Input Output Global (IOG), the primary development entity behind Cardano, submitted a proposal to secure funding for a 12-month development plan aimed at enhancing the network’s scalability, interoperability, and overall developer experience.

Source: X (@InputOutputHK)

Despite a handful of objections regarding transparency, accountability, and budget structure, the community largely supported the proposal. Out of 213 total votes, 200 were in favor, 6 against, and 7 abstained.

The funds will be used to support a number of high-impact upgrades, including:

To ensure responsible use of the treasury funds, payments will be disbursed only upon completion of specific milestones.

Intersect, a member-based organization formed to steward Cardano’s governance, will act as an independent administrator of the fund.

IOG is required to:

This framework aims to enhance transparency and build trust within the ecosystem.

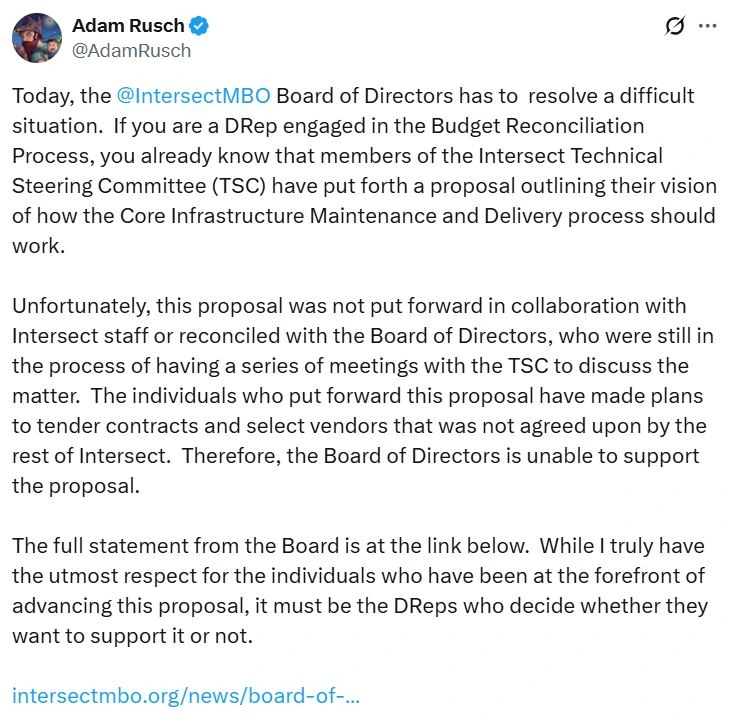

While the proposal ultimately passed, it did not go unchallenged. Several Cardano community members raised valid concerns about:

Source: X (@AdamRusch)

Cardano isn’t the only blockchain ramping up development efforts in 2025.

Across the crypto ecosystem, major platforms are initiating ambitious upgrades to improve network capacity, lower costs, and attract more developers.

With such a significant injection of capital into Cardano’s development roadmap, the long-term outlook for ADA becomes increasingly bullish, but with caution.

Historically, major upgrades and community-driven governance milestones have influenced positive sentiment, often preceding price rallies.

However, the Cardano price prediction still hinges on broader market conditions, Bitcoin performance, and the ability of IOG to meet their development milestones.

The funds are allocated for a 12-month development plan that includes upgrades for scalability, developer onboarding, transaction speed, and interoperability.

Intersect, a community-based organization, will administer the funds with oversight mechanisms such as smart contracts, budget reports, and milestone checks.

Key projects include Hydra (scalable transactions), Project Acropolis (node re-architecture), and performance enhancements to reduce costs for stake pool operators.

While it’s not a guarantee, historically, major development milestones and transparent governance can improve investor sentiment, potentially boosting ADA’s price over the long term.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.030.00%

Figure Heloc(FIGR_HELOC)$1.030.00% Wrapped stETH(WSTETH)$3,825.473.10%

Wrapped stETH(WSTETH)$3,825.473.10% USDS(USDS)$1.000.04%

USDS(USDS)$1.000.04% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.01%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.01% WETH(WETH)$3,133.883.13%

WETH(WETH)$3,133.883.13% Hyperliquid(HYPE)$29.72-4.60%

Hyperliquid(HYPE)$29.72-4.60% Wrapped eETH(WEETH)$3,392.443.10%

Wrapped eETH(WEETH)$3,392.443.10% Ethena USDe(USDE)$1.00-0.03%

Ethena USDe(USDE)$1.00-0.03% Coinbase Wrapped BTC(CBBTC)$91,277.001.96%

Coinbase Wrapped BTC(CBBTC)$91,277.001.96% sUSDS(SUSDS)$1.07-0.67%

sUSDS(SUSDS)$1.07-0.67% World Liberty Financial(WLFI)$0.1511650.16%

World Liberty Financial(WLFI)$0.1511650.16% USDT0(USDT0)$1.00-0.03%

USDT0(USDT0)$1.00-0.03% Ethena Staked USDe(SUSDE)$1.210.03%

Ethena Staked USDe(SUSDE)$1.210.03% Bittensor(TAO)$286.462.39%

Bittensor(TAO)$286.462.39% USD1(USD1)$1.000.00%

USD1(USD1)$1.000.00%