Vietnam’s crypto pilot has not received any applicants since its launch under Resolution 05/2025.

High capital requirements (10 trillion dong) and restrictions on stablecoins and tokenized assets are major deterrents.

Global trends show massive growth in stablecoins and tokenized treasuries, which are not allowed in Vietnam’s program.

Other jurisdictions in Asia offer lower barriers and more flexible frameworks, making them more appealing to crypto firms.

Unless Vietnam revises its pilot structure, it risks missing out on the opportunity to lead in the regulated crypto space.

At a recent press conference, Deputy Minister of Finance Nguyen Duc Chi confirmed that the Ministry of Finance has not yet received any applications from enterprises to join the pilot.

Deputy Minister Of Finance, Nguyen Duc Chi, Discussing Vietnam’s Crypto Pilot Program

Source: The Investor

The initiative, set to run for five years, is designed to test digital asset trading in a controlled and regulated environment.

Chi stated:

“As of now, the ministry has not received any proposals from enterprises.”

The program was launched under Resolution 05/2025, allowing up to five licensed participants.

However, Chi emphasized that launching the pilot depends on how well companies can meet the government’s stringent requirements:

“We hope to launch this pilot before 2026. However, the progress will depend on how well enterprises can meet the required conditions.”

One of the biggest barriers is the capital requirement for crypto asset service providers (CASPs).

To qualify, companies must maintain a minimum capital of 10 trillion dong (approximately $379 million), a figure more aligned with commercial banks than fintech startups.

By contrast, Singapore, Hong Kong, and Japan offer regulatory pathways that require significantly less capital, often between $1 million and $5 million, making them more attractive options for crypto businesses looking to expand in Asia.

Vietnam’s crypto pilot also imposes tight restrictions on the types of digital assets that can be offered:

Stablecoins backed by fiat currencies (like USDT and USDC) are not permitted.

Tokenized securities and money-market funds are also banned.

This means that some of the most in-demand crypto products, especially among institutional and retail investors, are off the table.

This restrictive framework significantly limits what companies can do within the pilot and may undermine its potential success.

Globally, the demand for fiat-backed stablecoins continues to soar. In Q3 2025 alone, the stablecoin market:

Reached a supply of over $300 billion

Facilitated over $15.6 trillion in transfers

Recorded $46 billion in inflows, led by:

USDT (Tether)

USDC (Circle)

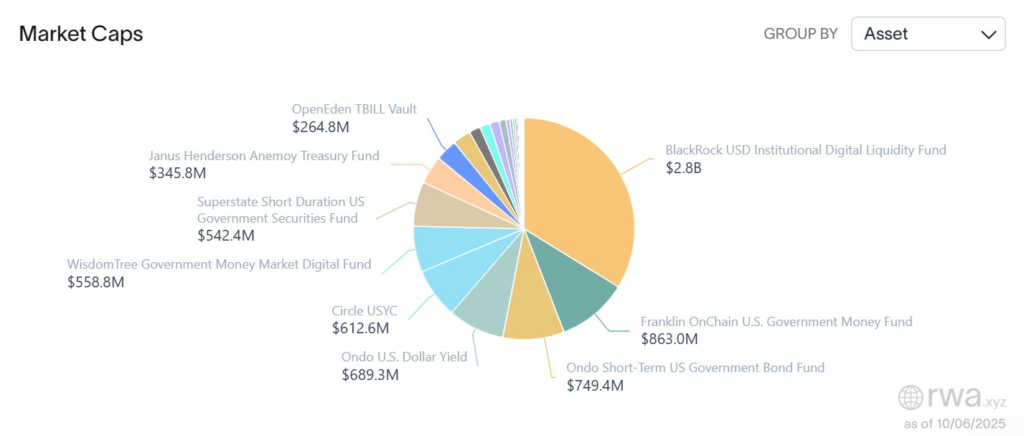

Meanwhile, tokenized real-world assets (RWAs), especially treasuries, have surpassed $8 billion in market value, according to RWA.xyz.

Tokenized Treasuries Data

Source: RWA.xyz

Key players include:

BlackRock’s BUIDL fund

Franklin Templeton’s BENJI tokens

These instruments offer yield, transparency, and faster settlement, appealing benefits for institutional investors. Unfortunately, Vietnam’s crypto pilot rules out these types of assets entirely.

Vietnam’s crypto pilot is a five-year program launched by the Ministry of Finance to test and regulate digital asset trading in the country. It allows for a maximum of five licensed participants.

So far, no companies have applied due to:

Extremely high capital requirements (~$379 million)

Prohibition of stablecoins and tokenized securities

Limited product offerings

The government hopes to begin the pilot before 2026, but the timeline depends on whether companies can meet the required conditions.

Other jurisdictions like Singapore and Hong Kong have:

Lower capital requirements

Support for a broader range of crypto products

This makes them more attractive to crypto firms than Vietnam.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.00-2.04%

Figure Heloc(FIGR_HELOC)$1.00-2.04% Wrapped stETH(WSTETH)$2,948.80-8.86%

Wrapped stETH(WSTETH)$2,948.80-8.86% USDS(USDS)$1.00-0.01%

USDS(USDS)$1.00-0.01% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.09%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.09% Wrapped eETH(WEETH)$2,614.69-8.76%

Wrapped eETH(WEETH)$2,614.69-8.76% Hyperliquid(HYPE)$30.902.07%

Hyperliquid(HYPE)$30.902.07% Canton(CC)$0.177168-6.43%

Canton(CC)$0.177168-6.43% Ethena USDe(USDE)$0.99-0.48%

Ethena USDe(USDE)$0.99-0.48% Coinbase Wrapped BTC(CBBTC)$78,610.00-5.21%

Coinbase Wrapped BTC(CBBTC)$78,610.00-5.21% WETH(WETH)$2,406.87-8.74%

WETH(WETH)$2,406.87-8.74% USD1(USD1)$1.00-0.08%

USD1(USD1)$1.00-0.08% USDT0(USDT0)$1.000.08%

USDT0(USDT0)$1.000.08% sUSDS(SUSDS)$1.080.26%

sUSDS(SUSDS)$1.080.26% Ethena Staked USDe(SUSDE)$1.21-0.12%

Ethena Staked USDe(SUSDE)$1.21-0.12% World Liberty Financial(WLFI)$0.122610-16.47%

World Liberty Financial(WLFI)$0.122610-16.47% Rain(RAIN)$0.0095645.40%

Rain(RAIN)$0.0095645.40%