Bitcoin is at risk of dropping to $105,000 or lower amid increased whale sell-offs and holiday-related trading lulls.

Futures and spot market data show sellers consistently overpowering buyers, especially during low-volume sessions.

Liquidation heatmaps indicate strong downside liquidity, suggesting the $104K–$100K range is a key battleground.

Macro factors such as potential Fed interest rate cuts and political uncertainty continue to influence sentiment.

Short-term recovery appears unlikely without a shift in whale behavior or a surge in post-holiday trading activity.

The U.S. Labor Day holiday typically brings reduced trading volume and thinner liquidity, particularly from institutional players.

With Wall Street closed, the absence of traditional market participants adds an extra layer of vulnerability to crypto markets, especially when coupled with increased sell pressure from whales.

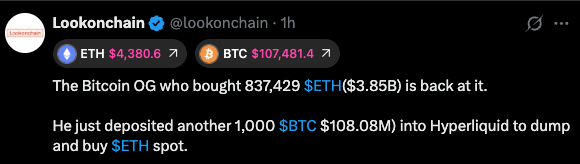

A major factor driving concern is the re-emergence of “OG” Bitcoin whales, wallets that have remained dormant for years, now actively transferring and selling large amounts of BTC.

Several recent whale transfers have seen billions in BTC converted into Ether (ETH), further eroding investor sentiment. According to Lookonchain, the threat of whale-driven liquidation continues to hang over the market.

Source: X (@lookonchain)

Despite short bursts of dip buying, futures data from Binance and Coinbase shows that sellers continue to dominate.

The cumulative volume delta (CVD) reveals persistent selling pressure from large traders, particularly in the 10,000 to 10 million USDT range, stifling any meaningful price recovery.

Spot buyers (100–10K BTC cohort) are buying dips.

Failed support flips show increasing short positions.

