BlackRock now holds over 3% of Bitcoin’s supply through IBIT, totaling more than 662,500 BTC.

IBIT is the fastest-growing ETF in history, reaching $70B AUM in under a year.

Institutional adoption of Bitcoin is no longer a question of “if,” but “how much.”

BlackRock sees Bitcoin as a scarce, digital alternative to fiat assets, with long-term macro upside.

Centralization of access challenges Bitcoin’s decentralization ethos—but may be necessary for global scale.

When BlackRock launched IBIT on January 11th, 2024, few expected such rapid growth.

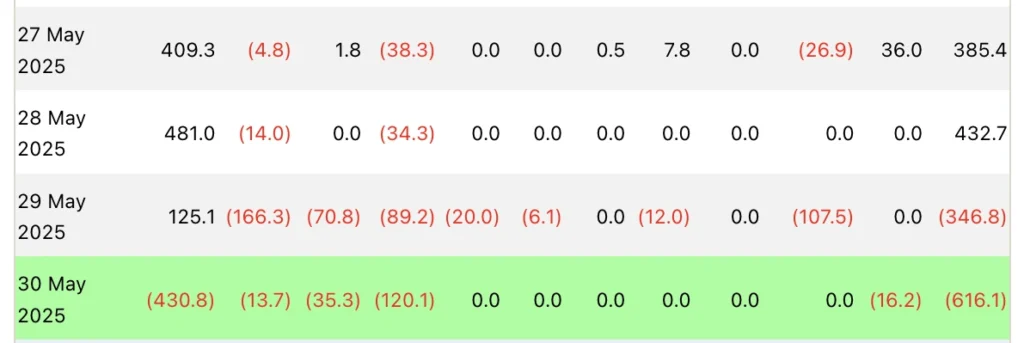

Spot Bitcoin ETFs Accumulated $44.35B Net Inflows Since January 2024

Source: Farside

Yet, within 341 trading days, IBIT surpassed $70 billion AUM, a feat that took SPDR Gold Shares (GLD) more than 1,600 days.

Total BTC: 662,500+

% of Total Supply: Over 3%

Equivalent Value: ~$72.4 billion

In raw Bitcoin holdings, only Satoshi Nakamoto’s estimated 1.1 million BTC outpaces IBIT, though even that gap is narrowing.

If inflows continue, IBIT may become the single largest holder of Bitcoin, reshaping the entire Bitcoin supply distribution.

BlackRock sees Bitcoin not as a speculative asset, but as a core component of modern portfolios. Their thesis centers around Bitcoin’s unique risk-reward profile and its role in a digitized financial future.

Scarcity by design: With only 21 million BTC ever to exist, Bitcoin mirrors gold—but with digital efficiency.

Geopolitical hedge: In an era of sovereign debt and currency risk, Bitcoin offers neutrality.

Macro shift to digital value: BlackRock views Bitcoin as part of a larger generational and technological transformation.

BlackRock recommends 1–2% exposure to Bitcoin within a standard 60/40 stock-bond portfolio. For institutional allocators, this “small” slice represents billions in capital and helps normalize Bitcoin within traditional finance.

They also benchmark Bitcoin’s risk profile against high-volatility equities, such as the “Magnificent Seven” tech stocks, to justify its inclusion.

Bitcoin’s legitimacy as an asset class took a giant leap with IBIT’s success. BlackRock’s deep involvement removed the reputational risks many institutions feared.

ETFs like IBIT offer:

Regulated exposure

Familiar investment vehicles

No need for wallets or private keys

Bitcoin’s ethos is decentralization, but BlackRock’s Bitcoin accumulation highlights a new reality. Most users access BTC through centralized platforms: ETFs, exchanges, and custodians.

For now, the market seems to accept a hybrid model: decentralized base layers with centralized access points.

BlackRock’s success was made possible by the SEC’s approval of spot Bitcoin ETFs in early 2024, enhanced by their new options limits.

Overview Of The New Options Limits By The SEC

Source: NYDIG

But beyond Bitcoin, regulation remains murky.

Asset classification is still unresolved, especially for tokens like ETH and SOL.

Staking products and altcoin ETFs remain stalled due to inconsistent global frameworks.

As SEC Commissioner Caroline Crenshaw noted, unclear rules “muddy the waters” for innovators and investors alike.

As of June 2025, BlackRock holds over 662,500 BTC, or more than 3% of the total supply.

No. The BTC for IBIT is custodied by Coinbase, not BlackRock. Private keys are stored offline and insured.

IBIT is BlackRock’s spot Bitcoin ETF, launched in January 2024, providing exposure to BTC without the need for wallets or direct ownership.

BlackRock views Bitcoin as a scarce digital asset with long-term value, capable of enhancing diversification within traditional portfolios.

If current inflows persist, IBIT may soon become the largest single holder of Bitcoin—further increasing institutional influence over the asset.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.03-0.02%

Figure Heloc(FIGR_HELOC)$1.03-0.02% Wrapped stETH(WSTETH)$3,641.031.60%

Wrapped stETH(WSTETH)$3,641.031.60% Wrapped eETH(WEETH)$3,228.931.60%

Wrapped eETH(WEETH)$3,228.931.60% USDS(USDS)$1.00-0.03%

USDS(USDS)$1.00-0.03% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.04%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.04% Coinbase Wrapped BTC(CBBTC)$88,184.000.03%

Coinbase Wrapped BTC(CBBTC)$88,184.000.03% WETH(WETH)$2,971.421.47%

WETH(WETH)$2,971.421.47% Hyperliquid(HYPE)$28.6717.92%

Hyperliquid(HYPE)$28.6717.92% Ethena USDe(USDE)$1.000.00%

Ethena USDe(USDE)$1.000.00% Canton(CC)$0.1530002.36%

Canton(CC)$0.1530002.36% USD1(USD1)$1.000.03%

USD1(USD1)$1.000.03% USDT0(USDT0)$1.00-0.05%

USDT0(USDT0)$1.00-0.05% World Liberty Financial(WLFI)$0.157792-1.21%

World Liberty Financial(WLFI)$0.157792-1.21% sUSDS(SUSDS)$1.08-0.07%

sUSDS(SUSDS)$1.08-0.07% Ethena Staked USDe(SUSDE)$1.22-0.04%

Ethena Staked USDe(SUSDE)$1.22-0.04% Rain(RAIN)$0.0100796.57%

Rain(RAIN)$0.0100796.57% MemeCore(M)$1.57-2.35%

MemeCore(M)$1.57-2.35%