Bitcoin surged to $125,700, reaching a new all-time high on Coinbase.

Exchange balances have dropped to six-year lows, signaling reduced selling pressure.

Over $14 billion in BTC has moved off exchanges in just two weeks.

Analysts suggest that a break above $126,500 could trigger a major price rally.

Market insiders are reporting liquidity shortages at exchanges and OTC desks.

On October 5th, Bitcoin briefly surged to $125,700 on Coinbase, surpassing its previous all-time high of $124,500 recorded in mid-August.

BTC/USD Daily Chart

Source: TradingView

This significant price action marks the latest bullish breakout in what investors are calling “Uptober,” a month historically known for positive crypto momentum.

Bitcoin did see a temporary pullback of around 13.5% by early September. However, the digital asset has since recovered, fueled by strong institutional interest and growing scarcity on trading platforms.

Nate Geraci, President of Nova Dius, said:

“Bitcoin hits new all-time high… And most people still don’t even know what Bitcoin is.”

Many analysts believe this latest price movement could just be the beginning.

Crypto analyst Rekt Capital commented that if BTC convincingly breaks above $126,500, it could trigger an accelerated price rally:

“If Bitcoin is able to convincingly break $126,500, then chances are price will go a lot higher — and quickly.”

This sentiment is echoed by other experts who point to tightening supply dynamics and surging demand as key drivers behind bullish Bitcoin price predictions for Q4 2025.

