Privacy coins are back in the spotlight, with Zcash overtaking Monero as the largest in the sector.

Zcash’s technical upgrades and integrations have fueled a massive rally.

Monero remains strong, focusing on enhanced network security and user anonymity.

Dash and Decred are benefiting from the wider privacy narrative, while ZKsync showcases how zero-knowledge tech is expanding privacy beyond traditional coins.

The broader interest in digital privacy could signal a longer-term shift in the crypto market.

Privacy coins are lighting up the crypto market this week, defying the broader downturn that’s left many investors feeling bearish.

As Bitcoin and Ethereum slow their momentum, a handful of privacy-focused tokens are seeing impressive price surges and attracting a lot of attention in the process.

After months of relatively quiet trading, privacy coins like Zcash, Monero, and Dash are experiencing a major rebound.

Analysts have long predicted a resurgence in the sector, citing growing concerns about financial surveillance, on-chain tracking, and data privacy.

Those predictions now appear to be coming true.

According to Zcash Foundation’s executive director, Alex Bornstein, the recent surge is tied to broader concerns about governments infringing on individuals’ right to privacy.

Zcash has been the standout performer, with its market capitalization jumping more than 10% and prices surging over 75% in the past week to around $632. That impressive move has helped Zcash flip Monero as the largest privacy coin by market cap.

The rally follows a major network upgrade by the Electric Coin Company, which introduced cross-chain swaps and private payments through integration with Near Intents, a transaction layer designed for seamless interoperability.

This update has expanded Zcash’s “shielded pool,” increasing private address activity and on-chain volume. The combination of hype, new functionality, and investor optimism has firmly placed Zcash back in the spotlight.

Monero, the long-time king of privacy coins, isn’t fading quietly. The project’s latest update, the Flourine Fermi upgrade, aims to strengthen privacy by blocking “spy nodes,” or malicious nodes that can analyze transactions to reveal user identities.

The V0.18.4.3 Release Of Monero’s Software Is Designed To Combat Spy Nodes

Source: Monero

While Monero’s gains have been more modest (up around 10% this week), its community remains fiercely committed to maintaining decentralization and anonymity, even as exchanges continue to delist privacy tokens under regulatory pressure.

The Monero Research Lab has even suggested that node operators maintain a “ban list” of suspected spy nodes, reinforcing Monero’s mission to stay private, no matter the obstacles.

Dash has shocked traders with an incredible 130% gain this week, closing above $100 for the first time in months. The surge coincides with Aster DEX launching Dash perpetual futures trading with 5x leverage, increasing the token’s liquidity and visibility.

While Dash has evolved beyond its privacy roots in recent years, the current narrative surrounding privacy coins has reignited investor interest in the project.

Analysts suggest that Dash’s strong community and renewed exposure could help sustain its upward momentum.

ZKsync, an Ethereum Layer 2 scaling solution that uses zero-knowledge rollups, has seen its token price jump over 113% this week to $0.063.

Co-founder Alex Gluchowski recently proposed a revamp to ZKsync’s governance token to align economic incentives with network activity. His plan includes using network fees and enterprise licensing deals to drive long-term value back to token holders.

This shift reflects a larger theme: as privacy technology advances, privacy coins and ZK-based systems are becoming more integrated into the future of DeFi.

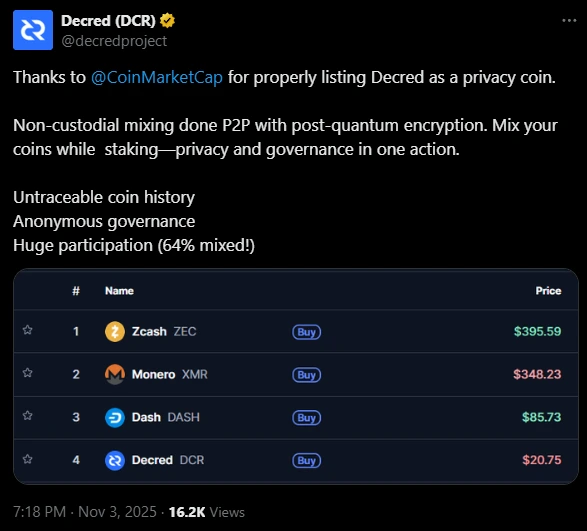

Decred has quietly been one of the week’s biggest winners, rising nearly 90% to around $30.

CoinMarketCap recently reclassified Decred as a privacy coin, which drew renewed attention to its hybrid proof-of-work and proof-of-stake governance model.

Source: X (@decredproject)

The network’s focus on community-driven decision-making, and its resistance to centralized control, aligns perfectly with the renewed narrative around financial sovereignty and privacy.

Privacy coins are cryptocurrencies designed to keep transaction data, including sender, receiver, and amount, hidden from public view. Popular examples include Zcash, Monero, and Dash.

Rising concerns about government surveillance, data leaks, and blockchain tracking tools have sparked renewed demand for financial privacy and censorship resistance.

The legality varies by country. While privacy coins are generally legal to own and trade, some exchanges have delisted them due to regulatory pressure.

Most privacy coins use advanced cryptography, such as zero-knowledge proofs or ring signatures, to make transactions nearly impossible to trace.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.031.10%

Figure Heloc(FIGR_HELOC)$1.031.10% Wrapped stETH(WSTETH)$3,574.180.62%

Wrapped stETH(WSTETH)$3,574.180.62% Wrapped eETH(WEETH)$3,168.320.64%

Wrapped eETH(WEETH)$3,168.320.64% USDS(USDS)$1.00-0.01%

USDS(USDS)$1.00-0.01% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.05%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.05% Coinbase Wrapped BTC(CBBTC)$87,883.000.17%

Coinbase Wrapped BTC(CBBTC)$87,883.000.17% WETH(WETH)$2,916.690.66%

WETH(WETH)$2,916.690.66% Hyperliquid(HYPE)$27.6324.60%

Hyperliquid(HYPE)$27.6324.60% Ethena USDe(USDE)$1.00-0.02%

Ethena USDe(USDE)$1.00-0.02% Canton(CC)$0.1501421.63%

Canton(CC)$0.1501421.63% USD1(USD1)$1.000.01%

USD1(USD1)$1.000.01% USDT0(USDT0)$1.00-0.01%

USDT0(USDT0)$1.00-0.01% World Liberty Financial(WLFI)$0.157967-1.96%

World Liberty Financial(WLFI)$0.157967-1.96% sUSDS(SUSDS)$1.080.07%

sUSDS(SUSDS)$1.080.07% Ethena Staked USDe(SUSDE)$1.22-0.01%

Ethena Staked USDe(SUSDE)$1.22-0.01% Rain(RAIN)$0.0100614.87%

Rain(RAIN)$0.0100614.87% MemeCore(M)$1.55-3.07%

MemeCore(M)$1.55-3.07%