BNP Paribas and HSBC have joined the Canton Foundation, strengthening the push for institutional tokenization.

The Canton Network is purpose-built for real-world asset tokenization and compliant financial infrastructure.

Institutional interest is replacing retail-driven hype cycles in crypto.

Regulatory progress in the U.S. and globally is acting as a catalyst for adoption.

Tokenization efforts are expanding beyond fixed-income markets into equities and commodities.

The Canton Foundation provides governance, strategic alignment, and development support for the Canton Network, a privacy-enabled blockchain optimized for institutional use.

It focuses on:

Regulatory interoperability

Cross-platform financial services

With over 30 member organizations, the Canton Foundation is rapidly becoming a collaborative hub for banks, regulators, and financial service providers.

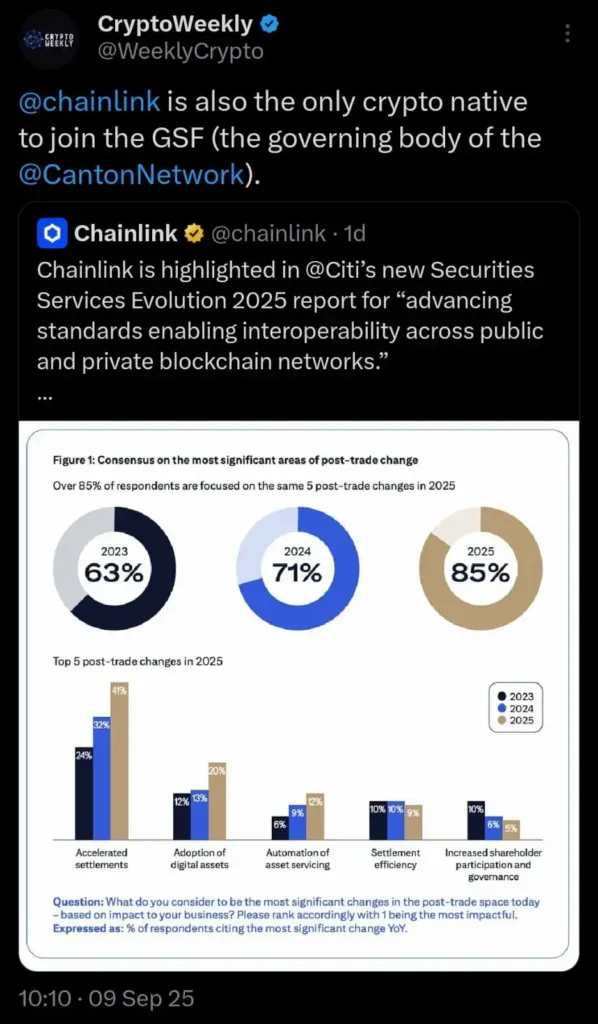

The Canton Network also recently secured a partnership with Chainlink, the latter becoming the only crypto native to join the GSF.

Source: X (@WeeklyCrypto)

In addition to BNP Paribas and HSBC, the foundation now includes:

Hong Kong FMI Services

Moody’s Ratings

This diverse and growing ecosystem reflects institutional confidence in blockchain-based infrastructure for financial applications.

Hubert de Lambilly, Head of Global Markets at BNP Paribas, described the bank’s membership as a “commitment to adopting distributed ledger technology to serve our evolving client needs.”

BNP Paribas has a history with Digital Asset, the company behind Canton Network. The bank previously participated in Digital Asset’s $135 million funding round, aimed at accelerating adoption of decentralized finance and tokenization.

John O’Neil, Head of Digital Assets and Currencies at HSBC, emphasized the bank’s goal to “foster industry maturation” and support real liquidity in digital markets.

HSBC has already been exploring:

Stablecoins, with a license application reportedly underway in Hong Kong

Blockchain for custody and bond issuance

Tokenized asset management initiatives

Unlike previous crypto bull cycles in 2017 and 2021, which were dominated by retail speculation, 2025 is shaping up to be the year of institutional tokenization.

This shift has been recognized by the World Economic Forum (WEF), which praised recent collaboration between regulators, financial institutions, and technology firms.

Source: World Economic Forum

According to the WEF, building trusted, interoperable frameworks is key to unlocking tokenization’s long-term potential.:

“The tokenization of real-world assets is no longer a concept; it’s becoming a cornerstone of modern finance.”

In the U.S., legislative moves such as the GENIUS Act and market structure bills passed by the House of Representatives have instilled new confidence among institutions.

U.S. President Donald Trump Signing The GENIUS Act

Source: Associated Press

These regulatory developments are seen as critical in paving the way for broader blockchain adoption.

To date, institutional tokenization has primarily focused on:

Private credit markets

U.S. Treasury bills

However, experiments are now expanding into:

Commodities

Energy infrastructure

Digital asset exchange Kraken has reportedly engaged with the SEC’s crypto task force to discuss regulatory frameworks for tokenization, illustrating the growing dialogue between industry leaders and U.S. regulators.

Institutional tokenization is the process by which large financial institutions tokenize real-world assets (such as bonds, equities, or real estate) using blockchain technology to improve efficiency, compliance, and liquidity.

It allows for greater transparency, faster settlement times, and lower costs in traditional financial markets — potentially revolutionizing how assets are issued, traded, and managed.

The Canton Foundation governs the Canton Network, a blockchain infrastructure designed specifically for institutions. It brings together banks, regulators, and tech firms to standardize tokenization frameworks.

So far, institutions are focusing on tokenizing private credit, Treasury bills, and increasingly, equities, commodities, and infrastructure projects.

Clear and favorable regulatory frameworks, such as the GENIUS Act in the U.S., are essential to building institutional confidence and fostering broader adoption.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.030.68%

Figure Heloc(FIGR_HELOC)$1.030.68% Wrapped stETH(WSTETH)$3,697.201.25%

Wrapped stETH(WSTETH)$3,697.201.25% Wrapped eETH(WEETH)$3,278.262.85%

Wrapped eETH(WEETH)$3,278.262.85% USDS(USDS)$1.00-0.06%

USDS(USDS)$1.00-0.06% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.06%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.06% WETH(WETH)$3,017.731.22%

WETH(WETH)$3,017.731.22% Coinbase Wrapped BTC(CBBTC)$89,944.000.63%

Coinbase Wrapped BTC(CBBTC)$89,944.000.63% Ethena USDe(USDE)$1.000.34%

Ethena USDe(USDE)$1.000.34% Canton(CC)$0.14672718.98%

Canton(CC)$0.14672718.98% Hyperliquid(HYPE)$21.783.01%

Hyperliquid(HYPE)$21.783.01% World Liberty Financial(WLFI)$0.1715776.86%

World Liberty Financial(WLFI)$0.1715776.86% USDT0(USDT0)$1.00-0.02%

USDT0(USDT0)$1.00-0.02% sUSDS(SUSDS)$1.080.00%

sUSDS(SUSDS)$1.080.00% Ethena Staked USDe(SUSDE)$1.220.07%

Ethena Staked USDe(SUSDE)$1.220.07% USD1(USD1)$1.000.08%

USD1(USD1)$1.000.08% Rain(RAIN)$0.0091126.66%

Rain(RAIN)$0.0091126.66% MemeCore(M)$1.60-1.91%

MemeCore(M)$1.60-1.91%