Bitcoin OG whales, investors who bought BTC at $10 or less, still hold significant supply and heavily influence price action.

A recent flash crash wiped out $45 billion in BTC market cap, triggered by a whale rotating BTC into ETH.

This whale executed a high-leverage ETH strategy, gaining $185 million in profits.

At least 152,000+ BTC remains under the control of the same whale, hinting at further potential volatility.

ETH has surged over 220% since April, making it an attractive alternative for large holders.

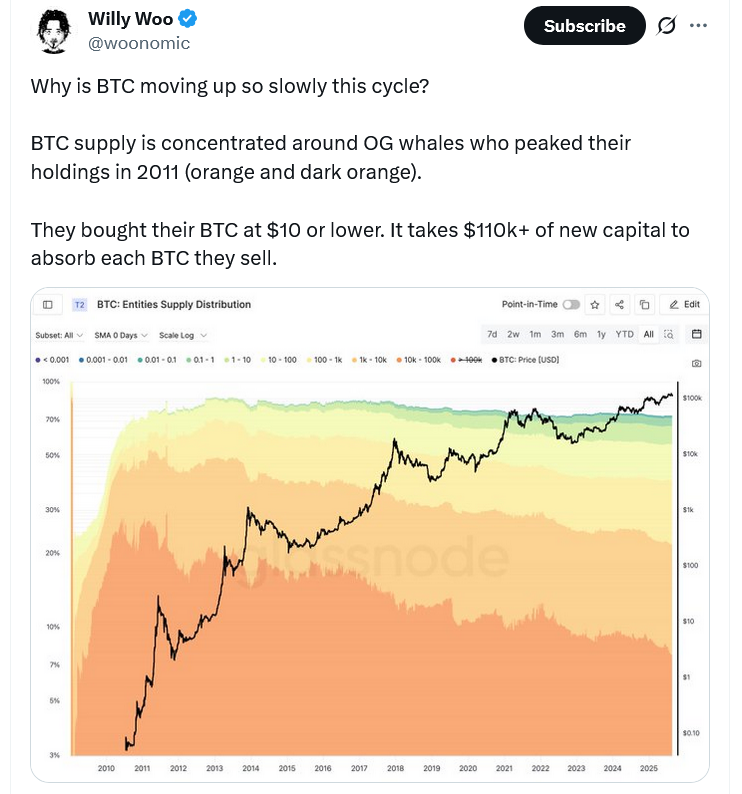

Popular on-chain analyst Willy Woo recently stated that Bitcoin OG whales, investors who acquired their holdings when BTC was trading at $10 or less, still dominate a substantial portion of the market’s circulating supply.

Source: X (@woonomic)

In Woo’s words:

“BTC supply is concentrated around OG whales who peaked their holdings in 2011. This differential in cost basis, the supply they hold and their rate of selling has profound impacts on how much new capital needs to come in to lift price.”

This dynamic creates a constant uphill battle for price action, as every sell from these OG whales requires a substantial inflow of fresh capital, more than $110K per Bitcoin, to maintain or grow BTC’s value.

On August 18th, Bitcoin experienced a sharp drop of over 2% in under 10 minutes, sparking alarm across the crypto markets. Industry watchers on X quickly pointed to whale activity as the primary trigger.

A single Bitcoin whale transferred 24,000 BTC (~$2.7 billion) across six transactions beginning August 16th.

Approximately 18,142 BTC (worth $2 billion) has already been liquidated, largely converted into 416,598 ETH, according to analyst MLM.

The whale didn’t stop at spot ETH purchases. An additional 275,500 ETH (~$1.3 billion) was staked, and another 135,263 ETH was longed on decentralized perpetuals exchange Hyperliquid. This resulted in a total ETH exposure exceeding $2.6 billion.

MLM reported the whale made a $185 million profit on the ETH/BTC trade by front-running market participants who tried to follow their strategy.

Data from CoinGecko shows that Bitcoin fell from $114,666 to a low of $112,174 within a short timeframe. The drop erased roughly $45 billion from Bitcoin’s market cap in minutes.

Bitcoin’s Recent Price Movements

Source: CoinGecko

Ethereum (ETH) wasn’t spared either, tumbling 4% from $4,937 to $4,738 before partially recovering.

Adding fuel to the fire, another crypto whale reportedly sold 670 BTC (~$76 million) last Thursday to open a new long ETH position.

This reflects a broader trend of large holders rotating out of BTC and into ETH as Ethereum’s fundamentals gain traction.

Since bottoming out at $1,471 on April 9th, ETH has gained more than 220%, playing catch-up with early cycle leaders like Bitcoin and Solana (SOL).

According to Sani, founder of TimechainIndex.com, the primary whale behind the recent BTC offloading still controls 152,874 Bitcoin spread across various wallet addresses.

These coins were originally sourced from HTX (formerly Huobi) roughly six years ago and had remained untouched until August 16th. This raises concerns about additional selling pressure if more Bitcoin OG whales choose to offload their holdings.

Bitcoin OG whales are early investors who acquired large amounts of Bitcoin in its early days, often at prices under $10. Many of them have held onto their coins for over a decade.

Their large holdings and low cost basis allow them to sell at significant profits. When they sell, it requires a massive influx of new capital to keep prices stable or rising.

A whale sold over 18,000 BTC and converted it into ETH, triggering automated sell-offs and a cascade of reactions in both BTC and ETH markets.

Yes. At least one whale still holds over 152,000 BTC. If these coins are sold, the market could see more volatility.

Ethereum has shown strong growth and offers staking opportunities. The current cycle has made ETH more appealing for long-term strategies and yield generation.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.03-0.88%

Figure Heloc(FIGR_HELOC)$1.03-0.88% USDS(USDS)$1.000.00%

USDS(USDS)$1.000.00% Hyperliquid(HYPE)$37.006.86%

Hyperliquid(HYPE)$37.006.86% Ethena USDe(USDE)$1.000.00%

Ethena USDe(USDE)$1.000.00% Canton(CC)$0.1508872.24%

Canton(CC)$0.1508872.24% USD1(USD1)$1.00-0.02%

USD1(USD1)$1.00-0.02% Rain(RAIN)$0.008754-1.90%

Rain(RAIN)$0.008754-1.90% World Liberty Financial(WLFI)$0.100185-0.78%

World Liberty Financial(WLFI)$0.100185-0.78% MemeCore(M)$1.440.67%

MemeCore(M)$1.440.67% Pi Network(PI)$0.225518-1.84%

Pi Network(PI)$0.225518-1.84% Circle USYC(USYC)$1.12-0.01%

Circle USYC(USYC)$1.12-0.01% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Bittensor(TAO)$201.983.63%

Bittensor(TAO)$201.983.63% Sky(SKY)$0.0795784.81%

Sky(SKY)$0.0795784.81% Global Dollar(USDG)$1.00-0.02%

Global Dollar(USDG)$1.00-0.02% Falcon USD(USDF)$1.000.03%

Falcon USD(USDF)$1.000.03%