Venezuela’s hyperinflation (229%) has decimated the bolívar’s value, pushing citizens to adopt Binance dollars (USDT stablecoins) for daily payments.

Binance dollars are favored for their stability, liquidity, and convenience compared to local currency and parallel market cash.

Multiple exchange rates complicate the currency landscape, but Binance dollars command a preferred rate close to the parallel market.

Crypto adoption in Venezuela is among the highest globally, with stablecoins dominating everyday transactions.

Capital controls and sanctions have accelerated the shift towards Binance dollars, even involving some local banks and industries.

Stablecoins like Tether’s USDT, commonly referred to as ‘Binance dollars’ in Venezuela, have transcended their initial niche within crypto communities.

Earlier this year, Binance introduced an enhanced listing mechanism alongside a new community co-governance model.

Source: X (@binance)

According to Mauricio Di Bartolomeo, co-founder of Ledn and a Venezuelan expatriate, Binance dollars are now widely used across the country for essential payments including condo fees, vendor services, and even salaries.

The bolívar, Venezuela’s official currency, has largely lost its value in daily commerce due to:

Hyperinflation that has pushed prices to unsustainable levels.

Strict government capital controls that restrict foreign currency access.

A fractured exchange rate system with multiple conflicting rates.

These factors drive consumers and businesses to prefer stablecoins over cash or local bank transfers.

The Binance dollar’s rate is often favored by vendors and consumers due to its liquidity and reliability, making USDT the most commonly used exchange rate in everyday transactions.

Di Bartolomeo explained:

“People and companies prefer to price their goods and services in USD and receive payment in USD. Binance dollars now act as a financial equalizer across Venezuela’s diverse social classes.”

Even routine expenses like condo maintenance fees, security services, gardening and local vendor payments are all increasingly priced and paid in Binance dollars rather than the bolívar.

Small bodegas (local shops) and mid-sized businesses have similarly largely adopted stablecoins as their primary means of settlement.

While large state-controlled enterprises still use the official BCV exchange rate, the majority of the market leans towards Binance dollars for their efficiency and accessibility.

Venezuela’s government-imposed capital controls create significant hurdles for foreign currency access. Official USD allocations often go to regime-connected companies, who resell dollars on the parallel market at a premium.

This dynamic has led to a robust parallel market for both foreign cash and digital assets. Di Bartolomeo said:

“Economic actors refuse to accept the worthless local currency for payment. If they accept it reluctantly, they rush to convert it immediately into Binance dollars or USD.”

