Bitcoin climbed near $118K following the Fed rate trim, while the global crypto market cap rose 2%.

The Federal Reserve cut interest rates by 25 basis points, a widely expected move.

Cautious language from Chair Powell tempered immediate enthusiasm for risk assets.

Historical patterns suggest that crypto gains may accelerate weeks after a rate cut.

Traders are eyeing the October Fed meeting for further clarity on monetary policy direction.

The crypto market cap rose to $4.2 trillion, buoyed by Bitcoin’s performance and broader sentiment across digital assets. Ether saw a 2.8% gain, hitting $4,609, and XRP climbed 2.9% to trade at $3.10.

The rally came shortly after the Federal Reserve delivered its first interest rate cut of 2025, a 25 basis point reduction, as part of what Fed Chair Jerome Powell framed as a “risk-management” move rather than the beginning of an aggressive easing cycle.

Source: X (@CNBC)

Despite the market’s positive reaction, Powell struck a reserved tone during the post-decision press conference.

He emphasized that the central bank would be moving carefully, keeping future cuts dependent on incoming data, especially inflation and labor market indicators.

In his words:

“We’re not on a preset course. Further policy adjustments will depend on the totality of data.”

This cautious outlook cooled expectations of a rapid easing cycle, putting a damper on speculative enthusiasm in the crypto space.

According to the CME FedWatch tool, traders had already priced in the likelihood of a 25 basis point cut with 96% certainty, turning the Fed’s move into a classic “buy the rumour, sell the news” scenario.

The Federal Open Market Committee (FOMC) voted 11-1 in favor of the cut, with newly appointed governor Stephen Miran as the sole dissenting voice, he had advocated for a deeper, 50 bp cut.

As a result, any immediate crypto rally was largely muted, with major assets moving moderately rather than surging.

While the Fed rate trim was not a surprise, it still created favorable macroeconomic conditions for crypto, according to Andrew Forson, President of DeFi Technologies.

Forson said:

“A lower cost of capital indicates more capital flows into the digital assets space because the risk hurdle rate for money is lower.”

He also pointed out that staking products and yield-generating blockchain projects could increasingly rival traditional bonds, particularly in a lower-rate environment.

However, post-cut data showed limited movement in Bitcoin futures open interest, and no major liquidation events occurred — a sign that most market participants are still in wait-and-see mode.

Looking back, crypto markets have often responded with a delay to rate cuts. When the Fed eased in December 2024, Bitcoin jumped briefly but entered a consolidation phase before sustaining gains weeks later.

Analysts expect a similar pattern this time around. The overall crypto sentiment is improving, but traders remain cautious amid macro uncertainty.

Many in the market are now looking ahead to the October FOMC meeting, where fresh economic data could determine whether this rate cut is part of a broader shift or just a one-off decision.

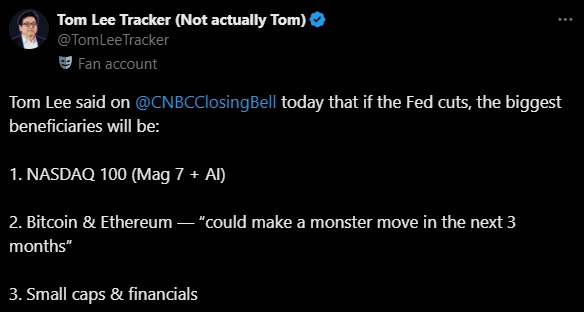

Tom Lee, Managing Partner at BitMine, said he sees potential for “monster gains” in Bitcoin and Ethereum over the next quarter, but only if the Fed signals continued easing.

Source: X (@TomLeeTracker)

For now, digital assets are riding the momentum of the Fed rate trim, albeit without the explosive rally that some may have hoped for.

A Fed rate trim refers to a small reduction in the U.S. Federal Reserve’s benchmark interest rate, typically done to stimulate borrowing, investment, and economic growth.

Lower interest rates reduce the cost of capital, often encouraging investors to seek higher returns in alternative assets like cryptocurrencies. This can result in increased capital inflows into the crypto market.

Because the rate cut was expected, much of the positive sentiment had already been priced in. Traders were anticipating the move, limiting surprise-driven buying momentum.

If the Fed signals further rate cuts in upcoming meetings, particularly in October, crypto markets may see stronger rallies as liquidity increases and investor confidence grows.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.000.00%

Figure Heloc(FIGR_HELOC)$1.000.00% Wrapped stETH(WSTETH)$3,803.88-3.65%

Wrapped stETH(WSTETH)$3,803.88-3.65% Wrapped eETH(WEETH)$3,372.41-3.61%

Wrapped eETH(WEETH)$3,372.41-3.61% USDS(USDS)$1.00-0.02%

USDS(USDS)$1.00-0.02% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.16%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.16% WETH(WETH)$3,106.53-3.56%

WETH(WETH)$3,106.53-3.56% Coinbase Wrapped BTC(CBBTC)$91,036.00-2.10%

Coinbase Wrapped BTC(CBBTC)$91,036.00-2.10% Ethena USDe(USDE)$1.00-0.33%

Ethena USDe(USDE)$1.00-0.33% Hyperliquid(HYPE)$22.52-5.60%

Hyperliquid(HYPE)$22.52-5.60% Canton(CC)$0.12519311.99%

Canton(CC)$0.12519311.99% USDT0(USDT0)$1.00-0.02%

USDT0(USDT0)$1.00-0.02% sUSDS(SUSDS)$1.080.35%

sUSDS(SUSDS)$1.080.35% World Liberty Financial(WLFI)$0.160149-2.81%

World Liberty Financial(WLFI)$0.160149-2.81% Ethena Staked USDe(SUSDE)$1.220.00%

Ethena Staked USDe(SUSDE)$1.220.00% USD1(USD1)$1.00-0.01%

USD1(USD1)$1.00-0.01% Rain(RAIN)$0.008955-1.68%

Rain(RAIN)$0.008955-1.68% MemeCore(M)$1.645.20%

MemeCore(M)$1.645.20%