Crypto is treated as a taxable capital asset, not as currency.

Authorities can trace transactions using advanced blockchain analytics.

Failing to report crypto income can lead to fines, audits, and criminal charges.

Using crypto tax software simplifies compliance.

Voluntary disclosure can help reduce penalties for past mistakes.

Governments around the world classify cryptocurrency as property or a capital asset, not as currency. This means that when you sell, trade, or even swap one token for another, you create a taxable event, just like when you sell stocks or real estate.

Income from staking, mining, yield farming, or airdrops must also be reported based on the fair market value at the time you receive it.

Even exchanging one cryptocurrency for another can result in a capital gain or loss, depending on how the prices differ between acquisition and disposal.

To file your crypto tax correctly, maintain records of every transaction, timestamps, purchase prices, sale values, and gas fees.

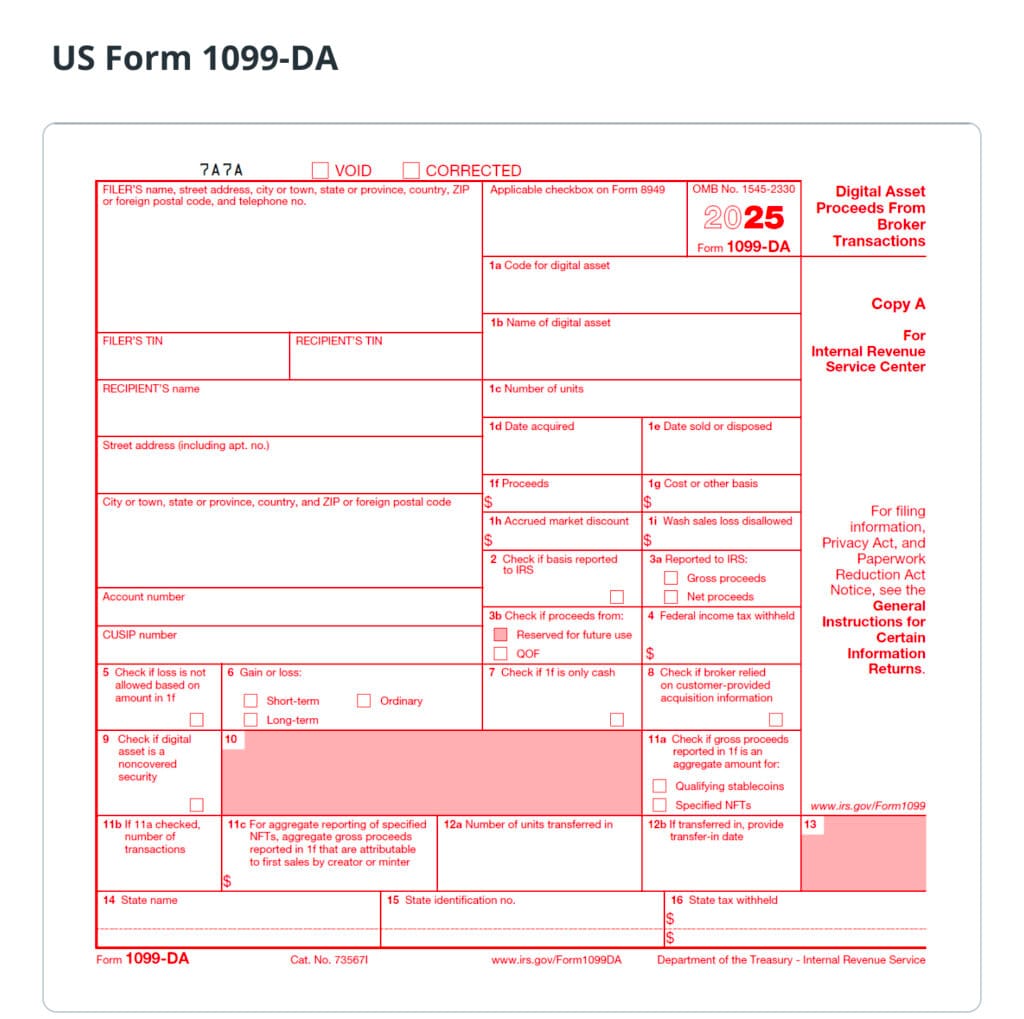

A Sample Crypto Tax Form

Source: IRS

Proper documentation helps you calculate accurate gains and minimizes the risk of errors or audits.

Many investors fail to pay their crypto tax because of confusion, misinformation, or complexity. Some of the most common reasons include:

Some users believe crypto transactions are completely private and can’t be traced. However, blockchain data is public, and tax authorities can link wallet addresses to real identities.

Trading on unregistered or anonymous exchanges doesn’t hide your transactions. Tax agencies now work closely with global partners to collect and cross-reference exchange data.

