Coinbase Wrapped BTC(CBBTC)$76,204.00-2.63% USD1(USD1)$1.000.06%

USD1(USD1)$1.000.06% WETH(WETH)$2,300.00-0.72%

WETH(WETH)$2,300.00-0.72% sUSDS(SUSDS)$1.090.42%

sUSDS(SUSDS)$1.090.42% USDT0(USDT0)$1.000.15%

USDT0(USDT0)$1.000.15% World Liberty Financial(WLFI)$0.1399198.65%

World Liberty Financial(WLFI)$0.1399198.65% Ethena Staked USDe(SUSDE)$1.22-0.02%

Ethena Staked USDe(SUSDE)$1.22-0.02% Rain(RAIN)$0.0094990.93%

Rain(RAIN)$0.0094990.93% MemeCore(M)$1.48-0.77%

MemeCore(M)$1.48-0.77%