REX-Osprey DOGE ETF (DOJE) is expected to launch as early as next week.

This would mark the first-ever Dogecoin ETF, providing direct exposure to the memecoin via a Cayman Islands subsidiary.

The fund operates under the Investment Company Act of 1940, using legal workarounds to comply with U.S. investment laws.

Other tokens mentioned in the prospectus include XRP, BONK, TRUMP, BTC, ETH, and SOL.

The SEC is showing increasing openness toward crypto ETFs in 2025.

In a bold move reminiscent of their Solana Staking ETF launch in June, REX and Osprey have submitted an effective prospectus with the U.S. Securities and Exchange Commission (SEC).

Source: X (@REXShares)

This new ETF, structured under the Investment Company Act of 1940 (commonly referred to as the ’40 Act), could pave the way for other memecoin-based investment vehicles.

Eric Balchunas noted:

“Looks like Rex is going to launch a Doge ETF via the 40 Act next week. The same filing includes other ETF possibilities tied to XRP, TRUMP, BONK, BTC, ETH, and SOL.”

The ’40 Act governs how investment companies operate, aiming to protect investors through transparency and fair practices.

However, this act typically restricts direct exposure to certain digital assets like commodities and derivatives.

To bypass these restrictions, the REX-Osprey DOGE ETF will gain exposure to Dogecoin via a subsidiary based in the Cayman Islands, officially named the REX-Osprey DOGE (Cayman) Portfolio S.P.

This strategy mirrors the approach used for the SOL Staking ETF launched earlier in 2025. According to ETF Trends:

“In such cases, the subsidiary is structured to meet the requirements of the ’40 Act, allowing the ETF to gain exposure to these complex assets without violating the direct rules for the parent fund.”

The SEC, under Chairman Paul Atkins, has shown increasing support for crypto-based investment products in 2025.

In July, the commission approved new rules allowing in-kind creations and redemptions for crypto ETFs, a crucial step for market liquidity and operational efficiency.