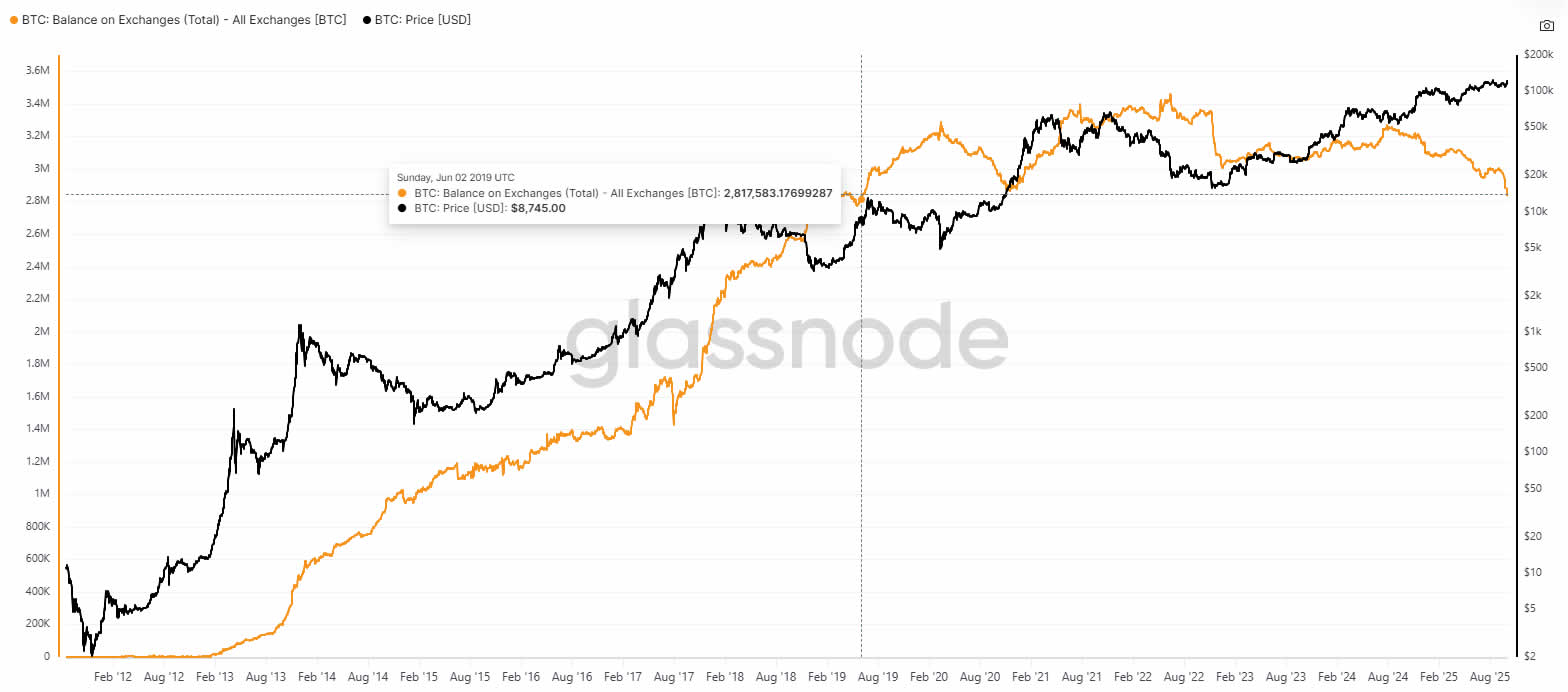

A deeper look at the on-chain data reveals a critical trend: the amount of Bitcoin held on centralized exchanges is rapidly drying up.

According to Glassnode, Bitcoin exchange balances fell to 2.83 million BTC, the lowest level since June 2019, when Bitcoin was trading near $8,000.

Bitcoin Balance On Exchanges Plummeted To 2019 levels

Source: Glassnode

CryptoQuant’s data presents an even starker picture, with just 2.45 million BTC remaining on centralized platforms, the lowest in seven years.

Over the past two weeks alone, more than 114,000 BTC (worth over $14 billion) has been withdrawn from trading platforms.

When Bitcoin leaves exchanges, it typically moves into cold storage, institutional treasuries, or long-term self-custody wallets. This suggests holders are not planning to sell anytime soon, reducing the liquid supply and putting upward pressure on the price.

BTC stored on exchanges is considered “available supply,” meaning it can be sold into the market at any moment. With that supply dwindling, the likelihood of aggressive upward price moves increases.

Insiders are now warning of potential liquidity shortages across major exchanges.

Matthew Sigel, Head of Digital Assets Research at VanEck, said on Saturday:

“Hearing exchanges are out of Bitcoin. Monday 9:30 a.m. might be the first official shortage.”

Meanwhile, investor Mike Alfred added:

“I just got off a 20-minute call with THE guy who runs the most important OTC desk. At the current pace, they will be completely out of Bitcoin to sell within two hours of futures opening tomorrow unless the price goes to $126,000–$129,000.”

This scarcity narrative adds weight to bullish Bitcoin price predictions in the short to medium term.

Many analysts expect Bitcoin to reach between $150,000 and $200,000 by mid-to-late 2025, assuming continued institutional adoption, ETF demand, and supply constraints.

BTC is being moved off exchanges into cold wallets and institutional custody, indicating long-term holding behavior and reducing the sellable supply.

A reduced exchange balance limits available supply, which can lead to higher prices, especially during periods of rising demand.

According to OTC desk insiders, yes — institutional demand is growing, and some platforms are struggling to meet large order volumes, especially as retail interest resurfaces.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.041.33%

Figure Heloc(FIGR_HELOC)$1.041.33% Wrapped stETH(WSTETH)$3,339.22-6.97%

Wrapped stETH(WSTETH)$3,339.22-6.97% USDS(USDS)$1.00-0.01%

USDS(USDS)$1.00-0.01% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.05%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.05% Wrapped eETH(WEETH)$2,959.57-6.99%

Wrapped eETH(WEETH)$2,959.57-6.99% Hyperliquid(HYPE)$29.40-13.57%

Hyperliquid(HYPE)$29.40-13.57% Coinbase Wrapped BTC(CBBTC)$82,635.00-5.98%

Coinbase Wrapped BTC(CBBTC)$82,635.00-5.98% Ethena USDe(USDE)$1.000.02%

Ethena USDe(USDE)$1.000.02% Canton(CC)$0.1721610.75%

Canton(CC)$0.1721610.75% WETH(WETH)$2,723.30-7.03%

WETH(WETH)$2,723.30-7.03% USD1(USD1)$1.00-0.01%

USD1(USD1)$1.00-0.01% USDT0(USDT0)$1.000.08%

USDT0(USDT0)$1.000.08% sUSDS(SUSDS)$1.09-0.18%

sUSDS(SUSDS)$1.09-0.18% World Liberty Financial(WLFI)$0.147336-8.12%

World Liberty Financial(WLFI)$0.147336-8.12% Ethena Staked USDe(SUSDE)$1.220.01%

Ethena Staked USDe(SUSDE)$1.220.01% Rain(RAIN)$0.009505-1.37%

Rain(RAIN)$0.009505-1.37% MemeCore(M)$1.44-6.97%

MemeCore(M)$1.44-6.97%