Many people don’t realize that selling or trading crypto, even for another token, can create a taxable event, requiring you to report gains or losses.

Tracking each transaction, exchange rate, and market value can be daunting. However, using crypto tax software like Koinly or CoinTracker simplifies this process.

Interestingly, simply holding (HODLing) your crypto isn’t a taxable event. Taxes apply only when you sell, trade, or spend it.

Modern tax agencies use advanced blockchain analytics tools to monitor and identify taxable crypto activity. Organizations like the IRS (U.S.), HMRC (U.K.), and ATO (Australia) collaborate with analytics firms such as Chainalysis and Elliptic to connect wallet data with user identities.

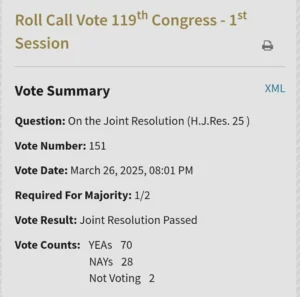

A Vote To Determine Whether To End The Controversial IRS Crypto Tax Rule

Source: United States Senate

Under frameworks like the OECD’s Crypto-Asset Reporting Framework (CARF), countries share taxpayer data automatically. Even DeFi platforms, privacy coins, and cross-chain bridges leave digital traces that can be followed.

Failing to report or pay taxes on crypto holdings can lead to escalating penalties:

Authorities may first issue late payment fines and interest. In the U.S., the IRS can impose penalties of up to 25% of the unpaid tax, while HMRC in the U.K. charges for inaccurate or missing disclosures.

Unreported crypto income can trigger audits or account restrictions. Regulators can request user data from major exchanges such as Coinbase, Binance, and Kraken.

Deliberate tax evasion can lead to prosecution, heavy fines, and even imprisonment. Repeated non-compliance can also damage your financial record, increasing future audit risks.

Notably, investors can reduce their taxable income through tax-loss harvesting, selling underperforming crypto assets to offset capital gains.

If you missed reporting your crypto taxes, act quickly:

Review your transaction history across exchanges and wallets.

Use crypto tax tools to calculate accurate gains and losses.

Amend your tax return if needed, many tax agencies allow corrections before initiating enforcement.

Consider voluntary disclosure programs, which may reduce fines or prevent prosecution.

Taking prompt action shows good faith and can help you avoid more severe penalties later.

To stay compliant with evolving crypto tax regulations:

Keep meticulous records of all crypto transactions.

Use registered exchanges to ensure your activity is traceable and reportable.

Regularly check updates to your country’s tax rules.

Seek help from a crypto tax professional if you engage in complex DeFi or NFT activities.

No, simply holding crypto isn’t taxable. Taxes apply when you sell, trade, or spend it and make a gain.

They use blockchain analytics and global reporting systems like CARF to trace wallet data and cross-border transactions.

You can usually set up a payment plan or file an amended return to reduce penalties before enforcement actions begin.

Yes. Staking, yield farming, and NFT sales are taxable based on the fair market value at the time of receipt or sale.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.040.14%

Figure Heloc(FIGR_HELOC)$1.040.14% Wrapped stETH(WSTETH)$2,770.32-3.49%

Wrapped stETH(WSTETH)$2,770.32-3.49% USDS(USDS)$1.00-0.03%

USDS(USDS)$1.00-0.03% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.05%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.05% Hyperliquid(HYPE)$33.00-7.87%

Hyperliquid(HYPE)$33.00-7.87% Wrapped eETH(WEETH)$2,460.55-3.61%

Wrapped eETH(WEETH)$2,460.55-3.61% Canton(CC)$0.182345-4.03%

Canton(CC)$0.182345-4.03% Ethena USDe(USDE)$1.00-0.04%

Ethena USDe(USDE)$1.00-0.04% Coinbase Wrapped BTC(CBBTC)$76,426.00-3.09%

Coinbase Wrapped BTC(CBBTC)$76,426.00-3.09% USD1(USD1)$1.00-0.02%

USD1(USD1)$1.00-0.02% WETH(WETH)$2,260.37-3.73%

WETH(WETH)$2,260.37-3.73% USDT0(USDT0)$1.00-0.12%

USDT0(USDT0)$1.00-0.12% sUSDS(SUSDS)$1.090.54%

sUSDS(SUSDS)$1.090.54% Ethena Staked USDe(SUSDE)$1.220.03%

Ethena Staked USDe(SUSDE)$1.220.03% World Liberty Financial(WLFI)$0.1332112.65%

World Liberty Financial(WLFI)$0.1332112.65% Rain(RAIN)$0.008816-7.42%

Rain(RAIN)$0.008816-7.42% MemeCore(M)$1.48-2.34%

MemeCore(M)$1.48-2.34%