Real-world asset tokenization must prioritize compliance, not just speed or innovation.

Unverified assets and anonymous trading increase the risk of fraud and market instability.

Smart contract-based trading rules, verified identities, and transparent governance are essential.

Emerging markets can benefit from tokenization—but only with proper infrastructure.

Long-term success depends on trust, which comes from building secure and regulated systems.

In 2022, a project selling tokenized shares in dozens of Detroit homes turned heads, not because of success, but because it collapsed in scandal. The offering included blockchain tokens, fractional real estate ownership, and rental income potential. On paper, it sounded like the future of property investment.

But in reality, many of the homes were either abandoned, in poor condition, or not legally owned by the seller. While the blockchain tracked token transfers flawlessly, it failed to verify whether the assets themselves were legitimate or generating income.

This was more than just a real estate mishap. It was a red flag for the entire real-world asset tokenization sector.

The appeal of tokenization lies in its ability to streamline asset ownership and trading.

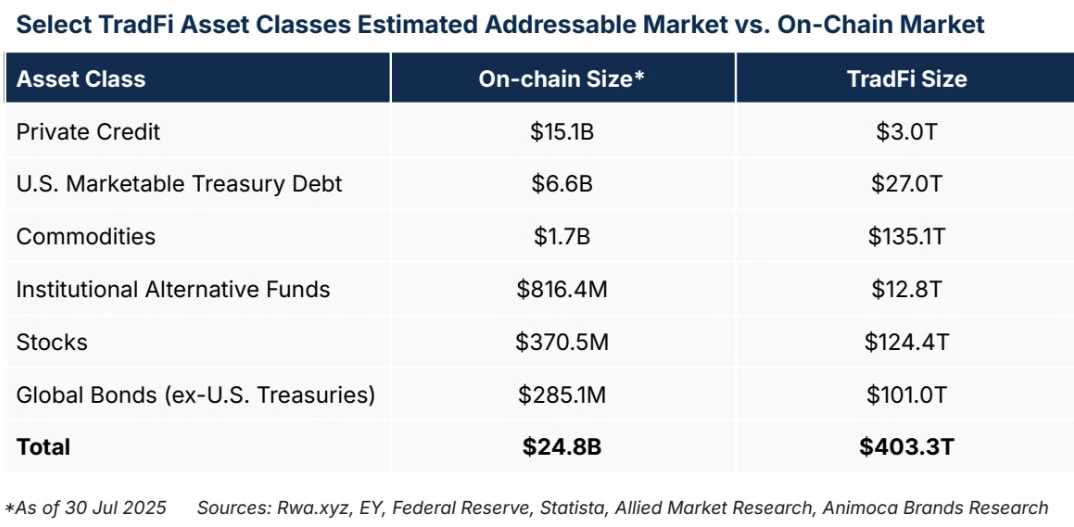

The TradFi Addressable Asset Market Is 16K Times Bigger Than The Current On-chain Market

Source: Animoca Brands

However, speed and decentralization can work against the integrity of markets if not backed by due diligence.

A tokenized bond is worthless without verified cash flows

A tokenized commodity means little if the physical asset isn’t accounted for

A tokenized property isn’t an asset if its title is disputed

While blockchain ensures transaction history, it doesn’t inherently validate the underlying asset. Tokenization does not equal transparency or enforceability.

Bad actors can exploit rapid transaction capabilities to commit fraud faster than regulators can respond. The result? A fragile ecosystem where trust erodes before value is realized.

The solution is not to halt tokenization efforts. Instead, it’s about embedding compliance, governance, and verification mechanisms from the outset.

Traditional finance systems rely on KYC (Know Your Customer) and verified ownership records. The same must apply to tokenized markets.

Only verified participants should be allowed to trade, and token ownership must connect to real-world identities, not anonymous wallets.

Smart contracts must be programmed with built-in restrictions:

Who can buy

When assets can be sold

What compliance conditions must be met

These rules cannot be optional add-ons, they must be enforced by design.

Dispute resolution, asset recovery, and protocol upgrades all require clear, transparent governance structures. These features make the difference between a speculative market and one that’s institution-ready.

In developing economies, real-world asset tokenization could leapfrog legacy financial systems.

Source: RWA.xyz

Many regions face:

Ambiguous property rights

Expensive cross-border settlements

High corruption risk

Limited access to capital

With strong compliance and regulatory alignment, tokenization can solve these pain points. Mobile-first adoption, rising interest in digital assets, and a demand for financial inclusion make emerging markets fertile ground for growth, if it’s done responsibly.

Some tokenization projects already model best practices. These initiatives use:

Permissioned blockchains for regulated assets

Tokens with compliance logic built-in

Partnerships with licensed custodians for safeguarding underlying assets

This isn’t just about tech. It’s about building systems that meet the scrutiny of institutional investors and global regulators.

Real-world asset tokenization could unlock trillions of dollars in dormant value across real estate, commodities, private credit, and more. But innovation without integrity is a recipe for failure.

The goal isn’t to launch the fastest product, it’s to build the most trustworthy system. Guardrails are therefore not a hindrance, rather they are the infrastructure that makes long-term progress possible.

Real-world asset tokenization is the process of converting physical or traditional financial assets—like real estate, bonds, or commodities—into digital tokens on a blockchain.

Compliance ensures that all assets are legally owned, participants are verified, and transactions follow financial regulations. It helps prevent fraud and builds investor confidence.

Yes. Especially in emerging markets, tokenization can lower entry barriers, reduce costs, and offer access to global capital—if proper regulations are followed.

Without safeguards, tokenized assets can be fraudulent, misrepresented, or unregulated, leading to loss of trust and potential legal consequences.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.041.37%

Figure Heloc(FIGR_HELOC)$1.041.37% Wrapped stETH(WSTETH)$3,461.92-6.26%

Wrapped stETH(WSTETH)$3,461.92-6.26% USDS(USDS)$1.00-0.02%

USDS(USDS)$1.00-0.02% Wrapped eETH(WEETH)$3,070.49-6.28%

Wrapped eETH(WEETH)$3,070.49-6.28% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.01%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.01% Hyperliquid(HYPE)$33.261.44%

Hyperliquid(HYPE)$33.261.44% Coinbase Wrapped BTC(CBBTC)$84,460.00-5.85%

Coinbase Wrapped BTC(CBBTC)$84,460.00-5.85% Ethena USDe(USDE)$1.00-0.07%

Ethena USDe(USDE)$1.00-0.07% WETH(WETH)$2,824.12-6.31%

WETH(WETH)$2,824.12-6.31% Canton(CC)$0.1663820.81%

Canton(CC)$0.1663820.81% USD1(USD1)$1.000.00%

USD1(USD1)$1.000.00% USDT0(USDT0)$1.00-0.07%

USDT0(USDT0)$1.00-0.07% sUSDS(SUSDS)$1.08-0.31%

sUSDS(SUSDS)$1.08-0.31% World Liberty Financial(WLFI)$0.157132-4.78%

World Liberty Financial(WLFI)$0.157132-4.78% Ethena Staked USDe(SUSDE)$1.220.01%

Ethena Staked USDe(SUSDE)$1.220.01% Rain(RAIN)$0.009550-4.73%

Rain(RAIN)$0.009550-4.73% MemeCore(M)$1.53-0.15%

MemeCore(M)$1.53-0.15%