Tokenized TradFi assets have the potential to revolutionize both the crypto and traditional finance sectors, expanding the market by trillions of dollars.

Chainlink oracles are essential for enabling seamless integration between blockchain networks and off-chain systems, allowing for the tokenization of assets in a compliant and secure manner.

Regulatory backing, especially in the U.S., is accelerating the tokenization of TradFi assets, with significant developments expected in the next 2-3 years.

The shift toward tokenization is a gradual process, but it is set to reshape the financial industry in the near future.

Nazarov believes that the tokenization of financial assets is not only inevitable but could transform the entire financial ecosystem.

He pointed out that the combined market capitalization of cryptocurrencies is around $4 trillion, while global traditional financial assets total a staggering $128 trillion in assets under management (AUM).

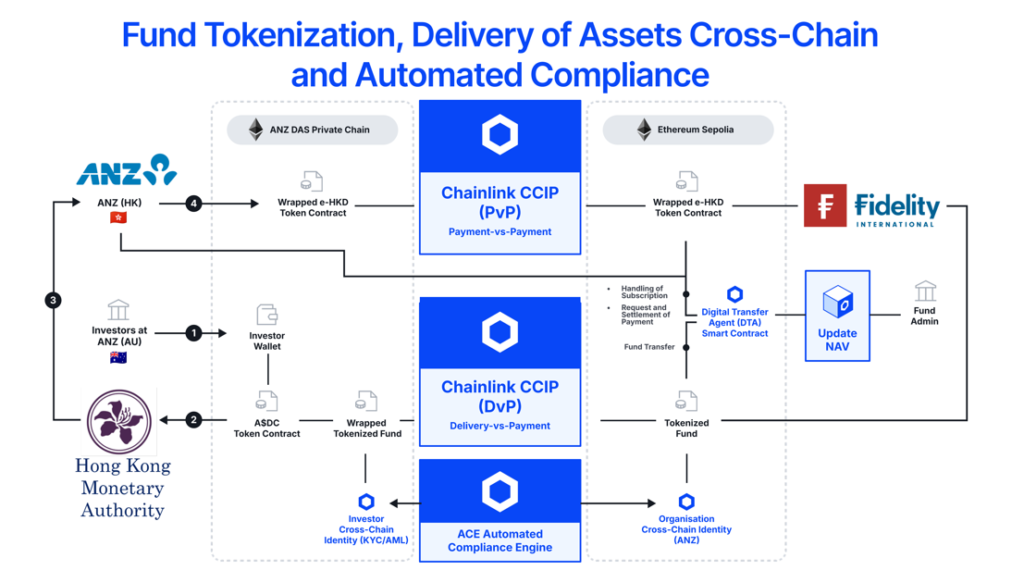

Elaborating on the concept of fund tokenization, delivery of assets cross-chain and automated compliance, Nazarov claims that if these assets were tokenized and brought onto the blockchain, the market could potentially grow by tenfold or more.

Source: Chainlink

In Nazarov’s words:

“What people don’t fully appreciate about TradFi is its sheer scale. While crypto has been primarily driven by retail investors, reaching a market cap of $50 trillion would require institutional participation from the TradFi world.”

The regulatory landscape for cryptocurrencies has undergone a drastic transformation in the U.S.

Over the past few years, regulatory bodies, including the Securities and Exchange Commission (SEC), have gone from warning institutional investors to stay clear of crypto to actively encouraging them to enter the market.

With figures like SEC Chairman Paul Atkins signaling support for the tokenization of financial systems, the path toward on-chain TradFi assets is now clearer than ever.

However, Nazarov acknowledged that tokenization won’t happen overnight. While the conditions are favorable, with expected interest rate cuts and regulatory backing, global economic factors, such as a shift to a “risk-off” investment environment, could slow progress.

