$465 million was withdrawn from U.S. spot Ethereum ETFs on Monday, the largest daily outflow since launch.

BlackRock’s ETHA experienced the biggest drawdown with $375 million in net outflows.

Other major funds like Fidelity (FETH) and Grayscale also faced notable losses.

ETH’s price dropped 12% over the weekend before rebounding on Tuesday.

Despite ETF outflows, whale and institutional buying of ETH remains strong through OTC deals.

According to data from Farside Investors, spot Ethereum ETFs saw net outflows of $465 million on Monday alone.

This was the second consecutive day of outflows, breaking a 20-day streak of uninterrupted gains. Just days earlier, these funds lost $152 million on Friday.

Spot ETH ETFs Data

Source: SoSoValue

The heavy outflows suggest a shift in investor sentiment, possibly triggered by price volatility in the Ethereum market.

On Sunday, ETH dropped to $3,380, marking a 12% decline from Thursday’s high of $3,858. By Tuesday, however, Ethereum had somewhat rebounded, reaching $3,629, according to CoinGecko.

The largest portion of Monday’s outflow came from BlackRock’s iShares Ethereum Trust (ETHA), which saw a massive $374.8 million in net redemptions.

Despite the drawdown, ETHA still maintains cumulative net inflows of $9.3 billion and net assets totaling $10.7 billion.

The Fidelity Ethereum Fund (FETH) reported the second-largest daily outflow, losing $55.11 million. Its cumulative net inflows remain at $2.2 billion, with $2.4 billion in net assets.

Meanwhile, Grayscale’s Ethereum-focused ETFs also recorded notable outflows:

Grayscale Ethereum Mini Trust (ETH): $28 million outflow

Grayscale Ethereum Trust (ETHE): $6.9 million outflow

ETHE: $4.3 billion in cumulative net outflows; $4.1 billion in net assets

ETH: $1.1 billion in cumulative inflows; $2.3 billion in net assets

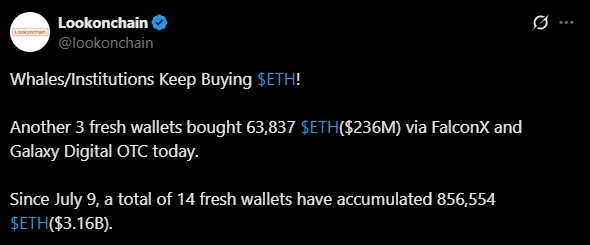

Interestingly, while retail investors appear to be offloading ETH-focused ETFs, on-chain data suggests institutions are buying.

According to Lookonchain, three wallets, believed to belong to whales or institutions, collectively acquired 63,837 ETH via over-the-counter (OTC) transactions with FalconX and Galaxy Digital.

Source: X (@lookonchain)

Since July 9th, 14 new wallets have collectively purchased 856,554 ETH, valued at over $3.1 billion. This indicates continued long-term confidence in Ethereum, despite ETF volatility.

An Ethereum ETF is a financial product that allows investors to gain exposure to Ethereum’s price movements without directly holding the cryptocurrency. These funds track Ethereum’s market price and are traded on traditional stock exchanges.

Recent price volatility, short-term profit-taking, or a shift in market sentiment could explain the large outflows. Some investors might also be reacting to macroeconomic uncertainty or reassessing their crypto allocations.

Despite the significant outflow, BlackRock’s ETHA still maintains strong net inflows ($9.3 billion) and solid assets under management ($10.7 billion), indicating ongoing investor interest over the long term.

Yes. On-chain data shows that institutions and crypto whales are actively accumulating ETH, even as ETF outflows increase. This signals continued belief in Ethereum’s long-term value.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.04-0.40%

Figure Heloc(FIGR_HELOC)$1.04-0.40% USDS(USDS)$1.000.03%

USDS(USDS)$1.000.03% Hyperliquid(HYPE)$30.780.74%

Hyperliquid(HYPE)$30.780.74% Ethena USDe(USDE)$1.00-0.02%

Ethena USDe(USDE)$1.00-0.02% Canton(CC)$0.161129-2.40%

Canton(CC)$0.161129-2.40% USD1(USD1)$1.000.04%

USD1(USD1)$1.000.04% Rain(RAIN)$0.0097890.07%

Rain(RAIN)$0.0097890.07% World Liberty Financial(WLFI)$0.103165-0.42%

World Liberty Financial(WLFI)$0.103165-0.42% MemeCore(M)$1.463.54%

MemeCore(M)$1.463.54% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Falcon USD(USDF)$1.000.01%

Falcon USD(USDF)$1.000.01% Aster(ASTER)$0.712.01%

Aster(ASTER)$0.712.01% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00% Global Dollar(USDG)$1.00-0.01%

Global Dollar(USDG)$1.00-0.01% HTX DAO(HTX)$0.0000021.32%

HTX DAO(HTX)$0.0000021.32%