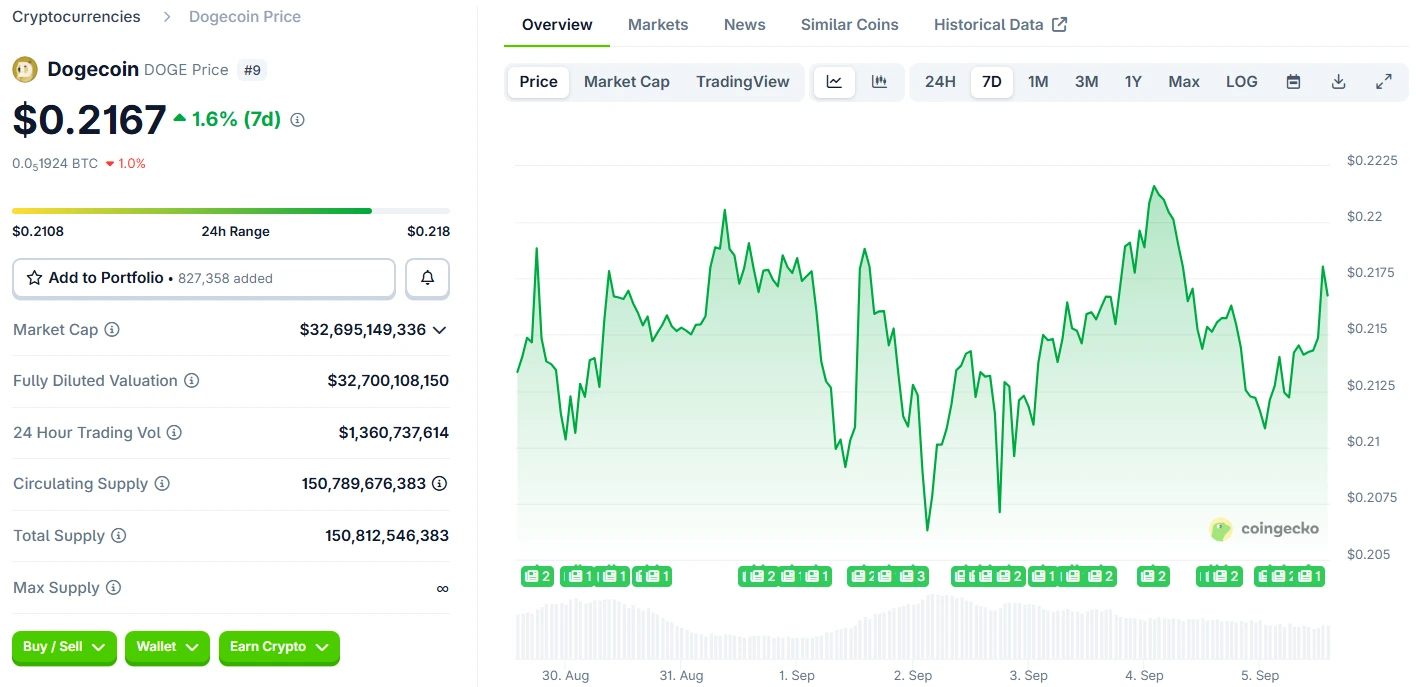

As of publication, Dogecoin is trading at $0.21, down 4.3% on the day. Despite the dip, the memecoin boasts a market capitalization of $32 billion, keeping it firmly in the top 10 cryptocurrencies by market cap.

Source: CoinGecko

While REX-Osprey is currently leading the race, Grayscale and Bitwise have also filed proposals for Dogecoin-related ETFs, further intensifying the competition in this space.

Additionally, the SEC has opened doors for spot Bitcoin and Ethereum ETFs, as well as options trading on select spot Bitcoin ETPs. These developments signal a maturing regulatory landscape more open to innovative products like a Dogecoin ETF.

A Dogecoin ETF is an exchange-traded fund designed to give investors exposure to Dogecoin’s price performance without having to hold the cryptocurrency directly.

The REX-Osprey Dogecoin ETF could launch as soon as next week, pending regulatory approval from the SEC.

The fund uses a Cayman Islands-based subsidiary to legally gain exposure to Dogecoin, staying compliant with the U.S. Investment Company Act of 1940.

The ETF will trade under the ticker “DOJE” on U.S. exchanges.

Apart from REX-Osprey, Grayscale and Bitwise have also submitted proposals to launch their own Dogecoin ETFs.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.040.40%

Figure Heloc(FIGR_HELOC)$1.040.40% Wrapped stETH(WSTETH)$3,684.642.44%

Wrapped stETH(WSTETH)$3,684.642.44% Wrapped eETH(WEETH)$3,267.982.53%

Wrapped eETH(WEETH)$3,267.982.53% USDS(USDS)$1.000.00%

USDS(USDS)$1.000.00% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.03%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.03% Hyperliquid(HYPE)$31.9325.57%

Hyperliquid(HYPE)$31.9325.57% Coinbase Wrapped BTC(CBBTC)$89,185.000.74%

Coinbase Wrapped BTC(CBBTC)$89,185.000.74% WETH(WETH)$3,007.262.55%

WETH(WETH)$3,007.262.55% Ethena USDe(USDE)$1.00-0.06%

Ethena USDe(USDE)$1.00-0.06% Canton(CC)$0.153946-1.53%

Canton(CC)$0.153946-1.53% USD1(USD1)$1.000.01%

USD1(USD1)$1.000.01% World Liberty Financial(WLFI)$0.1639373.95%

World Liberty Financial(WLFI)$0.1639373.95% USDT0(USDT0)$1.00-0.05%

USDT0(USDT0)$1.00-0.05% sUSDS(SUSDS)$1.080.07%

sUSDS(SUSDS)$1.080.07% Ethena Staked USDe(SUSDE)$1.22-0.07%

Ethena Staked USDe(SUSDE)$1.22-0.07% Rain(RAIN)$0.009916-0.74%

Rain(RAIN)$0.009916-0.74% MemeCore(M)$1.57-2.15%

MemeCore(M)$1.57-2.15%