The Bitcoin fear index has plunged to 24, its lowest reading in a year.

Bitwise sees this fear-driven environment as a prime accumulation opportunity.

Retail and mid-tier investors are buying, while miners and long-term holders show signs of selling.

Bitcoin’s relative price stability suggests institutional demand is still strong.

This dynamic could set the stage for a bullish Q4, aligning with previous seasonal patterns.

The Crypto Fear and Greed Index, a widely watched sentiment tracker, has dropped to a score of 24, marking a sharp reversal from last week’s “Greed” rating of 71. This dramatic shift suggests growing anxiety among retail and institutional investors alike.

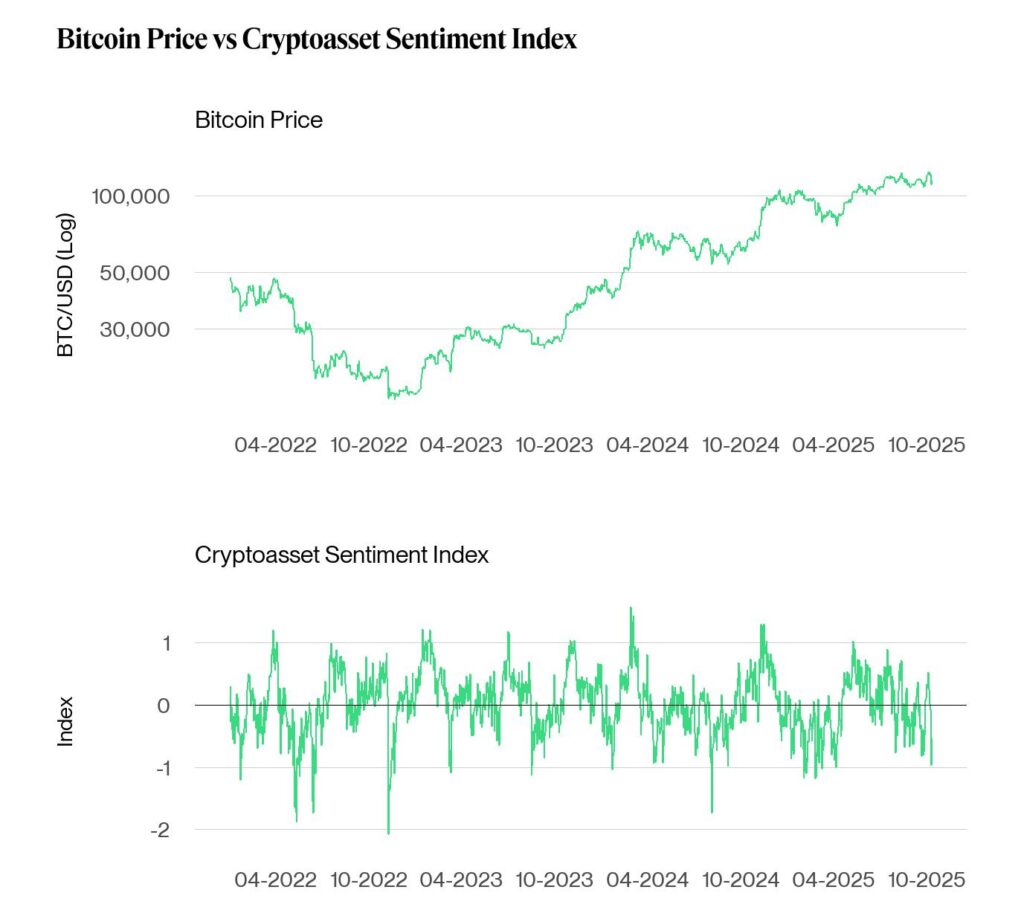

Source: Bitwise

Historically, such sentiment crashes have aligned with significant buying opportunities.

Similar sentiment lows were seen during previous bearish periods, including the 2018 and 2022 corrections, just before recovery phases began.

André Dragosch, head of research at Bitwise, said:

“Our in-house Cryptoasset Sentiment Index has dropped to its lowest level since the Yen carry trade unwind in August 2024. These extremes have historically marked favorable entry points ahead of seasonal Q4 strength.”

Despite the selling pressure, Bitcoin’s price remains relatively stable around the $110,000 mark.

Analysts suggest this stability could be due to continued demand from institutional investors and ETF flows, which are absorbing the increased supply and preventing deeper corrections.

Bitwise analysts argue that the recent BTC correction was not solely due to crypto-specific events.

Instead, it was exacerbated by macroeconomic tensions, including renewed trade friction between the U.S. and China, which triggered widespread risk-off behavior across global markets.

A significant portion of the selloff came from the derivatives market. According to Bitwise’s latest Crypto Market Compass, Bitcoin’s perpetual futures open interest fell by nearly $11 billion, the largest decline on record.

