Citi partners with Coinbase to pilot stablecoin payments, aiming to make fund transfers between fiat and crypto seamless.

The stablecoin market is projected to grow from $315 billion to $4 trillion by 2030.

The GENIUS Act establishes a regulatory framework for stablecoins, driving Wall Street adoption.

Major banks like JPMorgan and Bank of America are developing their own stablecoin initiatives.

Institutional and investor interest in stablecoins is rising, as shown by Circle’s IPO success.

According to Bloomberg, Citi has teamed up with Coinbase to enhance its digital asset offerings. The initial focus of this partnership is to simplify the transfer of funds between fiat currency and cryptocurrencies, providing clients with more seamless and efficient transaction options.

Debopama Sen, Citi’s Head of Payments, emphasized that clients are increasingly seeking payment solutions that include programmability, conditional execution, and faster processing times.

Sen explained:

“We are exploring solutions to enable on-chain stablecoin payments for our clients in the near future.”

Citi’s focus on stablecoins comes as the bank revises its market forecasts. By 2030, the digital dollar market is expected to reach $4 trillion, a significant jump from its current valuation of roughly $315 billion.

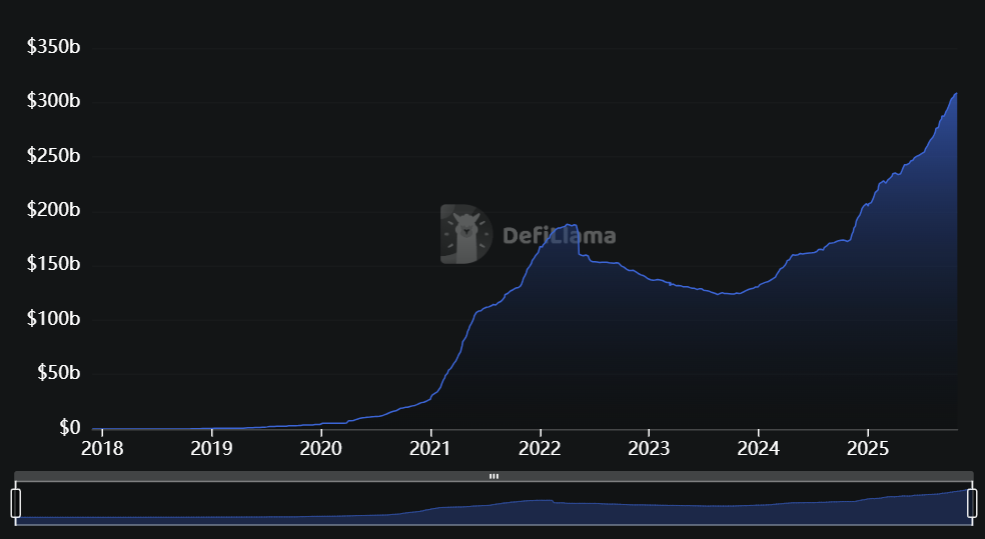

The stablecoin market has grown exponentially, from under $5 billion in early 2020 to over $315 billion today, according to DefiLlama.

The Stablecoin Market Grew To Over $315 Billion

Source: DefiLlama

This surge reflects a broader trend: institutional adoption of cryptocurrency is no longer a fringe strategy but a core part of major banks’ long-term growth plans.

Sen also highlighted the potential of stablecoin payments to transform the digital payment landscape:

“Stablecoins will be another enabler in the digital payment ecosystem, helping expand functionality for our clients. This aligns with Citi’s strategy to embrace digital assets while providing faster, more programmable payment solutions for its global client base.”

As Citi tests stablecoin payments with Coinbase, the broader implications for the banking and payments sectors are significant:

Faster, programmable payments across borders

Reduced reliance on traditional banking rails

Increased transparency and efficiency in financial transactions

Citi’s initiative illustrates how traditional banks are adapting to evolving customer demands while preparing for a digital-first future.

The passage of the US GENIUS Act, which creates a regulatory framework for stablecoins effective in early 2027, has accelerated interest among major financial institutions.

President Trump Signing The GENIUS Act Into Law

Source: Associated Press

Citi is now joining other Wall Street giants, including JPMorgan and Bank of America, in developing stablecoin-based solutions.

Even JPMorgan’s CEO, Jamie Dimon, long a vocal skeptic of crypto, acknowledged the bank’s plans to engage with stablecoins:

“We plan to be involved in stablecoin development.”

Investor enthusiasm mirrors institutional interest. Circle, the issuer of USDC, the world’s second-largest dollar-pegged stablecoin, went public earlier this year.

Its stock skyrocketed 167% on the first day of trading, highlighting confidence in the stablecoin sector. Circle currently has a market capitalization of around $35 billion, demonstrating the scale and momentum of tokenized dollar adoption.

Stablecoin payments involve transferring digital tokens pegged to a stable asset, like the US dollar, which enables faster, programmable, and borderless transactions.

Citi’s partnership with Coinbase aims to simplify the movement of funds between fiat and crypto, enabling clients to access stablecoin payments efficiently.

The stablecoin market has grown from under $5 billion in 2020 to over $315 billion today, with projections reaching $4 trillion by 2030.

The US GENIUS Act creates a regulatory framework for stablecoins, effective in early 2027, encouraging banks to develop compliant digital currency solutions.

Yes, major institutions such as JPMorgan and Bank of America are actively exploring stablecoin-based services to stay competitive in the evolving digital asset landscape.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.031.39%

Figure Heloc(FIGR_HELOC)$1.031.39% Wrapped stETH(WSTETH)$3,584.832.86%

Wrapped stETH(WSTETH)$3,584.832.86% Wrapped eETH(WEETH)$3,179.152.89%

Wrapped eETH(WEETH)$3,179.152.89% USDS(USDS)$1.00-0.02%

USDS(USDS)$1.00-0.02% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.12%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.12% Coinbase Wrapped BTC(CBBTC)$88,112.001.02%

Coinbase Wrapped BTC(CBBTC)$88,112.001.02% WETH(WETH)$2,925.932.84%

WETH(WETH)$2,925.932.84% Ethena USDe(USDE)$1.000.03%

Ethena USDe(USDE)$1.000.03% Hyperliquid(HYPE)$24.088.40%

Hyperliquid(HYPE)$24.088.40% Canton(CC)$0.151590-2.52%

Canton(CC)$0.151590-2.52% USD1(USD1)$1.00-0.03%

USD1(USD1)$1.00-0.03% USDT0(USDT0)$1.000.03%

USDT0(USDT0)$1.000.03% World Liberty Financial(WLFI)$0.159279-2.79%

World Liberty Financial(WLFI)$0.159279-2.79% sUSDS(SUSDS)$1.09-0.33%

sUSDS(SUSDS)$1.09-0.33% Ethena Staked USDe(SUSDE)$1.220.07%

Ethena Staked USDe(SUSDE)$1.220.07% Rain(RAIN)$0.009459-1.38%

Rain(RAIN)$0.009459-1.38% MemeCore(M)$1.61-3.18%

MemeCore(M)$1.61-3.18%