TRUMP memecoin issuer is negotiating to acquire Republic.com’s U.S. operations.

The company plans to raise $200 million to support its token’s liquidity.

The token has lost about 90% of its peak value, now sitting near $1.6 billion market cap.

A successful acquisition could introduce memecoin transactions to a broader investor base.

The move mirrors industry trends toward integrating crypto with traditional investment platforms.

The TRUMP memecoin was launched in January, ahead of Donald Trump’s second inauguration, as part of a broader effort to merge political branding with decentralized finance.

At its peak, the token reached a $9 billion market capitalization, according to CoinMarketCap, before crashing nearly 90% to around $1.64 billion.

Despite the downturn, the memecoin saw a 5.6% uptick in the last 24 hours, signaling renewed investor interest.

Reports suggest that Fight Fight Fight is now working to raise $200 million for a digital asset treasury designed to buy back TRUMP tokens and support long-term liquidity. This initiative is seen as a stabilization strategy following the token’s volatile performance.

In parallel, World Liberty Financial (WLFI), another crypto venture tied to Trump, announced a giveaway of 8.4 million WLFI tokens, worth about $1.2 million, to participants in its USD1 stablecoin loyalty program.

Source: X (@worldlibertyfi)

Fight Fight Fight, the company behind the Donald Trump-linked memecoin, is said to be in advanced discussions to acquire the US branch of Republic.com, an investment and crowdfunding platform.

If the acquisition proceeds, it could allow Republic users to buy, sell, and transact using the Official TRUMP memecoin, creating a new bridge between traditional investors and the expanding world of blockchain-based finance.

The move may also give crypto startups a streamlined channel to raise capital through tokenized campaigns.

Sources close to the matter noted that negotiations remain private and involve several potential strategic partners. Currently, Fight Fight Fight and CIC Digital, an affiliate of The Trump Organization, collectively hold 80% ownership of the TRUMP token.

Republic is well-known for its investment crowdfunding services, having facilitated over 3,000 fundraising campaigns for both retail and accredited investors. The platform’s backers include Galaxy Digital and Binance Labs, according to Bloomberg.

In recent years, Republic has leaned into tokenization of real-world assets (RWA), allowing investors to hold digital representations of tangible assets.

This aligns with the TRUMP memecoin issuer’s push toward integrating blockchain finance with traditional markets.

The TRUMP memecoin issuer’s potential deal comes shortly after Coinbase revealed a $375 million acquisition of Echo, an onchain fundraising platform founded by the crypto influencer Cobie.

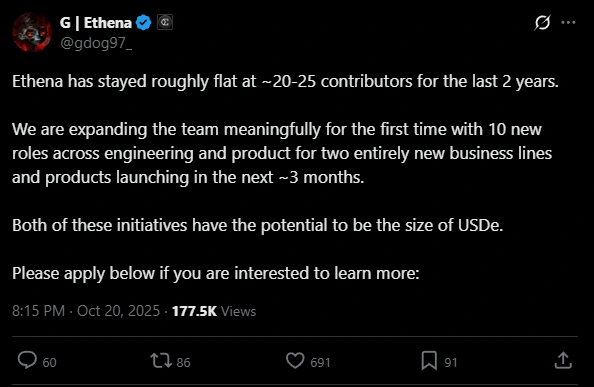

Launched in April 2024, Echo enables communities to co-invest in private startup rounds. In just eight months, it has secured $51 million in funding across 131 deals, including notable blockchain projects like Ethena, the developer of USDe, one of the fastest-growing yield-bearing stablecoins.

Source: X (@gdog97_)

This rapid growth in onchain capital-raising platforms could signal a broader industry shift—one that the TRUMP memecoin issuer appears eager to join through its proposed Republic acquisition.

The TRUMP memecoin issuer’s strategy reflects a growing trend among crypto projects seeking legitimacy through acquisitions and partnerships with regulated investment platforms.

If the Republic deal is finalized, it could:

Bring mainstream investors into memecoin ecosystems.

Boost liquidity and trading volume for TRUMP tokens.

Strengthen the token’s credibility through association with a compliant investment platform.

While the move may spark optimism, skeptics caution that market volatility and regulatory scrutiny remain significant hurdles.

The TRUMP memecoin is a cryptocurrency inspired by U.S. President Donald Trump. It aims to blend political branding with blockchain-based finance.

The token is primarily owned by Fight Fight Fight and CIC Digital, which together control about 80% of the supply.

Republic.com is a U.S.-based investment platform that allows retail and accredited investors to back startups and blockchain projects through tokenized fundraising.

The fund is intended to buy back TRUMP tokens, stabilize prices, and create a digital asset treasury for future growth.

As of now, discussions are ongoing and have not been finalized. Both companies have declined to comment publicly.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.030.06%

Figure Heloc(FIGR_HELOC)$1.030.06% Wrapped stETH(WSTETH)$3,688.843.50%

Wrapped stETH(WSTETH)$3,688.843.50% Wrapped eETH(WEETH)$3,271.773.49%

Wrapped eETH(WEETH)$3,271.773.49% USDS(USDS)$1.000.00%

USDS(USDS)$1.000.00% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.01%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.01% Hyperliquid(HYPE)$29.7421.20%

Hyperliquid(HYPE)$29.7421.20% Coinbase Wrapped BTC(CBBTC)$89,171.001.53%

Coinbase Wrapped BTC(CBBTC)$89,171.001.53% WETH(WETH)$3,010.403.49%

WETH(WETH)$3,010.403.49% Ethena USDe(USDE)$1.000.05%

Ethena USDe(USDE)$1.000.05% Canton(CC)$0.1550771.55%

Canton(CC)$0.1550771.55% USD1(USD1)$1.000.05%

USD1(USD1)$1.000.05% World Liberty Financial(WLFI)$0.1633843.29%

World Liberty Financial(WLFI)$0.1633843.29% USDT0(USDT0)$1.00-0.06%

USDT0(USDT0)$1.00-0.06% sUSDS(SUSDS)$1.08-0.25%

sUSDS(SUSDS)$1.08-0.25% Ethena Staked USDe(SUSDE)$1.220.02%

Ethena Staked USDe(SUSDE)$1.220.02% Rain(RAIN)$0.010159-2.13%

Rain(RAIN)$0.010159-2.13% MemeCore(M)$1.58-1.87%

MemeCore(M)$1.58-1.87%