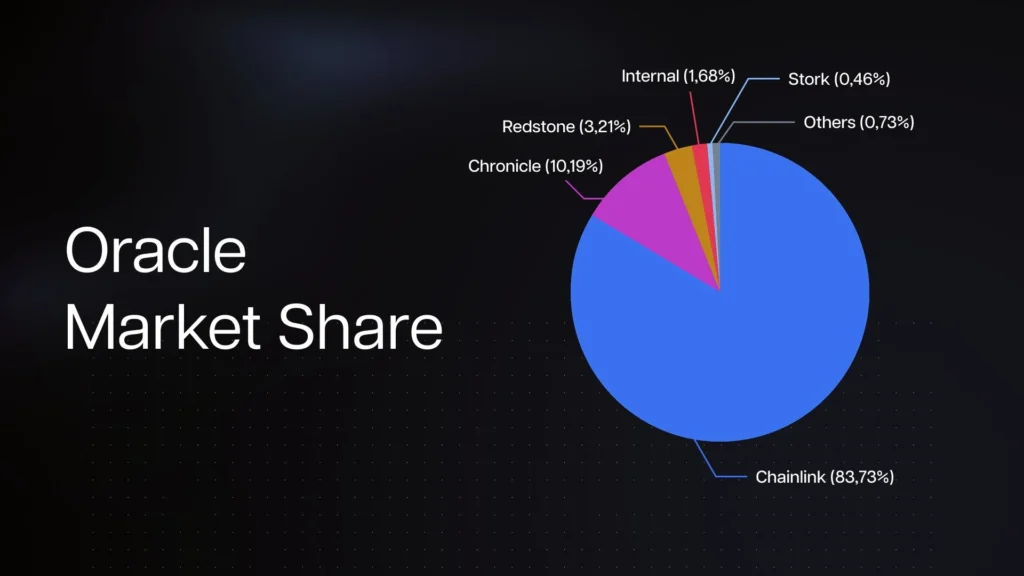

A crucial component of the tokenization process is blockchain oracles, which are used to connect blockchain networks with off-chain data.

Chainlink, the leading provider of decentralized oracles, is actively facilitating this integration. Oracles help verify real-world information, such as stock prices or transactions, ensuring that smart contracts function smoothly and securely.

Source: Chainlink

One example of Chainlink’s impact is the use of multiple oracles to execute transactions between traditional financial giants like ANZ Banking Group and Fidelity International.

In this case, oracles were used to move tokenized assets across different blockchains while also ensuring compliance and identity verification, which is crucial for institutional investors.

As blockchain oracles evolve, their ability to integrate complex off-chain data with on-chain systems will become increasingly important in bringing tokenized TradFi assets into mainstream finance.

Traditionally, regions like Singapore, Hong Kong, and Dubai have been at the forefront of blockchain innovation and tokenization.

However, with U.S. regulators now fully onboard, Nazarov expects large-scale tokenization projects to launch within the next couple of years, particularly as the SEC’s stance becomes more favorable.

Nazarov stated:

“Next year, you’ll see a race. In two to three years, tokenized assets could account for a significant portion of the crypto industry, redefining it entirely.”

Tokenized TradFi (Traditional Finance) assets are financial assets from the traditional sector, like stocks, bonds, or real estate, that are converted into digital tokens on a blockchain. This allows for fractional ownership, improved liquidity, and access to a broader range of investors.

Tokenizing TradFi assets allows the crypto market to grow beyond its current size. With the integration of traditional finance, the market could expand by trillions of dollars, making blockchain and crypto a dominant force in global finance.

Oracles provide a bridge between blockchain networks and real-world data. They ensure that smart contracts can execute based on real-world events, such as financial transactions, asset prices, or compliance checks, which is crucial for the secure and effective tokenization of TradFi assets.

While tokenization is happening now, widespread adoption is expected in the next few years. The U.S. regulatory environment is evolving, and Nazarov predicts that within 2-3 years, tokenized assets could constitute a significant portion of the crypto market.

Tokenization makes it easier for institutional investors to access new investment opportunities, particularly in markets that are traditionally less liquid. It also streamlines processes, reduces barriers to entry, and enhances compliance, all of which are crucial for institutional participation.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.03-0.08%

Figure Heloc(FIGR_HELOC)$1.03-0.08% Wrapped stETH(WSTETH)$3,675.110.43%

Wrapped stETH(WSTETH)$3,675.110.43% Wrapped eETH(WEETH)$3,258.540.48%

Wrapped eETH(WEETH)$3,258.540.48% USDS(USDS)$1.000.29%

USDS(USDS)$1.000.29% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.08%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.08% Hyperliquid(HYPE)$32.9316.96%

Hyperliquid(HYPE)$32.9316.96% Coinbase Wrapped BTC(CBBTC)$89,565.001.87%

Coinbase Wrapped BTC(CBBTC)$89,565.001.87% WETH(WETH)$2,998.750.72%

WETH(WETH)$2,998.750.72% Ethena USDe(USDE)$1.000.02%

Ethena USDe(USDE)$1.000.02% Canton(CC)$0.1680708.84%

Canton(CC)$0.1680708.84% USD1(USD1)$1.00-0.07%

USD1(USD1)$1.00-0.07% World Liberty Financial(WLFI)$0.1650174.50%

World Liberty Financial(WLFI)$0.1650174.50% USDT0(USDT0)$1.000.06%

USDT0(USDT0)$1.000.06% sUSDS(SUSDS)$1.08-0.29%

sUSDS(SUSDS)$1.08-0.29% Ethena Staked USDe(SUSDE)$1.220.01%

Ethena Staked USDe(SUSDE)$1.220.01% Rain(RAIN)$0.010006-0.67%

Rain(RAIN)$0.010006-0.67% MemeCore(M)$1.541.53%

MemeCore(M)$1.541.53%