The Chainlink Swift integration allows traditional banks to initiate blockchain transactions using existing Swift messaging protocols.

The integration is part of a pilot with UBS Asset Management and the Monetary Authority of Singapore under Project Guardian.

Transactions like fund subscriptions and redemptions can now be processed on-chain, reducing friction and operational overhead.

Swift has been building blockchain interoperability through collaborations with Chainlink, Consensys, and BIS.

The global move toward tokenized assets is accelerating, with this integration marking a critical infrastructure milestone.

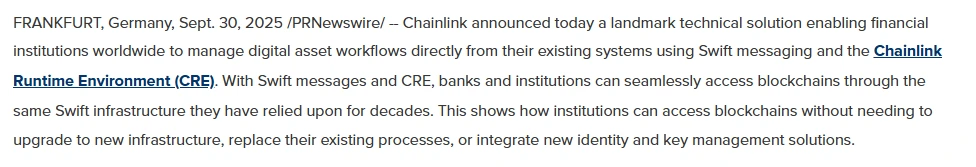

On October 1st, 2025, Chainlink officially announced the integration of its Chainlink Runtime Environment (CRE) with Swift’s global financial messaging network.

Source: PRNewsWire

This allows financial institutions to trigger on-chain fund transactions using Swift’s widely adopted ISO 20022 messaging standard.

This development builds on Project Guardian, a blockchain pilot conducted in 2024 involving Chainlink, UBS Tokenize, and the Monetary Authority of Singapore (MAS).

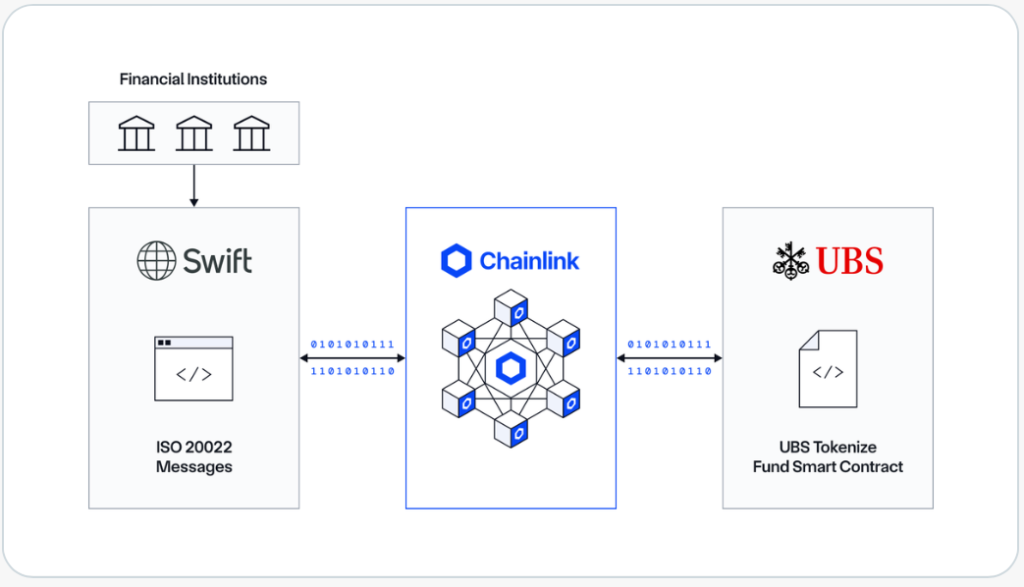

The Swift–Chainlink–UBS Workflow Designed For Tokenized Fund Transactions

Source: Chainlink

The project proved how tokenized fund transactions could seamlessly interact with legacy financial infrastructure.

Traditionally, fund subscriptions and redemptions involve multiple intermediaries like custodians, fund administrators, and transfer agents.

This results in lengthy reconciliation processes and settlement delays. The Chainlink Swift integration simplifies this by enabling those same financial messages to directly trigger on-chain activity.

Using Swift’s ISO 20022 messages, transactions are processed on blockchain networks without needing to build entirely new systems. This creates a bridge between TradFi and DeFi, improving efficiency and reducing operational friction.

As per Chainlink’s official announcement:

“This interoperability unlock enables last-mile connectivity options already familiar and used by financial institutions and service providers today.”

Founded in the 1970s, Swift is a global cooperative known for its reliable cross-border payments network. Over the last few years, Swift has been actively exploring blockchain technologies.

In 2023, Swift began collaborating with Chainlink to demonstrate how financial institutions could use one access point to connect with multiple blockchains. This laid the groundwork for the current integration.

In 2024, Swift joined Project Agorá, a collaboration with the Bank for International Settlements and 41 financial institutions to explore tokenized commercial bank deposits alongside CBDCs (Central Bank Digital Currencies).

Later that year, Swift introduced a blockchain-compatible state machine using ISO 20022 messaging to track balances across institutions, yet another move toward 24/7, real-time settlement.

Swift is also working with Ethereum developer Consensys and over 30 financial institutions to build a blockchain-based cross-border settlement system.

According to McKinsey, global assets under management reached $147 trillion by mid-2025. With such a vast market, streamlining fund operations using blockchain is both logical and revolutionary.

Tokenization of assets, which means converting real-world assets into digital tokens on the blockchain, can dramatically improve transparency, speed, and cost-efficiency. The Chainlink Swift integration is a key step toward making this a practical reality.

The Chainlink Swift integration connects Chainlink’s blockchain oracle and execution environment with Swift’s financial messaging network, allowing traditional banks to trigger on-chain transactions using ISO 20022 messages.

It allows banks and asset managers to use their existing infrastructure to process blockchain-based transactions, eliminating the need for costly overhauls or custom blockchain integrations.

ISO 20022 is a global messaging standard for financial transactions. It’s widely used by banks and is now being adapted for blockchain compatibility through this integration.

The pilot involves Chainlink, UBS Asset Management (through UBS Tokenize), Swift, and the Monetary Authority of Singapore (MAS), among others.

The pilot focused on fund subscriptions and redemptions, traditionally complex processes that involve multiple intermediaries. These are now simplified through blockchain automation.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.051.23%

Figure Heloc(FIGR_HELOC)$1.051.23% USDS(USDS)$1.00-0.09%

USDS(USDS)$1.00-0.09% Hyperliquid(HYPE)$30.304.99%

Hyperliquid(HYPE)$30.304.99% Canton(CC)$0.1687343.21%

Canton(CC)$0.1687343.21% Ethena USDe(USDE)$1.000.00%

Ethena USDe(USDE)$1.000.00% USD1(USD1)$1.000.00%

USD1(USD1)$1.000.00% Rain(RAIN)$0.009730-5.52%

Rain(RAIN)$0.009730-5.52% World Liberty Financial(WLFI)$0.1059685.44%

World Liberty Financial(WLFI)$0.1059685.44% MemeCore(M)$1.431.14%

MemeCore(M)$1.431.14% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Falcon USD(USDF)$1.00-0.02%

Falcon USD(USDF)$1.00-0.02% Aster(ASTER)$0.708.10%

Aster(ASTER)$0.708.10% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00% Global Dollar(USDG)$1.00-0.01%

Global Dollar(USDG)$1.00-0.01% HTX DAO(HTX)$0.0000021.92%

HTX DAO(HTX)$0.0000021.92%