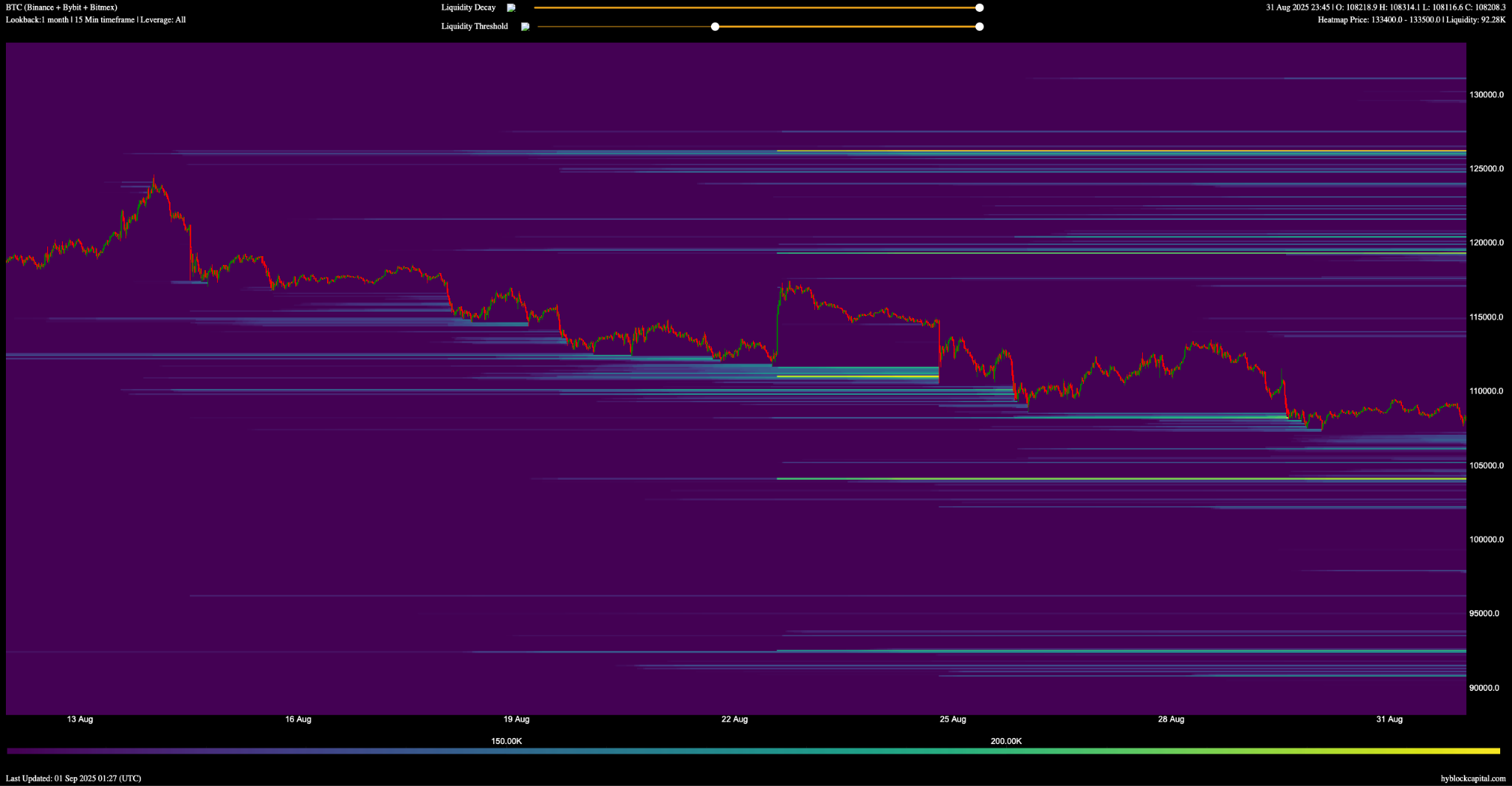

Bid liquidity appears around $105K, $102.6K, and $100K.

The 30-day liquidation heatmap shows significant downside liquidity clustering at the $104,000 level, hinting that this price target could be tested soon.

BTC/USDT 30-Day Lookback Liquidation Heatmap

Source: Hyblock

Meanwhile, shorter time frame charts from TRDR.io show strong bids only reappearing between $99K and $92K, leaving a liquidity gap that favors sellers.

Uncertainty around U.S. economic policy continues to loom large. While some traders are hopeful that the Federal Reserve may cut interest rates as early as late September, these expectations haven’t been enough to boost short-term confidence.

Additionally, President Trump’s recent comments on tariffs and attempts to exert influence over the Fed have stirred volatility in broader markets, weighing further on crypto.

While the immediate outlook looks bleak, several factors could help avert a full-blown Bitcoin Labor Day crash:

A sudden reversal in whale activity.

Strong buying interest from retail and institutional players post-holiday.

Positive developments in ETF inflows or macroeconomic announcements.

However, for now, bearish sentiment dominates the landscape.

The “Bitcoin Labor Day crash” refers to a potential sharp decline in Bitcoin’s price around the Labor Day holiday, often triggered by reduced market activity and increased sell pressure from whales or large holders.

While Bitcoin trades 24/7, major financial institutions and ETFs do not. The closure of Wall Street leads to reduced liquidity and less institutional activity, making the market more susceptible to volatility.

Bitcoin whales are individuals or entities that hold large amounts of BTC. Their actions, such as moving or selling coins, can significantly impact price due to their large order sizes.

It depends on several variables including whale behavior, ETF inflows, and broader macroeconomic conditions. Post-holiday trading volume will be crucial in determining the next direction.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.000.00%

Figure Heloc(FIGR_HELOC)$1.000.00% Wrapped stETH(WSTETH)$3,803.88-3.65%

Wrapped stETH(WSTETH)$3,803.88-3.65% Wrapped eETH(WEETH)$3,372.41-3.61%

Wrapped eETH(WEETH)$3,372.41-3.61% USDS(USDS)$1.00-0.02%

USDS(USDS)$1.00-0.02% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.16%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.16% WETH(WETH)$3,106.53-3.56%

WETH(WETH)$3,106.53-3.56% Coinbase Wrapped BTC(CBBTC)$91,036.00-2.10%

Coinbase Wrapped BTC(CBBTC)$91,036.00-2.10% Ethena USDe(USDE)$1.00-0.33%

Ethena USDe(USDE)$1.00-0.33% Hyperliquid(HYPE)$22.52-5.60%

Hyperliquid(HYPE)$22.52-5.60% Canton(CC)$0.12519311.99%

Canton(CC)$0.12519311.99% USDT0(USDT0)$1.00-0.02%

USDT0(USDT0)$1.00-0.02% sUSDS(SUSDS)$1.080.35%

sUSDS(SUSDS)$1.080.35% World Liberty Financial(WLFI)$0.160149-2.81%

World Liberty Financial(WLFI)$0.160149-2.81% Ethena Staked USDe(SUSDE)$1.220.00%

Ethena Staked USDe(SUSDE)$1.220.00% USD1(USD1)$1.00-0.01%

USD1(USD1)$1.00-0.01% Rain(RAIN)$0.008955-1.68%

Rain(RAIN)$0.008955-1.68% MemeCore(M)$1.645.20%

MemeCore(M)$1.645.20%