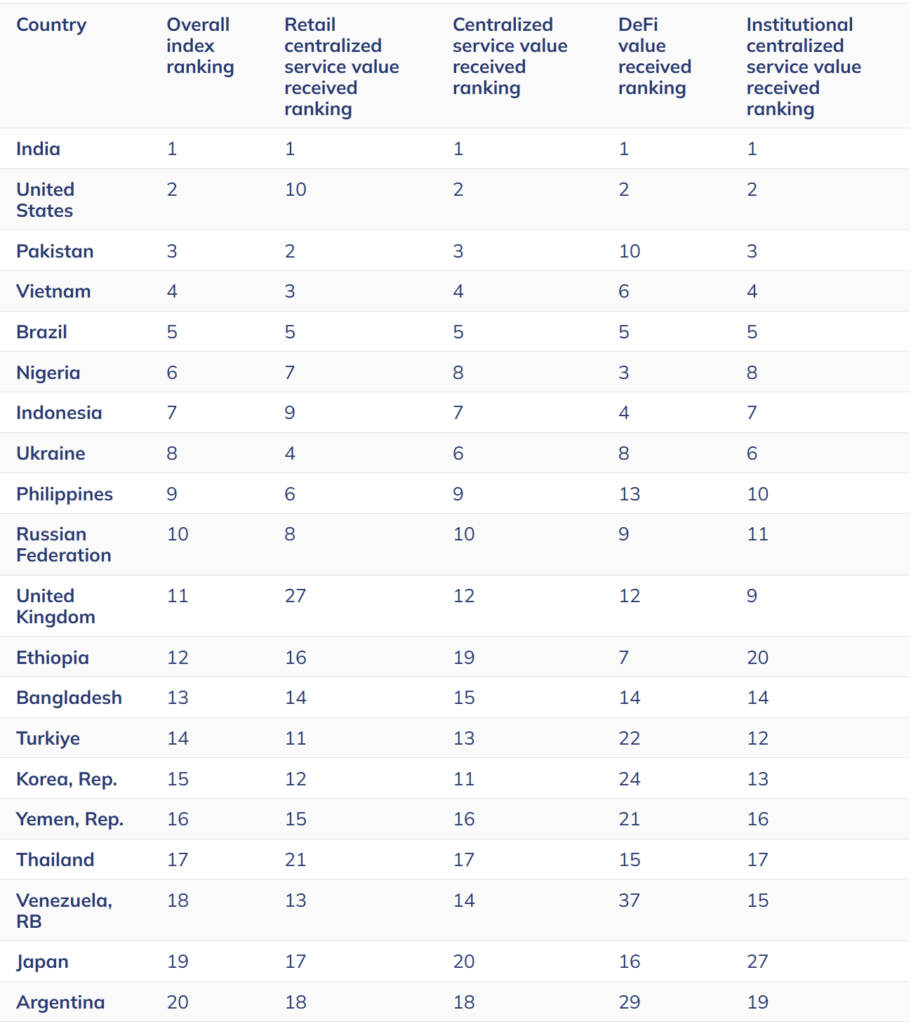

Venezuela ranks 18th globally and 9th by population-adjusted metrics for cryptocurrency adoption, according to Chainalysis’ 2025 Global Crypto Adoption Index.

Venezuela Ranked 18th Worldwide For Crypto Adoption

Source: Chainalysis

Stablecoins account for nearly half (47%) of all Venezuelan crypto transactions under $10,000, and overall crypto activity surged by 110% last year.

Venezuela is not alone. Countries like Argentina, Turkey, and Nigeria also show accelerating crypto adoption as their citizens seek alternatives to failing fiat currencies and restrictive capital controls.

Meanwhile, after the U.S. imposed sanctions on Venezuela’s oil sector and other industries, some local banks began facilitating stablecoin transactions. Oil companies and other sectors have increasingly turned to Binance dollars to bypass financial restrictions.

Binance dollars refer to USDt stablecoins (Tether) used widely in Venezuela as a reliable digital alternative to the bolívar for everyday payments.

With hyperinflation hitting 229%, government capital controls, and a fractured official exchange rate, Binance dollars offer stability, liquidity, and easier access for Venezuelans.

Unlike the bolívar, which is rapidly losing value, Binance dollars maintain a stable peg to the US dollar, making them preferable for pricing goods and services.

While not officially adopted as legal tender, Binance dollars are widely accepted across private and informal sectors due to their practicality amidst economic turmoil.

Yes, but usually through parallel markets or informal channels, as official mechanisms remain restrictive due to capital controls.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.04-0.38%

Figure Heloc(FIGR_HELOC)$1.04-0.38% USDS(USDS)$1.00-0.02%

USDS(USDS)$1.00-0.02% Hyperliquid(HYPE)$30.25-3.08%

Hyperliquid(HYPE)$30.25-3.08% Ethena USDe(USDE)$1.00-0.04%

Ethena USDe(USDE)$1.00-0.04% Canton(CC)$0.157275-5.66%

Canton(CC)$0.157275-5.66% USD1(USD1)$1.00-0.10%

USD1(USD1)$1.00-0.10% Rain(RAIN)$0.009897-3.31%

Rain(RAIN)$0.009897-3.31% World Liberty Financial(WLFI)$0.101482-5.62%

World Liberty Financial(WLFI)$0.101482-5.62% MemeCore(M)$1.40-0.66%

MemeCore(M)$1.40-0.66% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Aster(ASTER)$0.71-1.80%

Aster(ASTER)$0.71-1.80% Falcon USD(USDF)$1.00-0.07%

Falcon USD(USDF)$1.00-0.07% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00% Global Dollar(USDG)$1.00-0.01%

Global Dollar(USDG)$1.00-0.01% HTX DAO(HTX)$0.0000020.60%

HTX DAO(HTX)$0.0000020.60%