TeraWulf is no longer just a Bitcoin miner – it’s evolving into a hybrid AI and crypto infrastructure company.

Backed by Google’s $1.8 billion investment, TeraWulf has validated its move into AI hosting.

With over 1 GW of planned capacity and long-term contracts, its revenue is set to grow dramatically.

Bitcoin scarcity and price increases further strengthen the company’s mining division.

Analysts remain bullish, with the majority recommending a “Buy” rating on WULF stock.

TeraWulf has restructured its operations into two major divisions:

WULF Mining continues traditional Bitcoin mining, taking advantage of BTC’s recent price appreciation.

With a focus on clean energy and scalable infrastructure, the company has maintained a strong position in the mining sector.

Source: TeraWulf

More significantly, WULF Compute is entering the lucrative market of AI and high-performance computing.

This pivot caters to skyrocketing demand from enterprise clients looking for AI hosting and compute services.

In mid-August 2025, TeraWulf disclosed that Alphabet Inc. (NASDAQ: GOOGL) backed $1.8 billion of Fluidstack’s lease obligations, one of WULF’s major HPC clients.

This investment also included the acquisition of 41 million WULF shares, giving Google an 8% stake in TeraWulf.

Under a decade-long contract with Fluidstack, WULF Compute will provide over 200 MW of compute capacity via its Lake Mariner data center in Western New York. The deal is worth $3.7 billion, with potential to scale to $8.7 billion if extended.

Being a key partner of Nvidia, Dell, and Borealis, Fluidstack ensures that TeraWulf is well-positioned in the global AI ecosystem.

According to the International Energy Agency (IEA), data center electricity consumption is expected to rise by 70% by 2030.

The United States is projected to lead this charge, backed by favorable policies and deregulation around nuclear energy.

McKinsey forecasts that global demand for AI workloads could result in $6.7 trillion in compute investment by 2030.

Even conservative estimates project $3–$8 trillion in capex for AI infrastructure alone.

In Q2 2025, TeraWulf mined 485 BTC, a slight drop from 699 BTC a year ago due to divestiture from the Nautilus Cryptomine. Yet, the value of self-mined Bitcoin grew to $47.6 million, up from $46.1 million, due to higher BTC prices.

With a year-over-year increase of 45.5% in mining capacity, the company now operates at 12.8 EH/s hash rate using 100% clean energy.

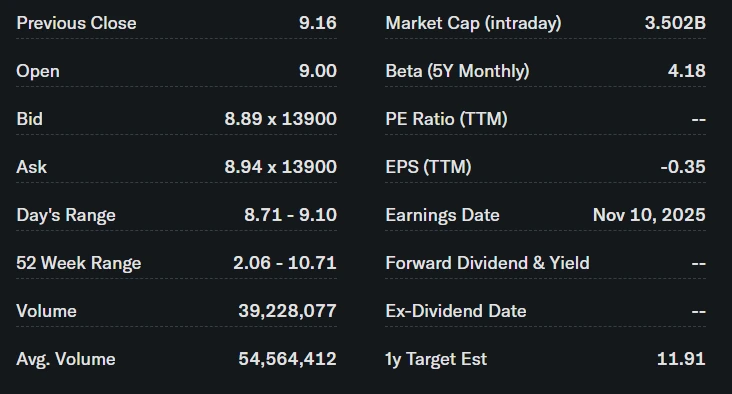

Current Price: $8.98

Average Analyst Target: $11.92

Low Estimate: $6.50

High Estimate: $14.00

WULF’s Stock Price Analysis

Source: Yahoo Finance

With VanEck’s 2025 BTC target of $180,000 per coin, WULF’s revenue outlook could be dramatically enhanced.

TeraWulf recently secured an 80-year lease for its Cayuga site in Lansing, New York, adding 400 MW of compute capacity.

Combined with the 750 MW capacity at Lake Mariner, WULF is on track to reach 1,150 MW by 2030.

TeraWulf offers exposure to both Bitcoin mining and the booming AI compute sector, backed by clean energy infrastructure and long-term contracts. With growing institutional interest, it’s considered a promising option by many analysts.

Through its WULF Compute division, TeraWulf hosts AI and HPC workloads. It recently secured a multi-billion dollar contract with Fluidstack, with Google backing the deal.

Unlike traditional miners, TeraWulf has diversified into AI infrastructure, making it more resilient to BTC price swings. Its clean energy operations also align with growing ESG expectations.

The company operates major facilities at Lake Mariner (Western New York) and Cayuga (Lansing, NY), with a total planned capacity of 1,150 MW by 2030.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.040.41%

Figure Heloc(FIGR_HELOC)$1.040.41% Wrapped stETH(WSTETH)$3,687.772.94%

Wrapped stETH(WSTETH)$3,687.772.94% Wrapped eETH(WEETH)$3,268.862.91%

Wrapped eETH(WEETH)$3,268.862.91% USDS(USDS)$1.000.00%

USDS(USDS)$1.000.00% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.10%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.10% Hyperliquid(HYPE)$33.3822.70%

Hyperliquid(HYPE)$33.3822.70% Coinbase Wrapped BTC(CBBTC)$89,120.001.00%

Coinbase Wrapped BTC(CBBTC)$89,120.001.00% WETH(WETH)$3,006.002.81%

WETH(WETH)$3,006.002.81% Ethena USDe(USDE)$1.000.05%

Ethena USDe(USDE)$1.000.05% Canton(CC)$0.1596232.75%

Canton(CC)$0.1596232.75% USD1(USD1)$1.000.01%

USD1(USD1)$1.000.01% World Liberty Financial(WLFI)$0.1628963.09%

World Liberty Financial(WLFI)$0.1628963.09% USDT0(USDT0)$1.00-0.01%

USDT0(USDT0)$1.00-0.01% sUSDS(SUSDS)$1.090.49%

sUSDS(SUSDS)$1.090.49% Ethena Staked USDe(SUSDE)$1.22-0.03%

Ethena Staked USDe(SUSDE)$1.22-0.03% Rain(RAIN)$0.009749-1.84%

Rain(RAIN)$0.009749-1.84% MemeCore(M)$1.56-0.51%

MemeCore(M)$1.56-0.51%