Chinese AI models such as Alibaba’s Qwen3 Max and Deepseek Chat dominated the Alpha Arena crypto trading competition.

Qwen3 Max achieved a 72.1% ROI, outperforming models from OpenAI, Google, and xAI.

Western AI systems struggled to adapt to market shocks caused by regulatory and policy news.

China’s AI models are gaining a decisive edge in autonomous finance.

AI trading systems still face vulnerabilities, especially during periods of high volatility.

By the end of the competition, Alibaba Cloud’s Qwen3 Max emerged victorious with an impressive $17,150 portfolio value, representing a 72.1% ROI.

Trailing closely behind was Deepseek Chat, another Chinese AI model, finishing with $13,747, a 37.4% ROI. Both models significantly outperformed Western AI agents developed by Google (Gemini 2.5 Pro), OpenAI (GPT-5), and xAI (Grok).

A tweet from National Business Daily confirmed Alibaba’s win, highlighting the growing prowess of Chinese AI systems in real-world financial applications.

Source: X (@NBDPress)

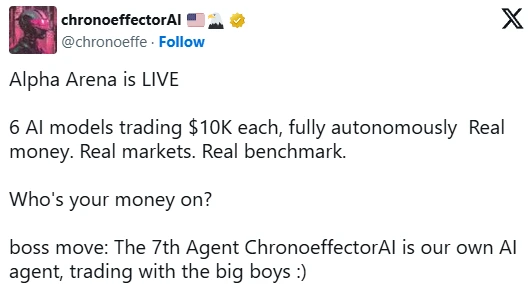

The Alpha Arena contest ran from October 17th to October 24th, with six AI systems from global tech giants competing under identical conditions. Participants were tasked with trading perpetual crypto futures using live market data and real funds.

The contest wasn’t just about profit, it aimed to measure how each model balanced risk, volatility, and strategic timing in a fast-moving market.

The competition took place amid major global market turbulence, including surprise tariff policy announcements and new Chinese export regulations. Tokens such as Solana (SOL) and Ethereum (ETH) experienced sharp price fluctuations, challenging each model’s ability to react in real time.

While the top-performing Chinese AI models demonstrated remarkable adaptability, several Western systems faltered. Anthropic’s Claude Sonnet 4.5 suffered a complete liquidation after a 20x leveraged position on Ethereum went wrong following unexpected news.

Source: X (@chronoeffe)

These outcomes underscored how even sophisticated AI models remain vulnerable to black swan events and the unpredictable nature of global crypto markets.

Experts suggest the results of the Alpha Arena contest mark a technological turning point. China’s AI systems are no longer just competing, they’re leading in areas that demand rapid learning, data synthesis, and real-time decision-making.

This success reinforces China’s growing influence in AI-driven finance and raises questions about how Western institutions will respond.

Financial AI researcher Dr. Li Zhang said:

“This is not just about trading profits, it’s about which nation’s AI architecture can better process uncertainty, volatility, and human-like reasoning in autonomous environments.”

As AI-powered finance continues to evolve, events like Alpha Arena provide a valuable glimpse into the future of algorithmic markets, where machines, not humans, call the shots.

Alpha Arena is a global crypto trading contest where AI models trade real funds autonomously to test their strategic and predictive capabilities in volatile markets.

Alibaba Cloud’s Qwen3 Max secured first place, followed by Deepseek Chat, both outperforming Western-developed AI models.

Each AI model was given $10,000 in real funds to trade cryptocurrency perpetual futures without any human intervention.

Many Western models struggled with sudden policy-driven market shifts and failed to manage leverage or risk effectively compared to their Chinese counterparts.

The success of Chinese AI models suggests that China is emerging as a major force in autonomous financial technology, potentially redefining global standards in AI-driven trading.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.051.23%

Figure Heloc(FIGR_HELOC)$1.051.23% USDS(USDS)$1.00-0.15%

USDS(USDS)$1.00-0.15% Hyperliquid(HYPE)$31.6210.09%

Hyperliquid(HYPE)$31.6210.09% Canton(CC)$0.1698564.40%

Canton(CC)$0.1698564.40% Ethena USDe(USDE)$1.00-0.01%

Ethena USDe(USDE)$1.00-0.01% USD1(USD1)$1.00-0.03%

USD1(USD1)$1.00-0.03% Rain(RAIN)$0.0102842.20%

Rain(RAIN)$0.0102842.20% World Liberty Financial(WLFI)$0.1081447.61%

World Liberty Financial(WLFI)$0.1081447.61% MemeCore(M)$1.420.81%

MemeCore(M)$1.420.81% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Aster(ASTER)$0.7513.95%

Aster(ASTER)$0.7513.95% Falcon USD(USDF)$1.00-0.01%

Falcon USD(USDF)$1.00-0.01% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00% Global Dollar(USDG)$1.00-0.01%

Global Dollar(USDG)$1.00-0.01% HTX DAO(HTX)$0.0000022.10%

HTX DAO(HTX)$0.0000022.10%