This wave of forced liquidations has likely purged much of the selling pressure. Dragosch said:

“This forced liquidation event meaningfully exhausted selling pressure. This suggests that a contrarian buying window may be emerging.”

On-chain data from Glassnode reveals a notable trend: smaller Bitcoin holders (1 to 1,000 BTC) have begun accumulating, even as the broader market turns fearful.

This indicates a rising confidence among everyday investors and mid-sized players.

At the same time, CryptoQuant reports that miners have deposited over 51,000 BTC to exchanges in recent days, a move typically associated with potential sell-offs.

This inflow, valued at over $5.7 billion, is the largest since July and could increase short-term volatility.

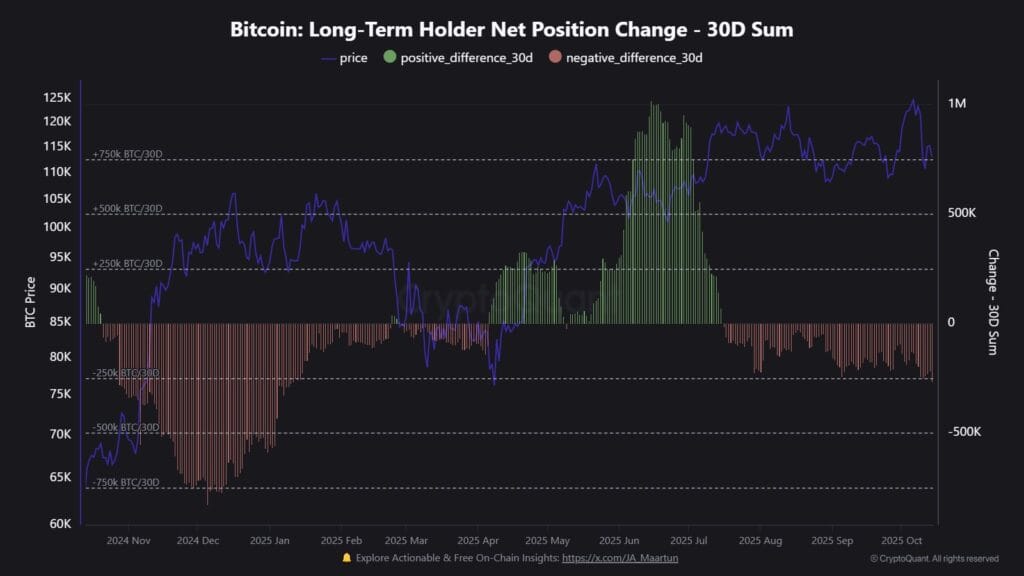

Further complicating the outlook, long-term Bitcoin holders have sold over 265,000 BTC in the past month, the biggest outflow since January 2025.

Bitcoin Long-Term Holder Net-Position Change

Source: Maartunn

This may point to a shifting dynamic, with early adopters taking profits while newer entrants pick up the slack.

The Bitcoin fear index is a sentiment indicator that measures the emotions driving the cryptocurrency market. A lower score indicates fear, while a higher score suggests greed.

Historically, extreme fear levels have preceded buying opportunities. When most investors are cautious, contrarian investors often find value.

Not necessarily. While miner transfers to exchanges can precede selling, they also reflect hedging strategies. The broader market context is essential.

While this isn’t financial advice, Bitwise analysts and on-chain data suggest that the current fear phase may offer strategic accumulation opportunities for long-term investors.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.031.38%

Figure Heloc(FIGR_HELOC)$1.031.38% USDS(USDS)$1.00-0.07%

USDS(USDS)$1.00-0.07% Hyperliquid(HYPE)$28.97-7.18%

Hyperliquid(HYPE)$28.97-7.18% Canton(CC)$0.1669173.97%

Canton(CC)$0.1669173.97% Ethena USDe(USDE)$1.000.03%

Ethena USDe(USDE)$1.000.03% USD1(USD1)$1.000.05%

USD1(USD1)$1.000.05% Rain(RAIN)$0.0098211.17%

Rain(RAIN)$0.0098211.17% World Liberty Financial(WLFI)$0.1068356.14%

World Liberty Financial(WLFI)$0.1068356.14% MemeCore(M)$1.536.56%

MemeCore(M)$1.536.56% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Bittensor(TAO)$189.34-2.31%

Bittensor(TAO)$189.34-2.31% Falcon USD(USDF)$1.00-0.05%

Falcon USD(USDF)$1.00-0.05% Aster(ASTER)$0.70-3.25%

Aster(ASTER)$0.70-3.25% Pi Network(PI)$0.1850946.88%

Pi Network(PI)$0.1850946.88% Global Dollar(USDG)$1.00-0.01%

Global Dollar(USDG)$1.00-0.01%